par Jaguar Mining Inc. (isin : CA47009M4002)

Jaguar Mining Reports Updated Mineral Reserves and Mineral Resources

TORONTO, ON / ACCESSWIRE / March 29, 2023 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce its annual Mineral Reserves and Mineral Resources (MRMR) statement for 2022. The Proven and Probable (2P) Mineral Reserve figures are derived from Jaguar's two operating mines: Turmalina and Pilar. The Mineral Resource figures are derived from these two mines and also includes updated Mineral Resources for the Faina Growth Project following 2022 infill drilling and restated Mineral Resources for the Company's dormant Paciência Complex (CPA). Initial Mineral Resources are also reported from the recent Zona Basal and Pontal South brownfields discoveries.

Detailed tabulations and discussion of this 2022 MRMR disclosure may be found within the Company´s AIF Document which will be uploaded to SEDAR on or before the 31st of March 2023 while an updated NI 43-101 Technical Report for the CPA Complex will be published by the end of May 2023.

HIGHLIGHTS

- Proven and Probable Mineral Reserves additions of 49 koz were offset by mined depletion of 103 koz for a net decrease of 11% to 454 koz, (3816 kt @ 3.70 g/t Au).

- Measured and Indicated Resources increased by 7% to 1320 koz, (9455 kt @ 4.43 g/t Au).

- Inferred Mineral Resources increased by 13% to 1191 koz, (10302 kt @ 3.60 g/t Au).

- Faina Growth Project infill drilling moved the project forward increasing the Measured and Indicated Mineral Resource from 58 koz to 233 koz with conversion from Inferred to Indicated Mineral Resources of 128 koz and with an addition of 47 koz.

- Paciência Complex (CPA) some 235 koz of Inferred Mineral Resources were added to inventory from Santa Isabel and Margazao after a full review of historical data and for Bahu after 2022 drilling.

- Life of Mine (LOM) plans at both operations schedules production at current rates into 2027 maintaining a near five-year mineral reserve pipeline in front of operations for the fifth consecutive year.

- Exploration Results from in-mine and brownfields areas were robust with solid increases reported in all Mineral Resource categories including initial disclosure of Inferred Mineral Resources reported from two new discoveries (Zona Basal and Pontal South).

Vern Baker, CEO of Jaguar Mining stated, "Jaguar has generated $91.2M in free cash flow over the last three years and paid out $29.6M in dividends. In addition to making the required investments to sustain current operations, its further objective is to make targeted capital allocations necessary to best exploit the Company's underutilized plant capacity. This year's Mineral Reserve and Mineral Resource update underlines this strategy."

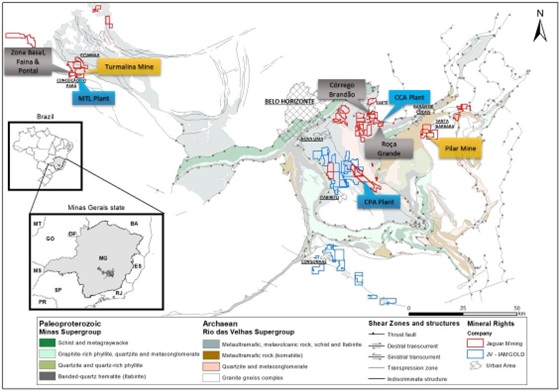

Figure 1. Location of Jaguar Mining Operations and Exploration Projects

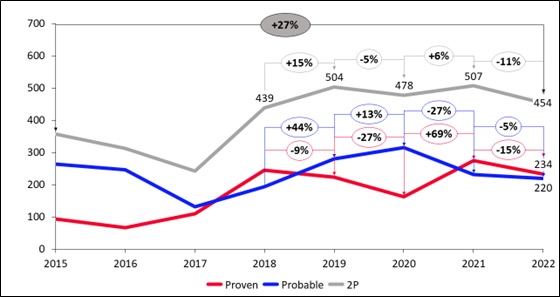

Figure 2. Jaguar Mineral Reserves 2015 - 2022

2022: MINERAL RESERVES AND MINERAL RESOURCES

Mineral Reserves

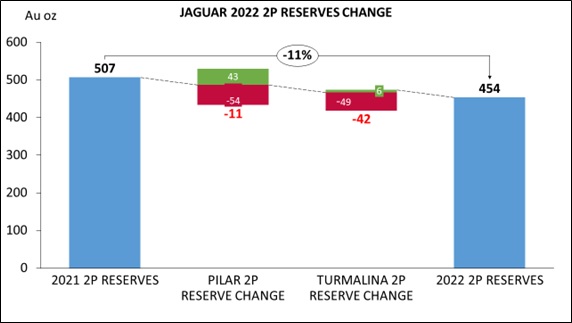

During the year, at the Company's operations, Proven and Probable (2P) Mineral Reserve additions of 49 koz were offset by mined depletion of 103 koz for a net decrease of 11% to 454 koz (3816 kt @ 3.70 g/t Au).

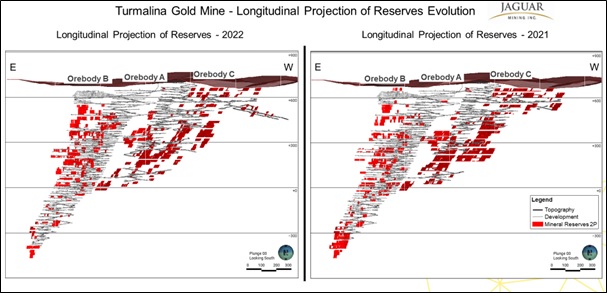

Turmalina Proven and Probable (2P) Mineral Reserves of 214 koz, (1855 kt @ 3.58 g/t Au) is a net decrease of 42 koz from the prior year. Mining in 2022 depleted 49 koz from the Mineral Reserve offset by a gain of 7 koz.

2P Mineral Reserves at Turmalina can be divided between Orebody A (53 koz, 379 kt @ 4.37 g/t Au), Orebody B (38 koz, 346 kt @ 3.42 g/t Au) and Orebody C (122 koz, 1130 kt @ 3.37 g/t Au).

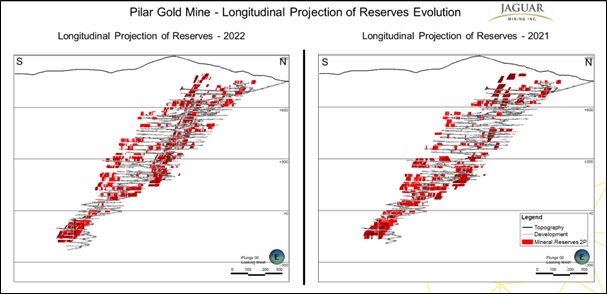

Pilar Proven and Probable (2P) Mineral Reserves are reported as 240 koz, (1961 kt @ 3.81 g/t Au) which reflects a small net decrease (11 koz) after mined depletion of some 54 koz from the prior year.

2P Mineral Reserves at Pilar can be divided between Orebody BA (29 koz, 223 kt @ 4.1 g/t Au), Orebodies BFs (90 koz, 708 kt @ 3.95 g/t Au), Orebody SW (77 koz, 631 kt @ 3.80 g/t Au), Orebody Torre (21 koz, 178 kt @ 3.73 g/t Au) and others (22 koz, 221 kt @ 3.12 g/t Au).

Table 1. Jaguar Consolidated Mineral Reserves as at 31st December 2022

December 31, 2022 | Proven Reserves | Probable Reserves | Proven & Probable Reserves | ||||||

Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | |

(000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | |

| Turmalina Gold Complex | |||||||||

| Ore Body A | 286 | 4.70 | 43 | 93 | 3.37 | 10 | 379 | 4.37 | 53 |

| Ore Body B | 215 | 3.32 | 23 | 130 | 3.59 | 15 | 346 | 3.42 | 38 |

| Ore Body C | 327 | 3.31 | 35 | 803 | 3.39 | 87 | 1130 | 3.37 | 122 |

| Total - Turmalina | 829 | 3.79 | 101 | 1026 | 3.41 | 113 | 1855 | 3.58 | 214 |

| Caeté Gold Complex | |||||||||

| Pilar | |||||||||

| Ore Body BA | 130 | 4.14 | 17 | 93 | 4.05 | 12 | 223 | 4.10 | 29 |

| Ore Body BF | 360 | 4.06 | 47 | 135 | 4.01 | 17 | 495 | 4.05 | 64 |

| Ore Body BFII | 131 | 3.94 | 17 | 20 | 3.03 | 2 | 152 | 3.82 | 19 |

| Ore Body BFIII | 26 | 3.54 | 3 | 35 | 3.52 | 4 | 61 | 3.53 | 7 |

| Ore Body Torre | 21 | 3.50 | 2 | 157 | 3.76 | 19 | 178 | 3.73 | 21 |

| Ore Body SW | 274 | 3.70 | 33 | 357 | 3.87 | 44 | 631 | 3.80 | 77 |

| Others | 136 | 3.14 | 14 | 85 | 3.09 | 8 | 221 | 3.12 | 22 |

| Total - Pilar | 1079 | 3.82 | 133 | 882 | 3.78 | 107 | 1961 | 3.81 | 240 |

| Total - Mineral Reserves | 1908 | 3.81 | 234 | 1909 | 3.58 | 220 | 3816 | 3.70 | 454 |

Notes:

1. CIM (2014) definitions are followed for Mineral Reserves.

2. Mineral Reserves reported are in-situ.

3. Mineral Reserves at Turmalina were estimated at a break-even cut-off grade of 2.32 g/t Au. Mineral Reserves at Pilar were estimated at a cut-off grade of 2.44 g/t Au.

4. Mineral Reserves are estimated using an average long-term gold price of $1,650 per ounce, and a US$/BRL$ exchange rate of 5.20 at both mines.

5. A minimum mining width of 3.50 m was used at Turmalina and 3.00 m at Pilar including dilution.

6. Numbers may not add due to rounding.

7. There are no known environmental, permitting, legal, title, socio-economic, political or other risk factors which could materially affect the Mineral Reserve estimates.

Figure 3. Waterfall Graph showing Jaguar consolidated Proven and Probable (2P) Mineral Reserves year on year changes by operation 2021 - 2022.

Figure 4. Long Section showing year on year changes in Pilar Mineral Reserves 2022 vs 2021.

Figure 5. Long Section showing year on year changes in Turmalina Mineral Reserves 2022 vs 2021.

Mineral Resources

Jaguar Mining´s Consolidated Mineral Resources as at 31st December 2022 are reported for both the Pilar and Turmalina Mines, updated Mineral Resources for the Faina Growth Project based on infill drilling completed during 2022 and restated Mineral Resources for its CPA assets Santa Isabel, Margazao and Bahu after a full review of historical data from these areas. Initial Mineral Resources are reported from the Zona Basal and Pontal South Exploration Projects.

Jaguar´s consolidated Measured and Indicated Mineral Resources as of 31st December 2022 are reported as 1320 koz (9455 kt @ 4.43 g/t Au) which are 87 koz above the prior year reflecting a 7% increase in reported Measured and Indicated Mineral Resource inventory year on year.

Inferred Mineral Resources for 2022 are reported as 1191 koz (10302 kt @ 3.60 g/t Au) which is a 133 koz net increase on the prior year reflecting a 10% increase in reported Inferred Mineral Resource inventory year on year.

Table 2. Jaguar Mining´s Consolidated Mineral Resources as at 31st December 2022

December 31, 2022 | Measured Resources | Indicated Resources | Measured & Indicated Resources | Inferred Resources | ||||||||

Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | |

(000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | |

| Underground Turmalina Gold Complex | ||||||||||||

| Ore Body A | 739 | 6.26 | 149 | 263 | 3.64 | 31 | 1002 | 5.57 | 179 | 94 | 3.60 | 11 |

| Ore Body B | 315 | 3.81 | 39 | 202 | 3.92 | 25 | 517 | 3.85 | 64 | 169 | 4.33 | 23 |

| Ore Body C | 734 | 3.59 | 85 | 1390 | 3.47 | 155 | 2124 | 3.51 | 240 | 1012 | 3.05 | 99 |

| Sub-Total Turmalina | 1788 | 4.73 | 272 | 1855 | 3.54 | 211 | 3643 | 4.13 | 483 | 1274 | 3.26 | 134 |

| Faina | ||||||||||||