par Silver Tiger Metals Inc. (isin : CA82831T1093)

Silver Tiger Announces Updated Mineral Resource Estimate for the El Tigre Silver-Gold Project

HALIFAX, NS / ACCESSWIRE / September 12, 2023 / Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) ("Silver Tiger" or the "Corporation") is pleased to announce an Updated Mineral Resource Estimate ("MRE") for its 100% owned, high-grade silver-gold El Tigre Project (the "Project" or "El Tigre") located in Sonora, Mexico. This Updated MRE was based on information and data supplied by Silver Tiger, and was undertaken by Yungang Wu, P.Geo. and Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc. of Brampton, Ontario.

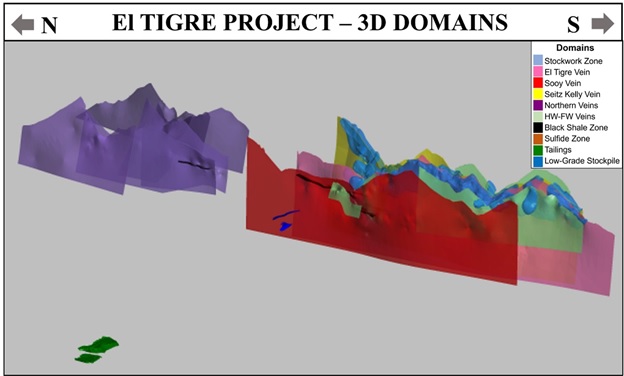

The Updated MRE includes the newly-discovered Sulfide and Black Shale Zones, Veins and Pit-Constrained Resources (Figure 1).

Highlights Include:

- Increase of 84% in Indicated Silver Equivalent ("AgEq") Ounces from initial September 2017 Mineral Resource, with 3% increase in AgEq grade;

- Increase of 257% in Inferred AgEq Ounces from initial September 2017 Mineral Resource, with an 13% increase in AgEq grade;

- Pit-constrained El Tigre Indicated Mineral Resources of 61.4 Million ounces (Moz) AgEq grading 44 g/t AgEq contained in 43.0Million tonnes ("Mt");

- Pit-constrained El Tigre Inferred Mineral Resources of 20.0 Moz AgEq grading 54 g/t AgEq contained in 11.5 Mt;

- Out-of-Pit El Tigre Indicated Mineral Resources of 20.8 Moz AgEq grading 279 g/t AgEq contained in 2.3 Mt;

- Out-of-Pit El Tigre Inferred Mineral Resources of 69.8 Moz AgEq grading 235 g/t AgEq contained in 9.2 Mt;

- Out-of-Pit Indicated Mineral Resources, at a cut-off grade of 263 g/t AgEq (3.5 gpt AuEq), contains 12.8 Moz ounces AgEq grading 484 g/t AgEq within in 0.8 Mt;

- Out-of-Pit Inferred Mineral Resources, at a cut-off grade of 263 g/t AgEq (3.5 gpt AuEq), contains 32.4 Moz ounces AgEq grading 400 g/t AgEq within in 2.5 Mt; and

- The El Tigre Project Mineral Resource is amenable to both open pit and bulk underground mining methods;

Indicated Mineral Resources are estimated at 46.4 Mt grading 25 g/t silver, 0.39 g/t gold, 0.01% copper, 0.03% lead, and 0.06% zinc (0.77 g/t AuEq). The Updated Mineral Resource Estimate includes Indicated Mineral Resources of 37.2 Moz of silver, 575 koz of gold, 9.4 Mlb of copper, 35.5 Mlb of lead, and 64.3 Mlb of zinc (1.1 Moz AuEq).

Inferred Mineral Resources are estimated at 20.9 Mt grading 78.4 g/t silver, 0.56 g/t gold, 0.04% copper, 0.13% lead, and 0.22% zinc (1.79 g/t AuEq). The Updated Mineral Resource Estimate includes Inferred Mineral Resources of 52.6 Moz of silver, 374 koz of gold, 18.1 Mlb of copper, 59.7 Mlb of lead, and 103.4 Mlb of zinc (1.2 Moz AuEq).

Preliminary Economic Assessment

As previously announced, Silver Tiger expects to deliver its PEA during September 2023.

Glenn Jessome, President and CEO, stated: "I would like to thank our technical team and our external consultants for delivering this positive Mineral Resource Estimate. The discovery of the Shale and Sulphide Zones, increased tonnage in the Veins and further delineation of the Open Pit has greatly increased the Mineral Resource and grade since our last published Technical Report. We have now delineated approximately 37.2 million ounces of silver and 575 thousand ounces of gold in the Indicated category, and 52.6 million ounces of silver and 374 thousand ounces of gold in the Inferred category." Mr. Jessome further stated: "With this successful MRE being complete, we now turn our attention to economics. As previously announced, we expect to deliver our PEA in Q4 2023. This coming milestone will see Silver Tiger transition from an explorer to a developer. This transition could significantly increase shareholder value."

A Technical Report is being prepared on the Updated Mineral Resource Estimate in accordance with National Instrument 43-101 ("NI-43-101"), and will be available on the Company's website and SEDAR within 45 days of the date of this release. The effective date of this Updated Mineral Resource Estimate is September 12, 2023.

Mineral Resource Estimate Methodology - El Tigre Project

A total of 482 drill holes (124,851 metres) and 3,160 surface and adit channel samples (6,473 metres) were used in the Mineral Resource Estimate. Historical underground chip samples from the El Tigre Mine, totaling 16,319, were used to define the vein limits only and not grade estimation.

P&E Mining Consultants Inc. ("P&E") collaborated with Silver Tiger personnel to develop the mineralization models, estimates, and reporting criteria for the Mineral Resources at El Tigre. Mineralization models were initially developed by Silver Tiger and were reviewed and modified by P&E. A total of twenty-three individual mineralized domains have been identified through drilling and surface sampling. The outlines of the halos and veins below surface from 0 to 100 m were influenced by the selection of mineralized material above 0.3 g/t AuEq, whereas 1.0 g/t AuEq was applied for the veins >100 m below surface that demonstrated lithological and structural zonal continuity along strike and down-dip.

Mineralization wireframes were used as hard boundaries for the purposes of grade estimation. A 5 m x 5 m x 5 m three-dimensional block model was used for the Mineral Resource Estimate. The block model consists of estimated Au, Ag, Cu, Pb and Zn grades, estimated bulk density, classification criteria, and a block volume inclusion percent factor. Au and Ag equivalent block grades were subsequently calculated from the estimated metal grades.

Sample assays were composited to a 1.5m standard length. Au, Ag, Cu, Pb and Zn grades were estimated using Inverse Distance Cubed weighting of between 1 and 12 composites, with a maximum of 2 composites per drill hole. Composites were capped prior to estimation by mineralization domain. Composite samples were selected within an anisotropic search ellipse oriented down the plunge of identified high grade trends.

A total of 5,699 bulk density analyses were provided in the drill hole database. The bulk density ranged from 1.6 (dump) to 3.02 t/m 3 in the mineralized wireframes.

Classification criteria were determined from observed grade and geological continuity as well as variography. Indicated Mineral Resources are informed by 2 or more drill holes within 50 m; Inferred Mineral Resources are informed by 1 or more drill holes with a search radius sufficient to populate the wireframes. No Measured Mineral Resources were calculated.

P&E is of the opinion that the Mineral Resource Estimates are suitable for public reporting and are a reasonable representation of the mineralization and metal content of the El Tigre Deposit.

Table 1: El Tigre Project 2023 Mineral Resources Statement (1-10)

Deposit | Tonnes | Average Grade | Contained Metal | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Au | Ag | Cu | Pb | Zn | AuEq | AgEq | Au | Ag | Cu | Pb | Zn | AuEq | AgEq | ||

(M) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (g/t) | (koz) | (koz) | (Mlb) | (Mlb) | (Mlb) | (koz) | (koz) | |

Indicated: | |||||||||||||||

South Zone In Pit | 43.0 | 0.39 | 14 | 0.01 | 0.02 | 0.59 | 44 | 535 | 20,049 | 1.8 | 7.0 | 14.3 | 818 | 61,381 | |

South Zone Out-of-Pit | 1.8 | 0.28 | 200 | 0.18 | 0.59 | 1.02 | 3.83 | 287 | 16 | 11,453 | 7.2 | 23.1 | 40.1 | 219 | 16,403 |

North Zone Out-of-Pit | 0.5 | 0.72 | 158 | 0.04 | 0.41 | 0.80 | 3.36 | 252 | 13 | 2,777 | 0.4 | 4.9 | 9.7 | 59 | 4,435 |

Out of Pit Total | 2.3 | 0.38 | 191 | 0.15 | 0.55 | 0.97 | 3.72 | 279 | 29 | 14,231 | 7.6 | 28.0 | 49.8 | 278 | 20,838 |

Vein (S & N) Total | 45.3 | 0.39 | 24 | 0.01 | 0.04 | 0.06 | 0.75 | 56 | 564 | 34,280 | 9.4 | 35.0 | 64.1 | 1,096 | 82,219 |

Low Grade Stockpile | 0.1 | 0.9 | 177 | 0.02 | 0.22 | 0.50 | 3.41 | 255 | 3 | 588 | 0.1 | 0.5 | 0.2 | 11 | 847 |

Tailings | 0.9 | 0.27 | 78 | 1.30 | 98 | 8 | 2,345 | 39 | 2,948 | ||||||

Total Indicated | 46.4 | 0.39 | 25 | 0.01 | 0.03 | 0.06 | 0.77 | 58 | 575 | 37,212 | 9.4 | 35.5 | 64.3 | 1,147 | 86,014 |

Inferred: | |||||||||||||||

South Zone In Pit | 11.5 | 0.47 | 17 | 0.00 | 0.01 | 0.02 | 0.72 | 54 | 176 | 6,396 | 0.8 | 3.7 | 4.3 | 267 | 20,045 |

South Zone Out-of-Pit | 5.5 | 0.61 | 170 | 0.09 | 0.22 | 0.39 | 3.23 | 242 | 107 | 30,072 | 10.7 | 26.9 | 46.8 | 571 | 42,821 |

North Zone Out-of-Pit | 3.7 | 0.74 | 132 | 0.08 | 0.35 | 0.64 | 3.00 | 225 | 89 | 15,813 | 6.6 | 29.0 | 52.3 | 360 | 26,981 |

Out of Pit Total | 9.2 | 0.66 | 155 | 0.09 | 0.27 | 0.49 | 3.14 | 235 | 197 | 45,885 | 17.3 | 55.9 | 99.0 | 931 | 69,801 |

Vein (S & N) Total | 20.8 | 0.56 | 78 | 0.04 | 0.13 | 0.23 | 1.80 | ||||||||