par Context Analytics, Inc.

Context Analytics Launches Quantitative News Feed

Predictive News Sentiment for Quantitative Strategies and Alpha Generation

CHICAGO, IL / ACCESSWIRE / February 12, 2024 / At Context Analytics, we pride ourselves on being at the forefront of harnessing unstructured financial data to provide actionable insights for investors. We are thrilled to announce the launch of our newest data source: News Articles. The Quantitative News Feed provides predictive news sentiment for quantitative strategies and alpha generation.

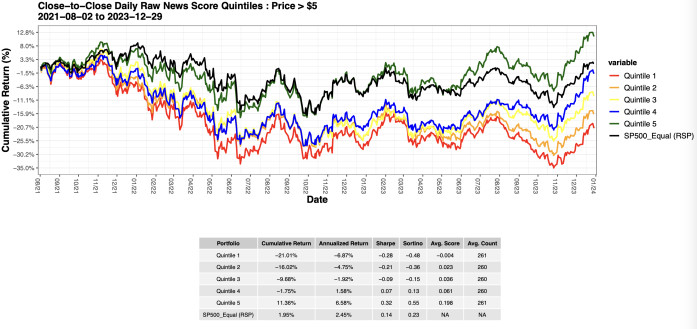

Companies in the top quintile consistently outperform the S&P 500 Equal Weighted ETF (RSP), serves as a testament to the predictive power of our news data.

The Quantitative News Feed provides extensive coverage. In real-time, we ingest articles from over 3,000 news sources, covering more than 4,000 unique companies. With our proprietary natural language processing (NLP) technology, we analyze and score news articles at the individual article level, producing sentiment metrics that are usable in trading decisions. Importantly, these metrics are independent of sentiment data from social media platforms, offering a unique perspective on market sentiment.

Features and benefits of Context Analytics' Quantitative News feed include:

- Machine-Readable format

- Alpha Generation

- Risk Mitigation

- Customized Solutions

Context Analytics' CEO Joe Gits explains, "Our research shows the correlation between sentiment from news articles and subsequent market returns, highlighting the value proposition of our news data feed for investors." The implications extend beyond mere performance metrics, offering actionable insights for traders and fund managers alike. Whether it's identifying potential winners or avoiding under-performers, our news data opens a variety of opportunities for strategic decision-making.

About Context Analytics: A financial data analytics company that sources, cleans, structures, and analyzes textual data for investable insights and business intelligence. Founded in 2011, CA has built Intellectual Property in four Major FinTech Areas: Sentiment Natural Language Processing, Source Agnostic Textual Parsing, Complex Topic Modeling, and Source Accuracy. CA provides the financial and marketing communities with new data sources to evaluate financial data sets, enhance returns, and reduce risk.

Contact Information

Madison Wray

Business Development Analyst

madison@contextanalytics-ai.com

(312) 788-2607

SOURCE: Context Analytics Inc.

View the original press release on newswire.com.