par Clear Start Tax

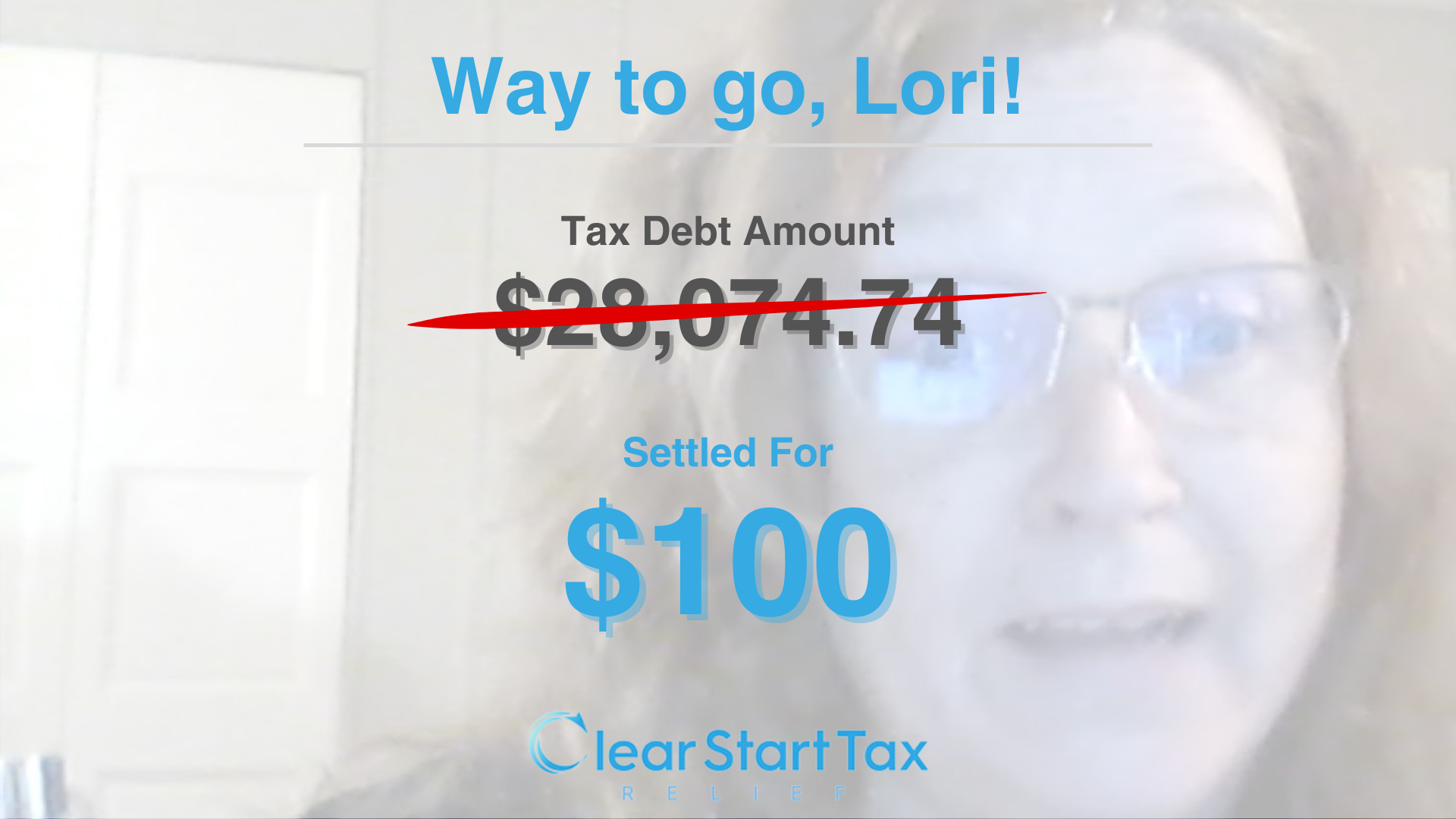

Clear Start Tax Helps Client Settle $28,000 Tax Debt Down to $100 Using the IRS Fresh Start Program

From Overwhelming Debt to Financial Freedom: How Clear Start Tax Delivered Life-Changing Results

IRVINE, CA / ACCESSWIRE / January 15, 2025 / Clear Start Tax, a trusted leader in tax resolution services, proudly shares the inspiring story of Lori Lorance, a client who overcame a $28,000 tax debt with the company's expert guidance and the IRS Fresh Start Program. Lori's case highlights Clear Start Tax's dedication to delivering personalized and effective solutions for clients facing complex tax challenges. By negotiating an Offer in Compromise, Lori's debt was reduced to just $100, offering her a fresh start and renewed financial stability.

Clear Start Tax Helps Client Settle $28,000 Tax Debt Down to $100 Using the IRS Fresh Start Program

Personalized Guidance for a Longstanding Tax Challenge

Lori's tax troubles began after a divorce in 2006, leaving her burdened with $28,000 in back taxes. Financial hardships forced her to claim nine dependents to make ends meet, creating a debt that felt impossible to overcome. The constant stress of IRS actions and fear of losing property compounded her anxiety.

That's when Lori turned to Clear Start Tax for help. Through personalized care, Clear Start Tax's team carefully assessed Lori's financial situation and developed a tailored strategy to address her unique challenges.

A Tailored Strategy with Remarkable Results

Clear Start Tax's expertise in navigating IRS programs led to a transformative outcome for Lori. Through the IRS Offer in Compromise, her $28,000 tax liability was reduced to just $100. This extraordinary settlement relieved her of years of financial stress and allowed her to reclaim control of her future.

"Lori's case is a perfect example of how a tailored approach can lead to extraordinary outcomes," said the Head of Client Solutions at Clear Start Tax. "Every client's situation is unique, and our goal is to provide strategies that not only resolve tax burdens but also empower clients to move forward with confidence."

Client Praise for Clear Start Tax's Dedication

"Going through this process with Clear Start Tax was the greatest thing I could have ever done," Lori said. "They are willing to help you in any way possible. I had a wonderful gentleman named Jeff who guided me through the process."

With the weight of her debt lifted, Lori found a renewed sense of peace. "A big weight has been lifted off my shoulders, and I'm not as stressed as I was," she shared.

Lori enthusiastically recommends Clear Start Tax to others facing similar challenges: "If anybody else is going through this issue, please give Clear Start Tax a call. I definitely would recommend them."

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm serving taxpayers across the United States. The company specializes in addressing a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps clients navigate the IRS Fresh Start Program, providing expert guidance and proven strategies to resolve tax debt effectively. Fully accredited and A+ rated by the Better Business Bureau, Clear Start Tax is recognized for its commitment to long-term client success and its innovative approach to tax resolution.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Testimonials Disclaimer

All estimates and statements regarding program performance are based on historical client outcomes. Results for each individual may vary depending on their specific tax situation, financial status, and the timely and accurate submission of information. Among Clear Start Tax clients who enroll in tax resolution services, approximately 30% qualify for an Offer in Compromise (OIC), 40% qualify for Installment Agreements (IA) or Partial Payment Installment Agreements (PPIA), 15% qualify for Installment Agreements (IA) with Penalty Abatement, and 15% are placed in Currently Not Collectible (CNC) status. We do not guarantee that your tax debt will be reduced by a specific amount or percentage, or that your taxes will be paid off within a certain time frame. Interest and penalties will continue to accrue until your tax liability is resolved in full.

Testimonials provided by Clear Start Tax clients reflect their individual experiences and are based on their specific circumstances. Compensation may have been provided for their honest feedback. These are individual results, which will vary depending on the situation. No testimonial should be considered a promise, guarantee, or prediction of the outcome of your case.

Contact Information

Clear Start Tax

Corporate Communications Department

seo@clearstarttax.com

949-800-4044

Related Video

https://www.youtube.com/watch?v=es4PVkUS-io

SOURCE: Clear Start Tax

View the original press release on accesswire.com