par Core Assets Corp. (isin : CA21871U1057)

Core Assets Channel Samples 15m of 1.43% Cu and 92g/t Ag at the Kim Target

VANCOUVER, BC / ACCESSWIRE / April 11, 2023 / Core Assets Corp., ("Core Assets" or the "Company") (CSE:CC)(FSE:5RJ)(OTCQB:CCOOF) is pleased to announce surficial assay results from channel samples collected at the Kim Target ("Kim"), a historic high-grade Fe-Cu-Ag skarn occurrence located 22 KM north-northwest of the Silver Lime CRD-Porphyry Project ("Silver Lime"), north-central Blue Property ("Blue"); Atlin Mining District of NW British Columbia.

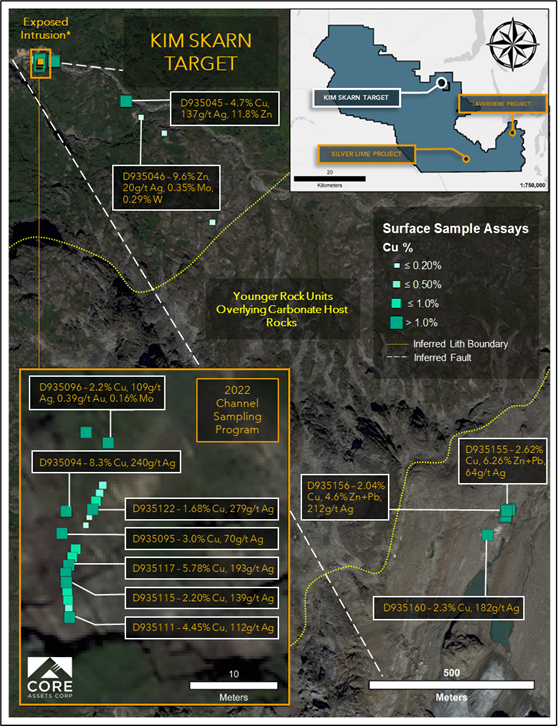

In 2022, channel sampling over a 17m long trend at the Historic Kim Skarn Showing returned significant copper (Cu) grades with associated silver (Ag) including 7m of 3.26% CuEq (2.41% Cu, 106g/t Ag, and 0.06g/t Au) within 15m of 2.17% CuEq (1.43% Cu, 92g/t Ag, 0.04g/t Au; Figure 1, Table 1). Surficial rock grab samples collected near this showing earlier in 2022 returned assay values of up to 8.3% Cu, 240g/t Ag, 0.16% Mo, 0.39g/t Au, and 0.21% Zn.

In addition to extending the historic high-grade copper-silver mineralization though channel sampling at the Kim Showing, a new skarn zone located approximately 2KM to the southeast was discovered by Core Assets' field team and is separated from the Historic Showing by younger rock units that overlie the carbonate host rocks. 10 Rock samples collected from this area in 2022 returned an average grade of 1.35% Cu, 85g/t Ag, and 2.4% Zn+Pb. Skarn mineralization at the Kim Target becomes more Zn+Pb-rich as it extends away from the Historic Showing, following the trend of a NW-SE oriented fault (Figure 1).

Table 1: 2022 Channel Sampling Results & Highlights - Kim Skarn Target | |||||||

Sample ID | From (m) | To (m) | Int (m) | Cu % | Ag g/t | Au g/t | CuEq % |

Combined Length* | 0.00 | 17.00* | 15.00 | 1.43 | 92 | 0.04 | 2.17 |

Including | 0.00 | 7.00 | 7.00 | 2.41 | 106 | 0.06 | 3.26 |

and | 4.00 | 7.00 | 3.00 | 3.55 | 142 | 0.10 | 4.71 |

D935111 | 0.00 | 1.00 | 1.00 | 4.45 | 112 | 0.08 | 5.37 |

D935112 | 1.00 | 2.00 | 1.00 | 0.40 | 38 | 0.01 | 0.69 |

D935113 | 2.00 | 3.00 | 1.00 | 0.85 | 120 | 0.01 | 1.77 |

D935114 | 3.00 | 4.00 | 1.00 | 0.51 | 44 | 0.01 | 0.85 |

D935115 | 4.00 | 5.00 | 1.00 | 2.20 | 139 | 0.11 | 3.35 |

D935116 | 5.00 | 6.00 | 1.00 | 2.66 | 94 | 0.15 | 3.49 |

D935117 | 6.00 | 7.00 | 1.00 | 5.78 | 193 | 0.04 | 7.30 |

D935118 | 7.00 | 8.00 | 1.00 | 0.68 | 21 | 0.01 | 0.84 |

D935119 | 8.00 | 9.00 | 1.00 | 0.72 | 19 | 0.01 | 0.87 |

2m of Overburden from 9-11m along Channel Trace (No Samples*) | |||||||

D935120 | 11.00 | 12.00 | 1.00 | 0.16 | 31 | 0.01 | 0.40 |

D935121 | 12.00 | 13.00 | 1.00 | 0.18 | 57 | 0.01 | 0.61 |

D935122 | 13.00 | 14.00 | 1.00 | 1.68 | 279 | 0.03 | 3.86 |

D935123 | 14.00 | 15.00 | 1.00 | 0.69 | 155 | 0.01 | 1.89 |

D935124 | 15.00 | 16.00 | 1.00 | 0.37 | 30 | 0.04 | 0.63 |

D935125 | 16.00 | 17.00 | 1.00 | 0.20 | 43 | 0.05 | 0.56 |

Assay results are presented as weighted averages and assume 100% metal recovery. Interval widths represent cut channel lengths. * indicates total average of combined lengths of channels samples. Copper equivalent (CuEq) grades are calculated using metal prices of silver US$21.25/oz., gold US$1,850/oz, copper US$4.00/lb. Copper equivalent grade is calculated as CuEq (%) = Cu (%) + (Ag (g/t) * 0.0077) + (Au (g/t) * 0.674).

"Our district-scale land package continues to return extraordinary results increasing the number of exploration targets substantially." said Core Assets' President & CEO, Nick Rodway. "Exploration at the Kim Target in 2022 yielded our highest-grade copper-silver channel samples to-date, and we expect to continue to unveil additional new discoveries during the 2023 drilling season set to start in June. Additional sampling results and technical updates are still to come prior to drill mobilization."

Figure 1: Schematic plan map of the Kim Skarn Target at the Blue Property showing 2022 surficial grab and channel sample locations, Cu (%) assay highlights, and local geology (including observations from: Massey et. al, 2005).

About the Kim Skarn Target

The Kim Skarn Target was originally identified in 1965 by Falconbridge Nickel Mines Ltd. near the confluence of the Kim and Fault creeks. That same year, Falconbridge reported an average grade of 4.03% Cu, 0.82% Zn, 99.5g/t Ag, 0.62g/t Au from chip samples collected from a massive magnetite-chalcopyrite-rich skarn1. The original showing was delineated over an area of 37m2 along the contact between marble and a Cu-bearing felsic intrusion.

1McDougall, J.J. (1965). Preliminary Report on Atlin Area Prospects. Falconbridge File. ARIS report 650344.

QA/QC and Sample Preparation

All channel samples were cut in the field using a gas-powered diamond blade saw. Locations were marked with spray paint across presumed mineralized horizons and parallel lines were cut approximately 5 centimetres apart. Perpendicular lines were then cut at approximately 1 meter sample intervals. A hammer and chisel were then used to remove the rock from the channels and the samples were placed in pre-labelled sample bags. Locations were obtained using a handheld GPS and azimuth measurements were collected using a compass.

Rock and channel samples collected at the Kim Target in 2022 were bagged, tagged, and labelled prior to being shipped by ground to ALS Preparation Facility in Whitehorse, YT where they were finely crushed and sieved to <75 microns. Samples were then shipped to ALS Geochemistry in North Vancouver, BC where they were analysed for gold by fire assay with an AA finish, over limits for Ag, Pb, Cu, Zn, and additional elements were analysed using four acid digestion with an ICP-AES finish.

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release.

About Core Assets Corp.

Core Assets Corp. is a Canadian mineral exploration company focused on the acquisition and development of mineral projects in British Columbia, Canada. The Company currently holds 100% ownership in the Blue Property, which covers a land area of114,073.93 ha (~1,140 km²). The Property lies within the Atlin Mining District, a well-known gold mining camp located in the unceded territory of the Taku River Tlingit First Nation and the Carcross/Tagish First Nation. The Blue Property hosts a major structural feature known as The Llewellyn Fault Zone ("LFZ"). This structure is approximately 140km in length and runs from the Tally-Ho Shear Zone in the Yukon, south through the Blue Property to the Alaskan Panhandle Juneau Ice Sheet in the United States. Core Assets believes that the south Atlin Lake area and the LFZ has been neglected since the last major exploration campaigns in the 1980's. The LFZ plays an important role in mineralization of near surface metal occurrences across the Blue Property. The past 50 years have seen substantial advancements in the understanding of porphyry, skarn, and carbonate replacement type deposits both globally and in BC's Golden Triangle. The Company has leveraged this information at the Blue Property to tailor an already proven exploration model and believes this could facilitate a major discovery. Core Assets is excited to become one of Atlin Mining District's premier explorers where its team believes there are substantial opportunities for new discoveries and development in the area.

On Behalf of the Board of Directors

CORE ASSETS CORP.

"Nicholas Rodway"

President & CEO

Tel: 604.681.1568

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include expectations regarding speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of sampling at the Blue Property; that the Company's plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at Silver Lime through additional field work and diamond drilling; the proposed diamond drilling program planned for Silver Lime in 2023; that drilling efforts will aim to confirm and extend certain targets and mineralization on the property; that the Company's exploration model could facilitate a major discovery at the Blue Property; that the Company anticipates it can become one of the Atlin Mining District's premier explorers and that there are substantial opportunities for new discoveries and development in this area. It is important to note that the Company's actual business outcomes and exploration results could differ materially from those in such forward-looking statements; that the Company may be unable to implement its plans to further explore the Blue Property and, in particular, that the proposed diamond drilling program planned for Silver Lime may not proceed as anticipated or at all; that drilling efforts may not confirm and extend any targets or mineralization on the Silver Lime; that the Company's exploration model may fail to facilitate any commercial discovery of minerals at the Blue Property; that the Company may not become one of Atlin Mining District's premier explorers or that the area may be found to lack opportunities for new discoveries and development, as anticipated; that further permits may not be granted in a timely manner, or at all; that the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; that certain exploration methods, including the Company's proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company's operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company's SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

SOURCE: Core Assets Corp.

View source version on accesswire.com:

https://www.accesswire.com/748457/Core-Assets-Channel-Samples-15m-of-143-Cu-and-92gt-Ag-at-the-Kim-Target