par Jaguar Mining, Inc. (isin : CA47009M8896)

Jaguar Mining Reports Financial Results for the Third Quarter 2024

TORONTO, ON / ACCESSWIRE / November 8, 2024 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) today announced financial and operating results for the third quarter ended September 30, 2024. All figures are in US Dollars, unless otherwise expressed.

Third Quarter Highlights

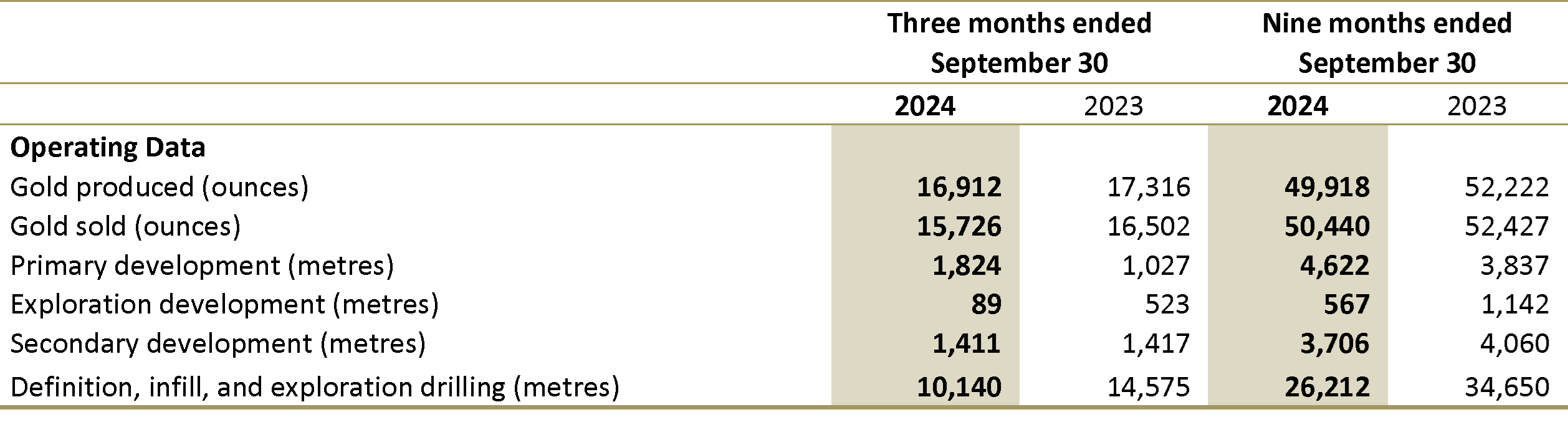

Gold production was 16,912 ounces, marginally lower than the 17,316 ounces produced in the third quarter of 2023. The net reduction reflects 16% fewer tonnes processed, substantially offset by 24% higher head grades.

Gold sold was 15,726 ounces, representing a 5% decrease from the 16,502 ounces sold in the third quarter of 2023, mainly reflecting the slightly lower year-over-year production. Realized gold prices for the quarter were $2,474 per ounce, an increase of 29% over the $1,916 per ounce realized in the third quarter of 2023.

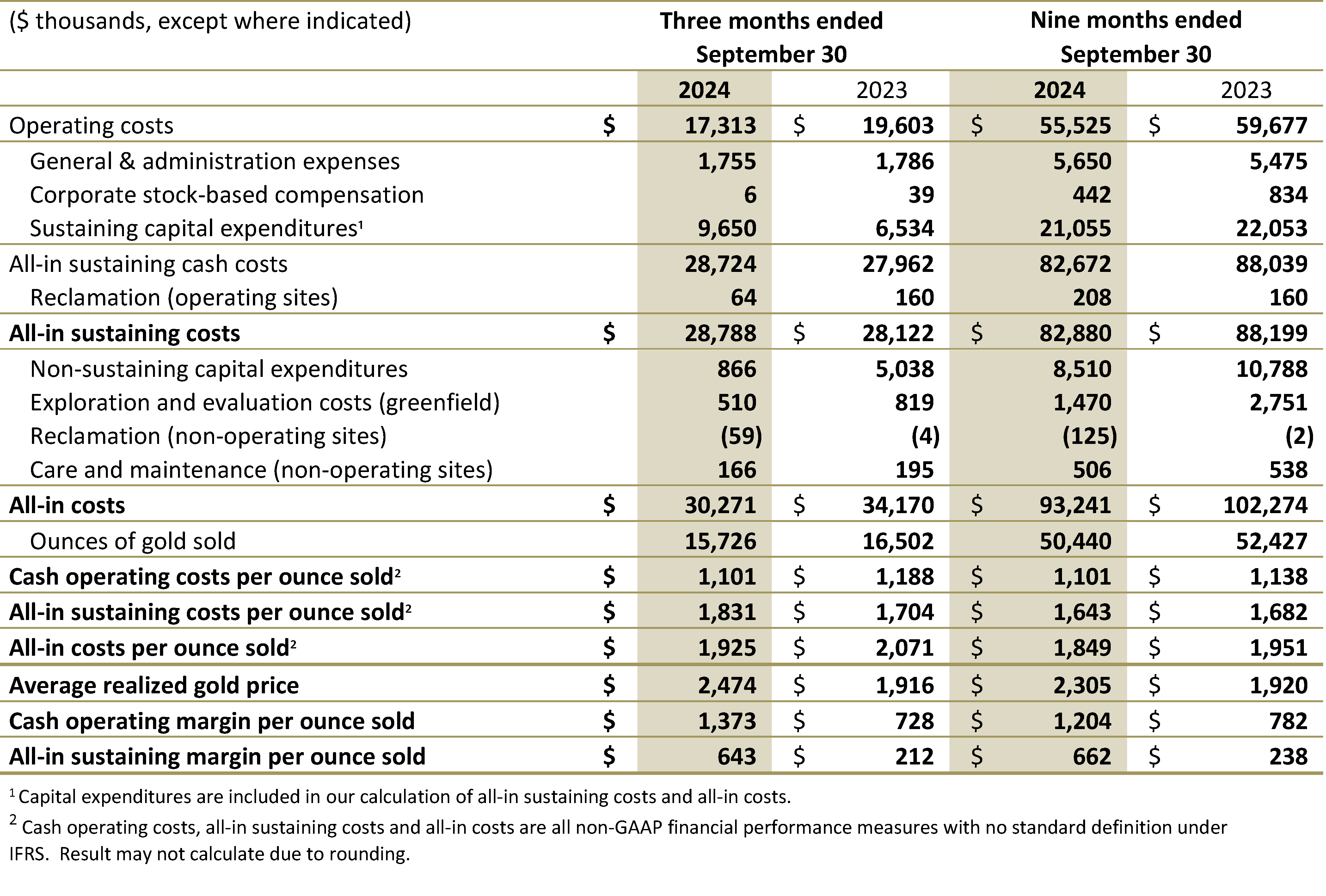

Cash operating costs per ounce¹ sold decreased by 7% to $1,101 per ounce of gold sold from $1,188 per ounce of gold sold in the third quarter of 2023, reflecting a 12% reduction in Operating Costs.

All-in sustaining costs (AISC) per ounce¹ increased by 7% to $1,831 per ounce of gold sold from $1,704 per ounce of gold sold in the third quarter of 2023. The increase mainly reflects higher sustaining capital investments in the Faina zone at the Turmalina mine, which became operational in the second quarter of 2024 and is still in the process of ramping up production.

As the Faina zone had its first production and gold sales during the second quarter of 2024, its ongoing development costs were reclassified from growth capital to sustaining capital. Over $2.0 million of growth capital incurred during the second quarter was reclassified in the current quarter to sustaining capital, which generated a negative figure for reported mine site non-sustaining capital at the Turmalina mine.

The elevated rate of development capital invested in the Faina zone during the quarter was to support the planned ramp-up of production in 2025 from this zone. Low production volume of 1,819 ounces from the Faina zone, combined with high levels of sustaining capital which included the catch-up of second quarter 2024 sustaining capital, resulted in the Turmalina mine's AISC per ounce sold being elevated this quarter.

Revenue for the quarter was $38.9 million, representing a 23% increase from the $31.6 million in revenue in the third quarter of 2023. This increase was driven by higher realized gold prices year-over-year and was partially offset by fewer ounces sold.

Operating costs for the quarter were $17.3 million, a reduction of 12% compared to operating costs of $19.6 million in the third quarter of 2023.

Net income for the quarter was $2.3 million, a decrease of $1.5 million compared to net income of $3.8 million in the third quarter of 2023. Adjusted net income 1 for the quarter, excluding the impact of $6.0 million in provisions for civil and labour litigations, was $8.3 million ($0.10 per share).

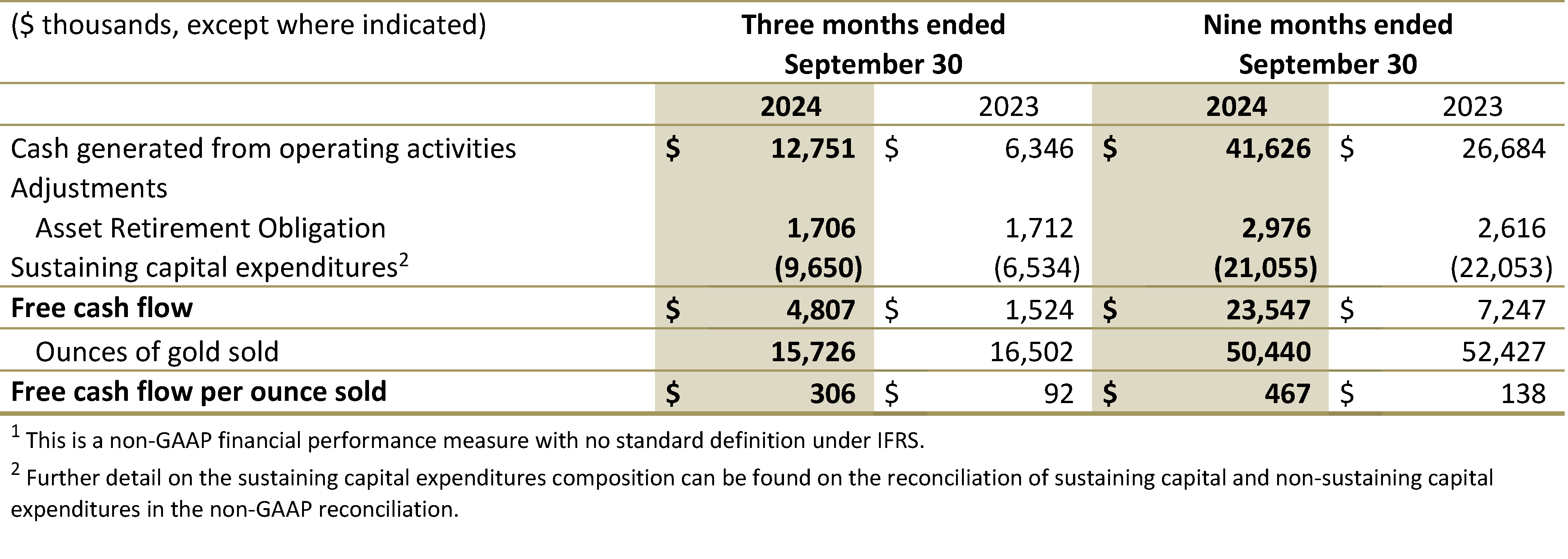

Free cash flow 1 for the quarter was $4.8 million, an increase of $3.3 million compared to free cash flow of $1.5 million in the third quarter of 2023. Free cash flow per ounce 1 sold for the quarter was $306 per ounce compared to $92 per ounce in the third quarter of 2023. Free cash flow is defined as operating cash flow less asset retirement obligation expenditures and sustaining capital expenditures.

Cash position and working capital 1

As of September 30, 2024, the Company had cash and cash equivalents of $41.6 million, compared to a balance of $22.0 million at December 31, 2023. Cash and cash equivalents increased by approximately $19.6 million during the first nine months of the year, mainly reflecting the impact of higher realized gold prices and the receipt of other accounts receivable of $4.0 million from BHP in March 2024.

Vern Baker, President and CEO of Jaguar, stated : "Results for this quarter reflect our continued focus on the development of new mining areas at both of our operations. We are encouraged by the Faina zone at the Turmalina mine which contributed 1,819 ounces to our production from a combination of development ore and our first stoping block. Overall grades were at an average head grade of 4.39 g/t. The stoping tonnes were less than half the total tonnage processed at average grades of over 5.0 g/t. Development of this area is going well and in the fourth quarter we expect to increase both development meters and diamond drilling meters at the Faina zone. In 2025, we plan to continue developing at higher rates and expect to see an increase in production to full rates starting in 2026.

Development of the BA zone at the Pilar mine also continued. Accesses reaching or progressing towards five separate sub-levels of the BA zone continued during the quarter for the purposes of test stoping in several levels starting in the fourth quarter. Diamond drilling also continued and our next MRMR update should reflect ounces in this part of the BA zone.

The focus on development of new sub-levels for the purpose of future production at both mines led to limited work in historical mining areas during the quarter, resulting in lower tonnes processed and higher waste tonnes moved. Efforts to maximize production grades combined with the addition of the higher-grade Faina ore led to improved head grades. Our average head grade increased significantly year-over-year from 2.95 g/t to 3.67 g/t.

On the cost side, our cash operating costs per ounce were 7% lower, the result of the higher grades, while our AISC's increased due to the inclusion of development expenditures as sustaining capital at the Faina zone rather than as growth capital as in prior quarters. The elevated AISC per ounce seen this quarter is expected to improve as production at Faina increases.

During the quarter, we continued to benefit from a strong realized gold price. We added over $4 million in cash and ended the quarter with approximately $42 million dollars, almost doubling our cash position over the past nine months. This positions us to continue investing in the development of our ore zones which will grow ounce production. It also allows us to invest in additional projects which support our growth plan to significantly increase production over the next five years."

Third Quarter 2024 Results

($ thousands, except where indicated) | Three months ended | Nine months ended | ||||||||||||||

September 30 | September 30 | |||||||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||||||

Financial Data | ||||||||||||||||

Revenue | $ | 38,910 | $ | 31,621 | $ | 116,266 | $ | 100,656 | ||||||||

Operating costs | 17,313 | 19,603 | 55,525 | 59,677 | ||||||||||||

Depreciation | 4,941 | 6,697 | 19,930 | 18,682 | ||||||||||||

Gross profit | 16,656 | 5,321 | 40,811 | 22,297 | ||||||||||||

Net income | 2,304 | 3,785 | 18,600 | 5,154 | ||||||||||||

Per share ("EPS") | 0.03 | 0.05 | 0.24 | 0.07 | ||||||||||||

Adjusted Net income 1,3 | 8,301 | 3,785 | 25,083 | 5,154 | ||||||||||||

Adjusted EPS 1,3 | 0.10 | 0.05 | 0.32 | 0.07 | ||||||||||||

EBITDA | 12,267 | 11,354 | 49,442 | 29,813 | ||||||||||||

Adjusted EBITDA 1,2 | 19,853 | 10,187 | 53,555 | 33,223 | ||||||||||||

Adjusted EBITDA per share 1,2 | 0.25 | 0.14 | 0.68 | 0.45 | ||||||||||||

Cash operating costs (per ounce sold) 1 | 1,101 | 1,188 | 1,101 | 1,138 | ||||||||||||

All-in sustaining costs (per ounce sold) 1 | 1,831 | 1,704 | 1,643 | 1,682 | ||||||||||||

Average realized gold price (per ounce) 1 | 2,474 | 1,916 | 2,305 | 1,920 | ||||||||||||

Cash generated from operating activities | 12,751 | 6,346 | 41,626 | 26,684 | ||||||||||||

Free cash flow 1 | 4,807 | 1,524 | 23,547 | 7,247 | ||||||||||||

Free cash flow (per ounce sold) 1 | 306 | 92 | 467 | 138 | ||||||||||||

Sustaining capital expenditures 1 | 9,650 | 6,534 | 21,055 | 22,053 | ||||||||||||

Non-sustaining capital expenditures 1 | 866 | 5,038 | 8,510 | 10,788 | ||||||||||||

Total capital expenditures | 10,516 | 11,572 | 29,565 | 32,841 | ||||||||||||

1 Average realized gold price, sustaining and non-sustaining capital expenditures, cash operating costs and all-in sustaining costs, free cash flow, adjusted net income, adjusted earnings per share, EBITDA and adjusted EBITDA, and adjusted EBITDA per share are non-GAAP financial performance measures with no standard definition under IFRS. Refer to the Non-GAAP Financial Performance Measures section of the MD&A. 2 Adjusted EBITDA excludes non-cash items such as impairment, foreign exchange, stock-based compensation and write downs. For more details refer to the Non-GAAP Performance Measures section of the MD&A. 3 Excluding the impact ($6.0 million) of provisions for civil litigation ($2.7 million) and labour litigation ($3.3 million) in Q3 2024. | ||||||||||||||||

Non-GAAP performance

The Company has included the following Non-GAAP performance measures in this document: cash operating costs per ounce of gold sold, all-in sustaining costs per ounce of gold sold, average realized gold price (per ounce of gold sold), sustaining capital expenditures, non-sustaining capital expenditures, adjusted operating cash flow, free cash flow, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA and working capital. These Non-GAAP performance measures do not have any standardized meaning prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other companies.

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. More specifically, Management believes that these figures are a useful indicator to investors and management of a mine's performance as they provide: (i) a measure of the mine's cash margin per ounce, by comparison of the cash operating costs per ounce to the price of gold; (ii) the trend in costs as the mine matures; and (iii) an internal benchmark of performance to allow for comparison against other mines. The definitions of these performance measures and reconciliation of the Non-GAAP measures to reported IFRS measures are outlined below.

Reconciliation of Sustaining Capital and Non-Sustaining Capital expenditures 1

($ thousands) | Three months ended | Nine months ended | ||||||||||||||

September 30 | September 30 | |||||||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||||||

Sustaining capital 1 | ||||||||||||||||

Primary development | $ | 7,358 | $ | 3,918 | $ | 15,202 | $ | 14,620 | ||||||||

Brownfield exploration | 358 | 617 | 998 | 1,403 | ||||||||||||

Mine-site sustaining | 1,832 | 1,378 | 4,545 | 5,169 | ||||||||||||

Equipment | 1,832 | 1,378 | 4,545 | 5,169 | ||||||||||||

Other sustaining capital 2 | 102 | 621 | 310 | 861 | ||||||||||||

Total sustaining capital 1 | 9,650 | 6,534 | 21,055 | 22,053 | ||||||||||||

Non-sustaining capital (including capital projects) 1 | ||||||||||||||||

Mine-site non-sustaining | (840 | ) | 3,326 | 5,534 | 8,172 | |||||||||||

Asset retirement obligation - non-sustaining 2 | 1,706 | 1,712 | 2,976 | 2,616 | ||||||||||||

Total non-sustaining capital 1 | 866 | 5,038 | 8,510 | 10,788 | ||||||||||||

Total capital expenditures | $ | 10,516 | $ | 11,572 | $ | 29,565 | $ | 32,841 | ||||||||

1 Sustaining and non-sustaining capital are non-GAAP financial measures with no standard definition under IFRS. Refer to the non-GAAP Financial Performance Measures section of the MD&A. Capital expenditures are included in the calculation of all-in sustaining costs and all-in costs. 2 Asset retirement obligation - non-sustaining is related to expenditures with dam closing projects. Payments related to the Company asset retirement obligation are classified as operating activities in accordance with IFRS financial measures. | ||||||||||||||||

Reconciliation of Free Cash Flow 1

Reconciliation of Cash Operating Costs, All-In Sustaining Costs and All-In Costs per Ounce Sold 1

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 1

($ thousands, except where indicated) | Three months ended | Nine months ended | ||||||||||||||

September 30 | September 30 | |||||||||||||||

2024 | 2023 | 2024 | 2023 | |||||||||||||

Net Income | $ | 2,304 | $ | 3,785 | $ | 18,600 | $ | 5,154 | ||||||||

Income tax expense | 3,401 | - | 7,923 | 3,417 | ||||||||||||

Finance costs | 1,588 | 854 | 2,889 | 2,505 | ||||||||||||

Depreciation and amortization | 4,974 | 6,715 | 20,030 | 18,737 | ||||||||||||

EBITDA 1 | $ | 12,267 | $ | 11,354 | $ | 49,442 | $ | 29,813 | ||||||||

Changes in other provisions and VAT taxes | 7,061 | 536 | 7,878 | 964 | ||||||||||||

Foreign exchange loss (gain) | 519 | (1,742 | ) | (4,207 | ) | 1,612 | ||||||||||

Stock-based compensation | ||||||||||||||||