par Metallic Minerals Corp. (CVE:MMG)

Metallic Minerals Drills 1,540 g/t Ag Eq over 1.63 meters within 20.9 meters of 230 g/t Ag Eq at Keno Silver Project in Yukon, Canada

VANCOUVER, BC / ACCESSWIRE / January 30, 2023 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to announce additional results from the 2022 field program at the Keno Silver project in the historic Keno Hill silver district of the Yukon: Canada's most important silver mining district. These results cover the West Keno area and represent the second in a series of results to be released from the Company's 2022 exploration program, which included 3,265 meters ("m") of diamond core drilling in 23 drill holes focused on expansion of advanced stage, "resource-ready" targets in anticipation of an inaugural NI 43-101 mineral resource estimate in 2023.

Exploration in 2022 at West Keno focused on drilling at the advanced-stage Formo target, which produced silver at various times since the 1930s from high-grade vein structures that graded over 1,000 g/t silver1. Formo is a significant inholding within the neighbouring Hecla Mining property and is on trend with the historic Hector-Calumet Mine, which produced nearly 100 million ounces of silver making it the largest individual mine in the district1.

2022 West Keno Exploration highlights

- High-grade silver ("Ag"), lead ("Pb") and zinc ("Zn") mineralization was encountered in five of seven holes (See Table 1). Both high-grade Ag-Pb-Zn vein-style mineralization and broader zones of moderate grade Ag-Pb-Zn mineralization were encountered.

- A total of 40 high-grade samples of over 100 g/t silver equivalent ("Ag Eq") were intercepted in the 2022 West Keno drilling, including:

- FOR22-01, 0.54 m @ 2,291 g/t Ag Eq (1,139 g/t Ag, 18.32% Pb, 14.79% Zn)

- FOR22-02, 0.5 m @ 1,025.1 g/t Ag Eq (14 g/t Ag, 0.07% Pb, 23.36% Zn)

- FOR22-04, 1.63 m @ 1,536.2 g/t Ag Eq (1,049.5 g/t Ag, 4.21% Pb, 9.45% Zn)

- FOR22-04, 0.64 m @ 2,127.9 g/t Ag Eq (1,358 g/t Ag, 4.16% Pb, 16.42% Zn)

- FOR22-05, 0.5 m @ 1,215.3 g/t Ag Eq (850 g/t Ag, 7.65% Pb, 3.97% Zn)

- All five holes encountering significant silver mineralization in 2022 also intercepted broad bulk-tonnage zones averaging 26.2 m @ 85.6 g/t Ag Eq comprised of multiple high-grade vein intervals with associated stringers and stockwork veining.

Metallic Minerals President, Scott Petsel, stated, "Impressive drill results, year over year, have consistently demonstrated that Formo is one of Metallics' highest-grade targets and have cemented it as a priority for a planned, near-term NI 43-101 resource estimate. The strategic location of the Formo deposit along the Silver Trail Highway provides easy access and adjacent electrical power and it is only two kilometers from the largest individual silver deposit in the district and less than five kilometers from both Hecla's active mine development operations at Bermingham and the Keno operations mill at Keno City. This new step-out drilling continues to show that the deposit remains open to further testing along trend and down dip with room for significant expansion of the mineralized footprint and additional new discoveries. With these results complete we have initiated resource modelling work with SGS Geological Services on the Formo deposit.

"The Company expects to announce additional drill results from both the Keno Silver Project (primarily at the advanced-stage Caribou target), and from follow up expansion drilling at the La Plata Project over the coming weeks."

Upcoming Events

Vancouver Resource Investment Conference - Metallic Minerals will be participating in the Vancouver Resource Investment Conference at the Yukon Pavilion on Monday January 30th. For more information, visit here.

GCFF Virtual Conference - Scott Petsel will be presenting during the GCFF Metals Investing Virtual Conference on February 23rd at 10am PT | 1pm ET. To register, click here.

OTC Markets Battery & Precious Metals Virtual Investor Conference - Metallic will be participating in the upcoming OTC Markets Battery & Precious Metals Investor Conference on Wednesday, February 15 at 10am PT | 1pm ET. To register, click here.

2023 Prospectors and Developers Convention (PDAC) - Booth, Presentation & YMA Core Shack

Metallic Minerals will be attending PDAC 2023 in Booth IE3024. Additionally, President Scott Petsel will be providing a corporate presentation at a Forum for Investors during the 2023 Prospectors and Developers convention in Toronto Monday March 6th in the silver-focused session, Room 803, between 10:00 am and 12:00 pm at the Metro Toronto Convention Center. For more information, visit here.

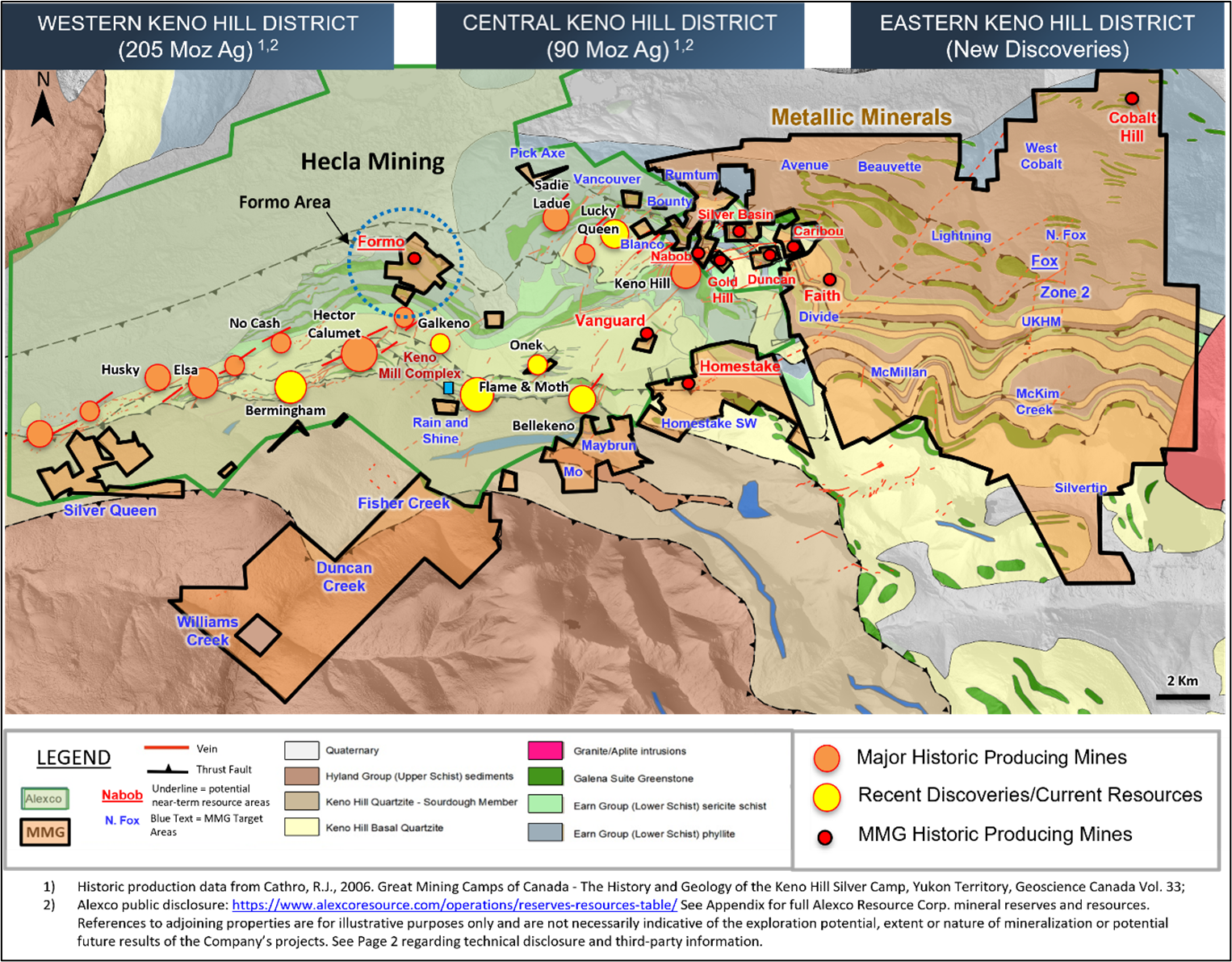

Figure 1. Keno Silver District Geology and Deposits

West Keno 2022 Drilling Program

Drilling at West Keno focused on the advanced-stage "resource-ready" Formo target area. A total of seven holes were completed over 1,145.6 meters on known projections of mineralization with the goal of expanding the potential resource footprint of the deposit in anticipation of an inaugural 43-101 mineral resource estimate in 2023. Previous drilling has recognized at least three separate parallel high-grade Ag-Pb-Zn vein structures and results of the 2022 drilling continue to demonstrate multiple vein zones in each hole with individual grades commonly more than 1,000 g/t Ag Eq (See Table 1). The Formo target represents one of the highest-grade areas drilled to date on Metallic's Keno Silver Property with 4.1 m of 2,536 g/t Ag Eq (FOR20-03) and 1 m of 2,961.6 g/t Ag Eq (FOR21-06) as examples of drill results from previous years efforts.

Table 1 - Highlights of 2022 Drill Results from the West Keno - Formo Target Area

DDH Hole ID | From (m) | To (m) | Length (m) | Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR22-01 | 72.3 | 103.95 | 31.65 | 86.5 | 41.1 | 0.01 | 0.54 | 0.70 |

incl | 72.3 | 72.8 | 0.5 | 496.4 | 349 | 0.00 | 3.70 | 1.17 |

And incl | 97.3 | 103.95 | 6.65 | 324.6 | 148.4 | 0.02 | 2.07 | 2.73 |

And incl | 98.8 | 99.34 | 0.54 | 2291 | 1139 | 0.06 | 18.32 | 14.79 |

| FOR22-02 | 91 | 119.2 | 28.2 | 69.8 | 11.6 | 0.02 | 0.11 | 1.25 |

incl | 91 | 105.5 | 14.5 | 123 | 17.1 | 0.01 | 0.16 | 2.34 |

And incl | 91 | 92 | 1 | 744.4 | 74 | 0.02 | 0.31 | 15.35 |

And incl | 95.3 | 95.8 | 0.5 | 1,025.1 | 14 | 0.01 | 0.07 | 23.36 |

| FOR22-03 | 77 | 81 | 4 | 154.2 | 93.6 | 0.01 | 0.83 | 0.90 |

incl | 77 | 77.81 | 0.81 | 489.6 | 386 | 0.00 | 3.54 | 0.31 |

and | 125 | 141.6 | 16.6 | 66.4 | 36 | 0.01 | 0.37 | 0.45 |

incl | 126.8 | 134 | 7.2 | 107.8 | 58.4 | 0.00 | 0.65 | 0.74 |

| FOR22-04 | 125.13 | 146 | 20.87 | 228.8 | 144.6 | 0.01 | 0.70 | 1.59 |

incl | 126.75 | 127.5 | 0.7 | 1,168.5 | 345 | 0.07 | 3.52 | 16.81 |

And incl | 137.6 | 144 | 6.4 | 557.7 | 395.9 | 0.02 | 1.65 | 2.99 |

And incl | 141.81 | 143.44 | 1.63 | 1,536.2 | 1,049.5 | 0.11 | 4.21 | 9.45 |

And incl | 142.8 | 143.44 | 0.64 | 2,127.9 | 1,358 | 0.00 | 4.16 | 16.42 |

| FOR22-05 | 60.9 | 61.62 | 0.72 | 293.5 | 3.5 | 3.34 | 0.01 | 0.10 |

and | 131.5 | 164.95 | 33.45 | 67.9 | 42.1 | 0.05 | 0.37 | 0.28 |

incl | 147 | 151 | 4 | 283 | 195.3 | 0.00 | 1.81 | 0.96 |

And incl | 148.8 | 149.3 | 0.5 | 1,215.3 | 850 | 0.00 | 7.65 | 3.97 |

And incl | 164.45 | 164.95 | 0.5 | 280 | 1.9 | 3.25 | 0.00 | 0.00 |

| FOR22-06 | 75.7 | 77.15 | 1.45 | 41.8 | 21.3 | 0.01 | 0.44 | 0.17 |

and | 131.52 | 132.07 | 0.55 | 42.8 | 15.3 | 0.02 | 0.12 | 0.53 |

| FOR22-07 | 93.4 | 93.9 | 0.5 | 44.9 | 22.3 | 0.01 | 0.20 | 0.39 |

and | 123.45 | 124.04 | 0.59 | 43.8 | 31.1 | 0.00 | 0.21 | 0.18 |

Notes to reported values:

- Ag equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $20.0/oz silver (Ag), $1.00/lb lead (Pb), $1.40/lb zinc (Zn).

- Rcovered Silver Equivalent in Table 1 is determined as follows: Ag Eq g/t = [Ag g/t x recovery] + [Au g/t x recovery x Au price/ Ag price] + [Pb % x 10,000 x recovery x Pb price / Ag price] + [Zn% x 10,000 x recovery x Zn price / Ag price].

- In the above calculations: 1% = 10,000 ppm = 10,000 g/t.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 95% for precious metals (Ag/Au) and 90% for all other listed metals, based on recoveries at similar nearby operations.

- Intervals are reported as measured drill intersect lengths and may not represent true width.

West Keno and the Formo Area Target

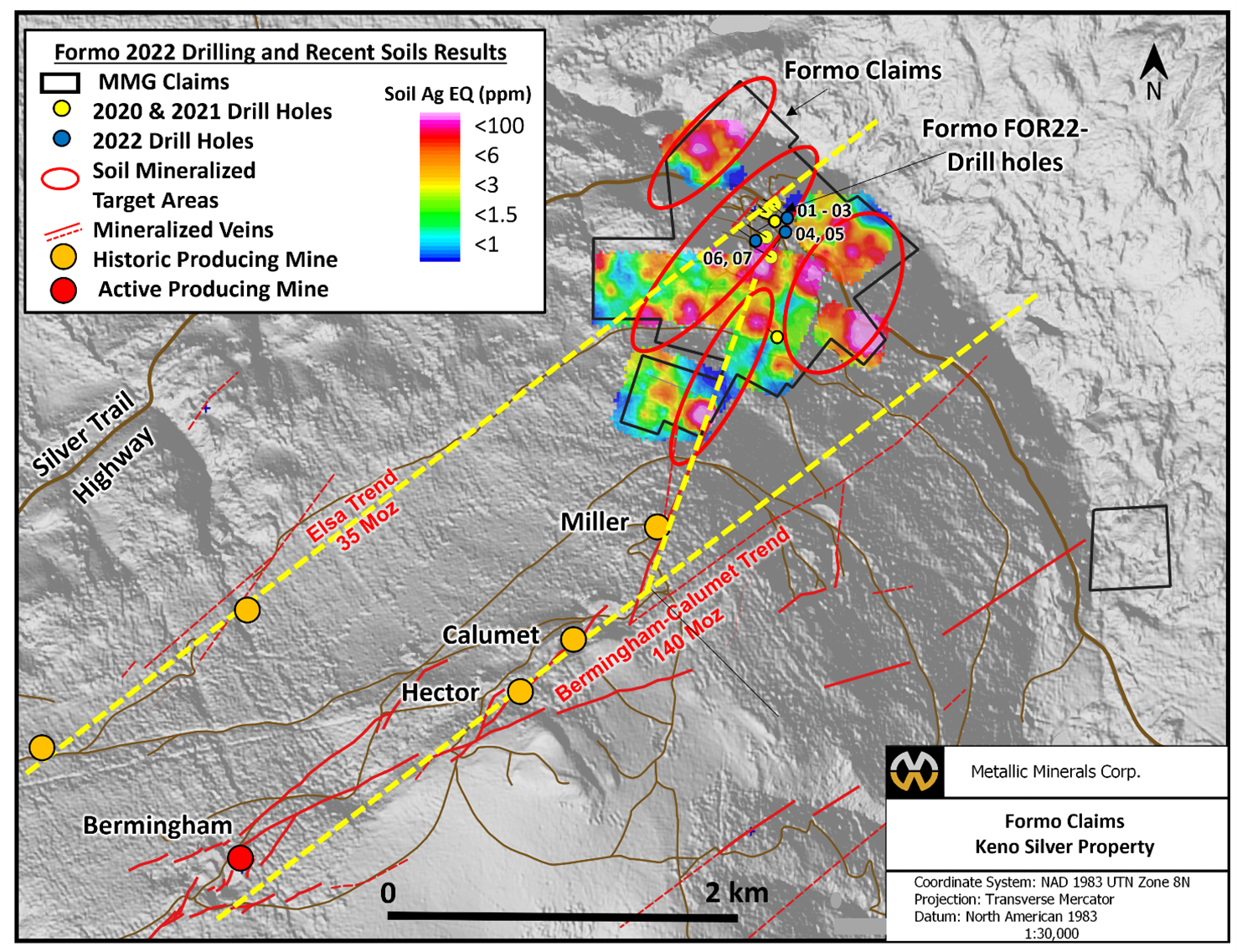

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2).

The Formo property, which include the Formo Mine, also known as the Yukeno Mine, was acquired by Metallic Minerals in 2017. The historic Formo mine produced high-grade silver at various times since the 1930s from high-grade vein structures that graded over 1,000 g/t silver1. Significant underground exploration drifts were developed in the 1950s with most of the historic production from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City and last mined in the 1980s.

Figure 2 - West Keno Plan Map

Figure 3 - Formo Vein Long Section (looking NW)

The primary Formo vein structure is exposed at surface in an open cut. Multiple veins have been encountered in the target area that demonstrate an association with Triassic greenstones in the Earn group schist, similar to the Sadie Ladue deposit which produced 12.7 Moz silver at a grade of 1,620 g/t Ag1. In addition to the mineralization at the known Formo deposit, two new surface targets have been identified through soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Pb-Zn veins on the Formo property.

Since 2020 Metallic Minerals has drilled 22 holes (3,306.9 m) at the Formo Target to compliment the six core holes and 54 percussion holes drilled by previous owners between 1980 and 1981. The Formo Target is open to significant expansion opportunities and is poised to lead the Company's efforts to