par Forensic Payroll Consultants, Inc.

Forensic Payroll Consultants, Inc. (FPC) Announces Launch of SaaS White-Label Platform for State & Local Payroll Tax ID Registration

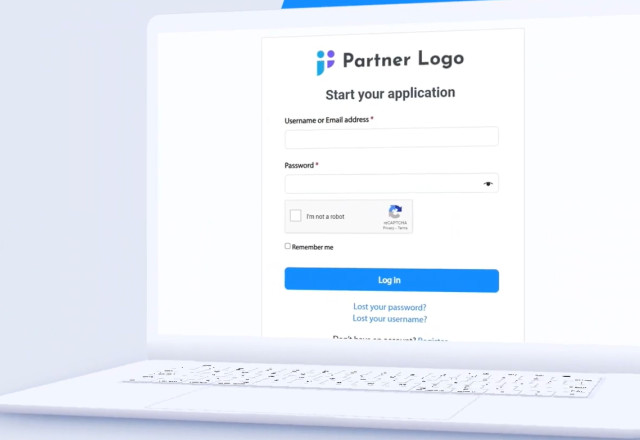

FPC is Disrupting the Multimillion-Dollar State Tax ID Registration Industry by Making It Easier for Payroll Providers to Provide Tax ID Registration Services Under Their Own Banner With Digital Automation

WHITTIER, CA / ACCESSWIRE / May 22, 2024 / Forensic Payroll Consultants, Inc., a national provider of forensic payroll service consulting, announces today it has launched a white-label option of its SaaS multi-state registration portal to payroll providers.

A state tax ID number is sometimes called a state employer ID, state EIN or state tax registration. It's assigned by a state to identify a business for tax administration purposes and since it's state-specific, the format varies by state. This variation causes severe pain points for payroll providers who remit payroll taxes and tax returns on behalf of their clients, ultimately leading to service interruptions when no tax ID is obtained.

FPC's proprietary portal is a single point of entry where users enter company information once and then select the states and tax types within those states in one session instead of having to go to each state website and enter the same information all over again. A SaaS platform for employers to register their tax account makes it easier for payroll service providers (PSPs) to bundle services and mitigate against service interruption as well as discrepancies at the tax agencies.

Most importantly, FPC's portal provides the following features:

- The ability to message the registration analyst handling the account.

- The ability to see where the registration is via a progress bar in the user's personalized dashboard rather than calling a support number.

- Once completed, the ability to see the confirmation of ID issuance.

"Tax registration companies in the U.S. are not payroll tax experts and often make mistakes. They've automated the process to the point of deadheading the data and do not review the information for accuracy. Our platform is a game changer in that we're asking relevant questions and providing the service around the automation," says Andrew Lopez, CEO of Forensic Payroll Consultants, Inc.

FPC will provide white labeling in two options for PSPs and other providers:

- Partner branding configuration while FPC provides behind-the-curtain registration fulfillment.

- Partner subscribership that brings the platform into the PSP's CRM systems via an API where the partner fulfills the registrations.

Forensic Payroll capitalizes on its experience and helps employers reduce costs while ensuring compliance through intelligent analysis of their registration and payroll tax data. "In the highly competitive world of payroll services, the only differentiators up to now have been accuracy, speed, and high compliance. FPC's registration platform provides an additional edge to PSPs' competency," says Lopez.

ABOUT FPC

Forensic Payroll Consultants works with employers to bring their current and prior payroll issues into compliance. FPC works directly with the employer, the employer's accountant or their payroll processing representative to resolve delinquencies in prior periods so they become compliant going forward. In addition to these services, FPC also offers payroll record reconstruction, amendment processing to all jurisdictions in the United States, payroll tax notice resolution, employment classification defense, and wage base tax recovery due to a merger or acquisition. To learn more, contact FPC at info@forensicpayroll.com or forensicpayroll.com.

Contact Information

Andrew Lopez

President and CEO

andrew@forensicpayroll.com

Related Images

|

SOURCE: Forensic Payroll Consultants, Inc.

View the original press release on newswire.com.