par Europacific Metals Inc. (CVE:EUP)

EuroPacific Announces Amendment to Partnership Agreement with BMP Holding and Indice Crucial Lda

VANCOUVER, BC / ACCESSWIRE / June 6, 2024 / Europacific Metals Inc. (TSX-V:EUP)(OTCQB:AUCCF) (the "Company" or "EuroPacific") is pleased to announce an amendment to an earn-in and partnership agreement ("SPA") with BMP Holding ("BMP") and Indice Crucial Lda ("ICL"). The latter is the title holder of the Barrancos Copper-Gold project along with two new Gold properties under application.

The Barrancos prospect area is located in south central Portugal, approximately 240 km by road east of Lisbon, and covers an area of 54 km2 with the license valid until June 2025. EuroPacific ("EUP") in June 2021, entered into an agreement with Indice Crucial Lda to acquire a 100% interest in the Barrancos copper-gold project, comprised of the Aparis Copper mine and the Lirio gold project. It also includes two advanced exploration applications for the Bigorne and Vilariça copper-gold projects in the north of Portugal.

TERMS OF THE AGREEMENT

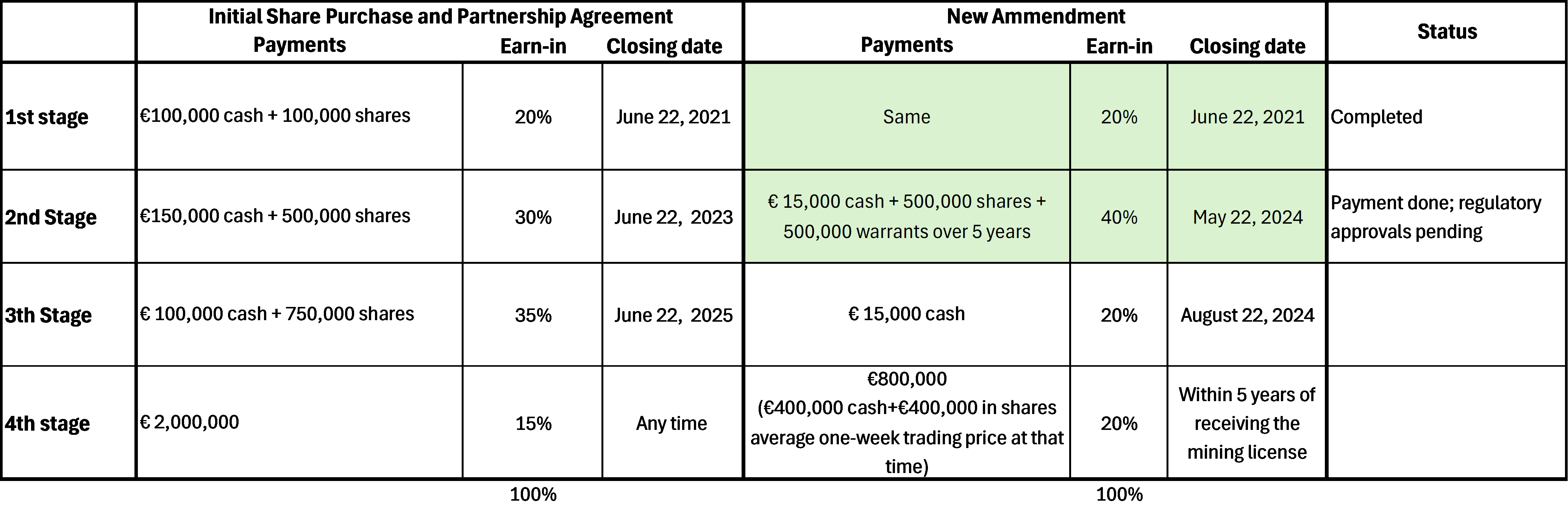

The initial SPA dated 22 June 2021 stipulated that the sale of ICL shares would take place in three stages: (i) in the first stage, BMP would transfer to EuroPacific 20% of the issued and outstanding ICL shares (the "First Stage Shares"), (ii) in the second stage, BMP would transfer to EuroPacific an additional 30% of the issued and outstanding ICL shares (the "Second Phase Shares"), and (iii) in the third stage, BMP would transfer to EuroPacific an additional 35% of the issued and outstanding ICL shares (the "Third Phase Shares"). EuroPacific would also benefit from a call option on the remaining 15% of ICL shares. EUP had already earned in 20% on ICL by paying €100,000 to BMP and issued 100,000 EUP Shares to BMP in accordance with the terms of the first stage of the agreement. Please see the table below.

This new amendment now signed replaces the second and third stages of the original agreement by significantly better terms as follows:

| i. | the payment to BMP of €15,000 in cash, 500,000 ordinary shares and 500,000 warrants at 7.5 cents over five years to get to 60% participation on ICL and another cash transfer of €15,000 in the next three months, to get to 80%. | |

| ii. | The remaining 20% to get to 100% on ICL can be acquired, within five years of receiving a mining license, by paying BMP the amount of €800,000 (half paid on cash and the other half on EUP shares). |

"We are pleased to have been able to rework our partnership agreement with BMP and Indice Crucial. The new terms reduce overall cash expenditures by a significant margin further allowing us to expand exploration immediately on our Gold Portfolio. Chief Executive Officer, Karim Rayani stated.

ABOUT THE BARRANCOS PROJECT

The Barrancos region is part of the Ossa Morena zone, one of the largest geodynamic and oldest units of the Hesperian massive of the Iberian Peninsula. The Barrancos sequence extends on 400 km along a NW trend and is composed of metasedimentary rocks from the Ordovician through to Devonian. The Aparis mine is hosted in Devonian turbidites and is a structurally controlled copper deposit. The Lirio prospect and other occurrences and mines lie in Silurian metasediments associated with replacements veinlets and breccia zones, the latter thought to be related with a post acid subvolcanic event that seems to be the driving mechanism of this the copper-gold system.

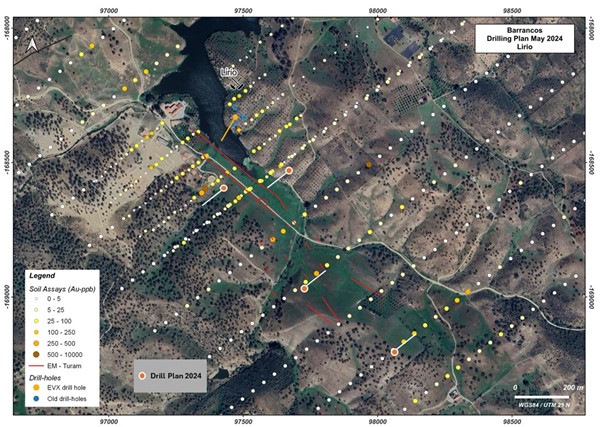

Lirio Gold-Copper Prospect

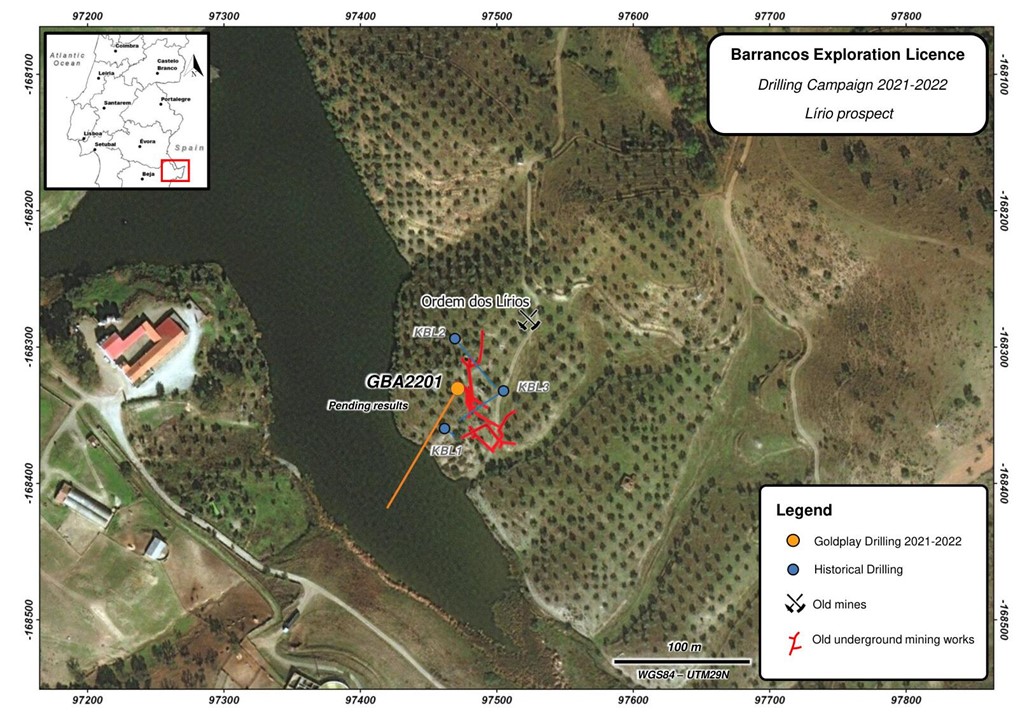

The Lirio project, although located close to the Aparis copper mine, is in a separate gold system. It is situated near old Cu mines such as Merces, Malhada das Vacas and Minancos. Previous work which included drilling, detailed surface sampling and general geology of the area identified a prospective gold system that could be extensive. Rock sampling returned highly anomalous gold results up to a maximum of 128 g/t Au.

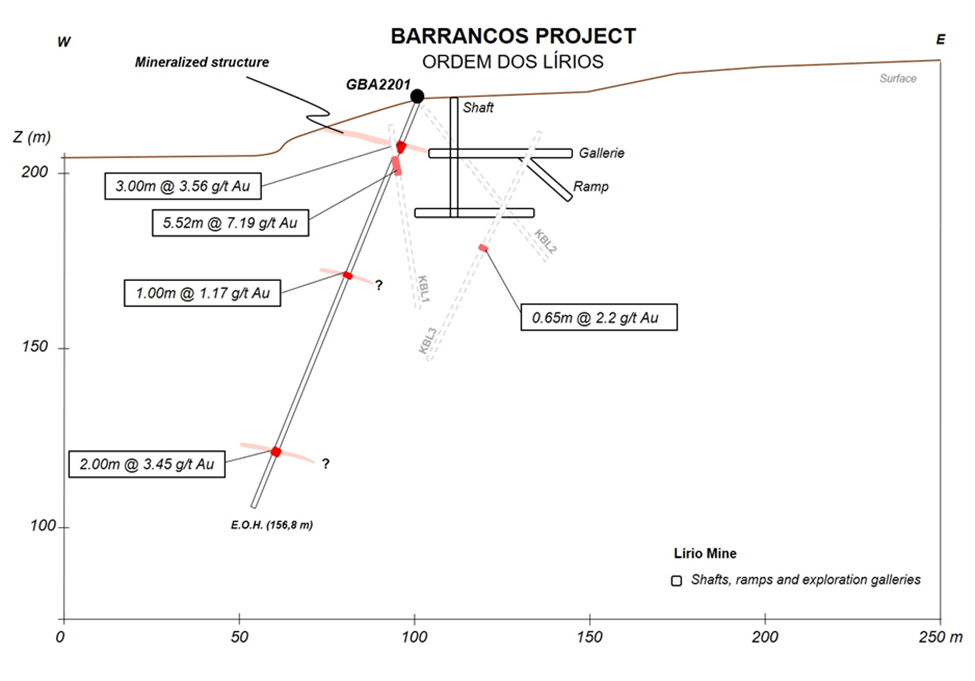

Limited drilling conducted in 2006 identified a volcanic breccia that is thought to be the driving mechanism of the Cu-Au hydrothermal system. The main mineralized zones occur on a shallow-dipping sheeted vein system intersected by a sub-vertical, NE-SW trending, shear zone. Both structures host arsenopyrite-chalcopyrite mineralization with associated gold and high-grade copper sections.

Historical intercepts from a 3 hole-193m drilling campaign undertaken in the Lirio prospect in 2006 by a JV between Rio Narcea Gold Mines and Kernow Resources include 5.52 meters grading 6.56 g/t Au and 0.63% Cu, comprising 2.03m grading 17.82 g/t Gold and 1.6% Copper (hole KBL-01).

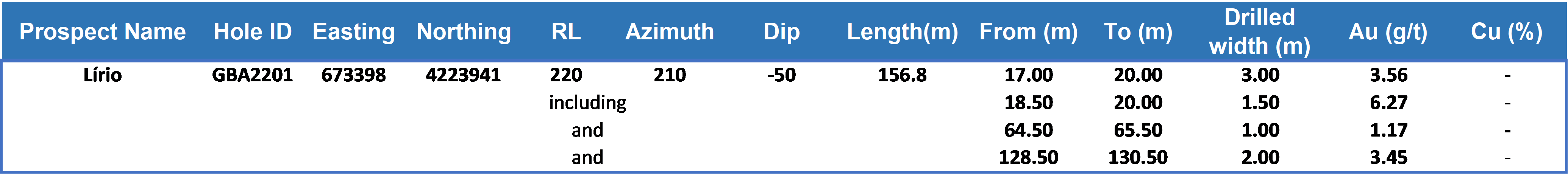

Scout hole GBA2201 drilled in 2022 by EuroPacific has confirmed previous results and shows significant mineralization with a shallow drilling intercept of 3 m grading 3.56 g/t Au from 17m, 1m grading 1.17 g/t Au from 64.5m and 2m grading 3.45 g/t Au from 128.5m. Follow-up drilling is planned for the next drilling season.

Highlights of drill intercepts are depicted in the table below:

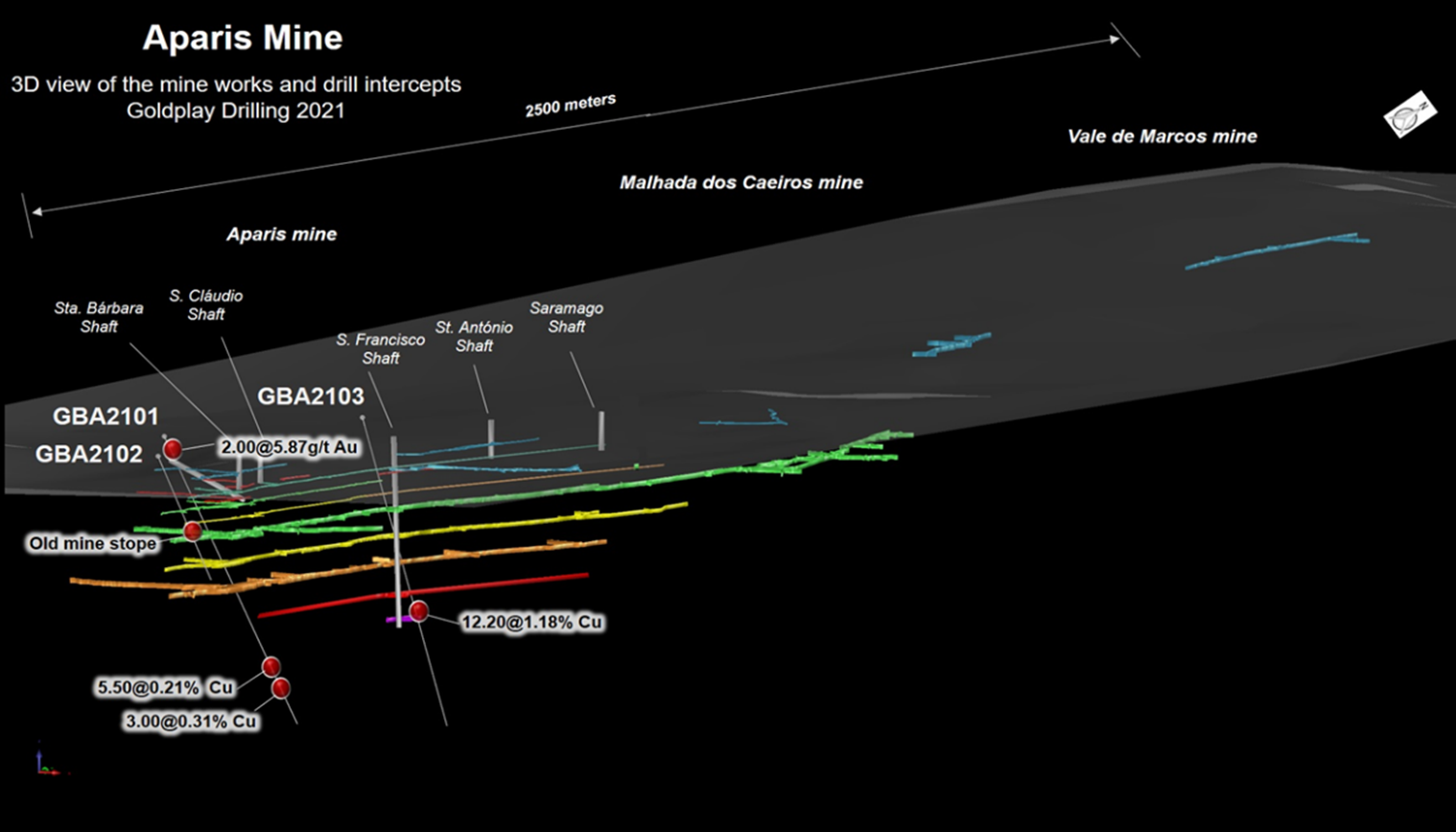

Aparis Copper Mine

The Aparis mine was an underground copper mine which operated intermittently from 1889 to 1975. It is located approximately 10 km to the southwest of the Lirio gold prospect. The mine operated to a maximum depth of 210 meters and government records indicate production figures of 8,100 tonnes of concentrate with a grade of between 23% and 35% Cu between the period 1961 to 1975. The mine consisted of a small-scale operation focused almost exclusively on one narrow (<1m thick) high-grade copper vein which frequently attains grades of > 10% Cu over these widths.

The Aparis copper mine is hosted by Devonian turbidites of the Terena Formation. The mining works extend on at least 2.5 km along strike down to a maximum depth of 210m. The deepest mine levels are in the southern section of the mine.

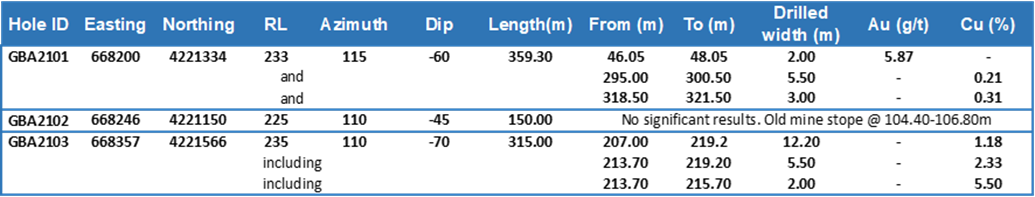

EuroPacific drilled the vein system from November 2021 to February 2022 with a total of 3 holes (824m in total) to investigate in detail the grades, nature, and potential mining widths. The full thickness (up to 10m) of the mineralized zone was never fully tested previously to EuroPacific.

Hole GBA2101 drilled the mineralized system and intersected two parallel vein swarms with average grades of 0.21% Cu over 5.5 m from 295m and 0.31% Cu over 3m from 318.5m. The same hole intersected a totally new mineralized auriferous zone with sulphide veinlets, grading 5.87 g/t Au over 2 m from 46.05m.

Hole GBA2102 intersected a broad zone with mining works that have not been identified previously. The existing data from old records pointed out to high grades in this zone which was probably mined out.

GBA2103 has successfully confirmed the potential of the main copper zone which includes a broad mineralized interval of 12.2m grading 1.18 % Cu and a high-grade section of 2m averaging 5.5 % Cu. The old workings were focused only on thin high-grade sections (>3% Cu typically) leaving behind a large part of the mineralized material.

Highlights of the mineralized intercepts are depicted in the table below:

UPCOMING PLANS AND EXPLORATION PROGRAMS

Lírio Project

Expansion of the soil geochemistry grid in the Lirio prospect has been completed by EuroPacific during the Q1 2024 and was planned to better delineate the strong gold-in-soils anomaly which was only partially covered. This new data confirmed the extensions of the existing gold anomaly that continues well beyond the main zones of the mine works of Lirio both laterally and along strike. This has been used to assist on the design of a 4 hole-500m follow-up drilling campaign planned for June-July 2024. Additional drilling conditioned to the results obtained is planned for 2025 prior to a decision to apply for a mining concession.

During the next two seasons, EuroPacific Metals plans to conduct a robust exploration project on the concession. This will include geological mapping and rock-soil sampling, as well as IP and/or EM over selected areas.

Aparis Mine

The investigation of the copper corridor, which was only partly mined, with most of the works concentrated in the southern part of the deposit, envisages an initial, "surgical" drilling program split into two phases, as follows:

Phase 1 (10 holes-2,500m)

• confirm reported high grade zones from old reports and expand the "mining widths" to a more substantial target size.

• check depth extensions to the mineralized system below reported known ore shoots

• investigate the N and NE extensions of mineralization

This campaign will enable a better planning for a more substantial drilling program, should the results be positive.

Phase 2

Depending on results from the previous phase, medium term plan (2024-2025) envisages a substantial brownfield drilling campaign in order to consolidate the geological model of the deposit and produce an initial resource estimation which will form the basis for a prefeasibility study. Infill drilling is planned on an approximate 200m x 200m grid to produce an initial resource estimation which at this stage would be mostly from the inferred category. This will lead to a decision to apply for a mining concession.

Other priority areas

Initial strategic grab/chip sampling has been conducted mainly of the east and southeast of the Lirio area where a good number of small copper operations and mineral occurrences have been identified. Detailed mapping led to the identification of mineralized polymictic breccia associated with late rhyolite elongated bodies interpreted to be post-Silurian in age.

The Mina Minancos, located 3 km east of Lirio, has been mined for copper since the turn of the 19th century. Historical production was reported to be 1,187 t of copper ore from narrow high-grade veins. Recent sampling of float and dump material returned assay values up to 9.7 % Copper. Gold results of up to 0.27 g/t Au were also obtained from grab sampling.

Along with Minancos, which was the largest operation in the area after Aparis, a series of other prospects have been identified along strike. All these occurrences seem to be spatially associated with the polymictic breccias and rhyolite sub-volcanic bodies and show highly anomalous gold and copper values. These occurrences include Pedra do Galo (1.5 g/t Au, 0.7 % Cu), Barrocal (0.46 g/t Au, 2.7 % Cu), Malhada das Vacas (1.6 g/t Au, 0.5% Cu), and Pias (0.63 g/t Au). Follow-up work including detailed mapping, soil geochemistry and ground geophysics are planned in these targets (IP/Resistivity).

About EuroPacific Metals Inc

EuroPacific Metals Inc. is a Canadian public company listed on TSXV and in US on OTCQB. The Company holds brownfield gold, and copper-gold projects located in Portugal. The Company is focused on exploration in highly prospective geological settings in Europe jurisdictions. EuroPacific Metals ("EUP") owns a total of 100% equity interest in EVX Portugal, a private Portugal based company, that holds the legal exploration rights from the Portugal Government on the Borba 2 ("Borba 2") exploration properties, covering approximately 328 square kilometers in the Alentejo region in Southern Portugal. Miguel Vacas is the most advanced prospect within the Borba 2 license.

Qualified Person

Technical information in this PR has been prepared in accordance with National Instrument 43-101 and approved for inclusion by Mr. José Mario Castelo Branco, EuroGeol, who is a "Qualified Person" with over 35 years' experience in the Exploration and Mining Geology industry. Mr. Castelo Branco holds a B.Sc. in Geology from the University of Porto in Portugal. He is also a member of the Portuguese Association of Geologists, the European Federation of Geologists, Member of the Prospectors and Developers of Canada, the Society of Economic Geologists and the Society for Geology Applied to Mineral Deposits.

On behalf of the Board of Directors

Europacific Metals Inc.

Mr. Karim Rayani, Chief Executive Officer

11th Floor - 1111 Melville Street

Vancouver, BC V6E 3V6

E: k@r7.capital

www.europacific.ca

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the exploration potential of the Company's properties. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. These forward-looking statements involve risks and uncertainties relating to, among other things, results of future exploration and development activities, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and unanticipated environmental impacts on operations. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement. The readers should not rely on any historical estimates. The Company and the QP has not done sufficient work to classify historical estimate as a current resource. Company is not treating the historical estimate as a current resource. Additional work including drilling will be required to verify and upgrade historical estimates.

SOURCE: Europacific Metals Inc.

View the original press release on accesswire.com