par Banyan Gold Corp. (CVE:BYN)

Banyan Announces Updated Pit-Constrained Mineral Resource Estimate for Hyland Gold Project, Yukon, Canada

VANCOUVER, BC / ACCESS Newswire / October 27, 2025 / Banyan Gold Corp. (the "Company" or "Banyan") (TSX-V:BYN)(OTCQB:BYAGF) is pleased to announce an updated Mineral Resource Estimate (the "MRE" or the "Mineral Resource") prepared in accordance with National Instrument 43-101, Standards for Disclosure for Mineral Projects ("NI 43-101") for the Hyland Project ("Hyland" or the "Project"), Yukon, Canada, an additional property to Banyan's flagship Aurmac Property as defined below in "about Banyan". The updated MRE incorporates all drilling completed through 2018 and reflects the most current information available, as no further drilling has been completed since then.

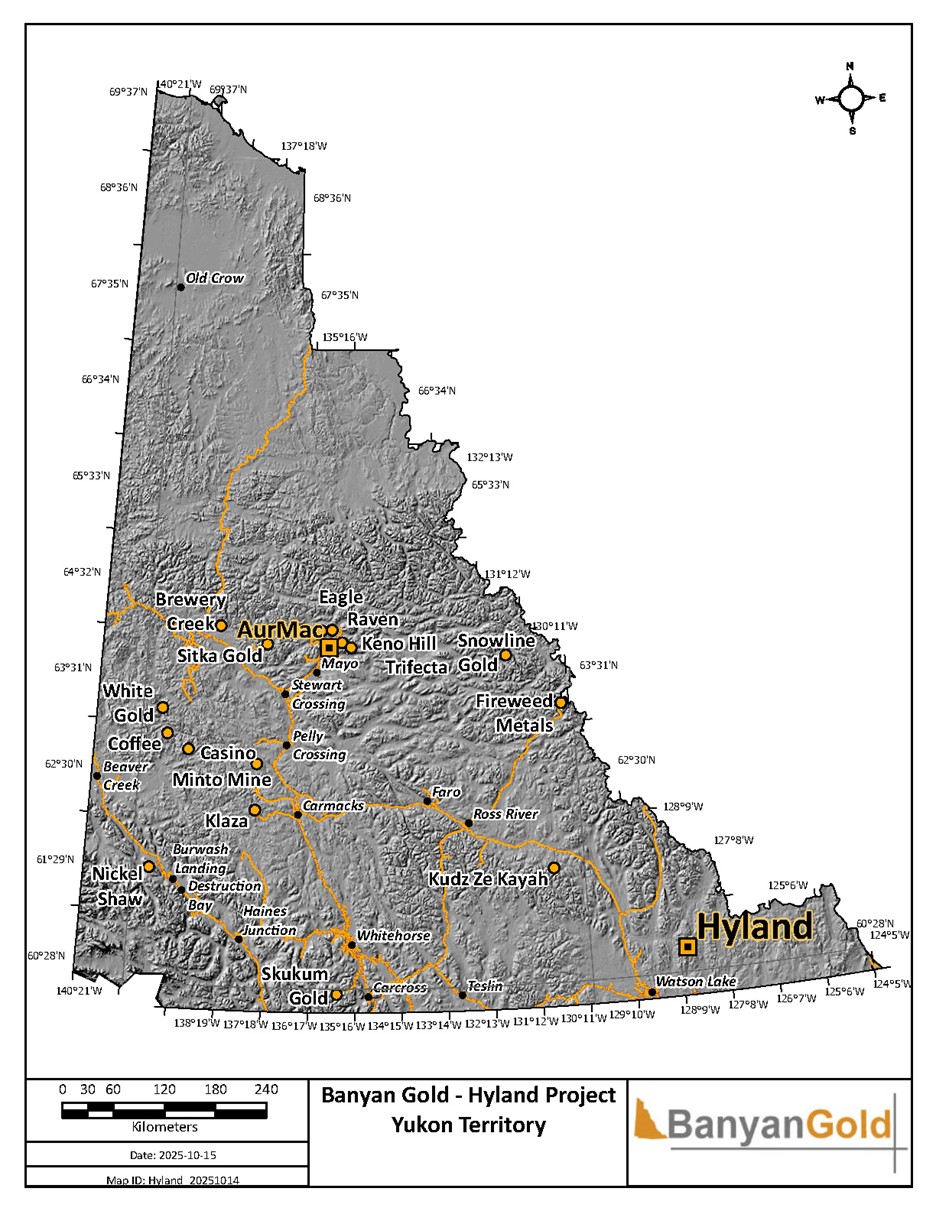

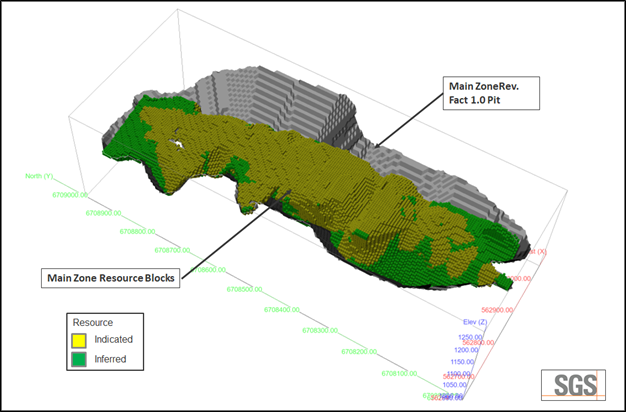

The updated MRE comprises an Indicated Mineral Resource of 337 thousand ("k") ounces ("oz") of gold ("Au") and 2.63 million ("M") oz of silver ("Ag") (11.3 M tonnes of ore at 0.93 g/t Au and 7.27 g/t Ag), and an Inferred Mineral Resource of 118k oz of Au and 0.86M oz Ag (3.9 M tonnes of ore at 0.95 g/t Au and 6.94 g/t Ag)(as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43â101). The updated MRE is summarized below in Table 1; cut-off grade sensitivities for the Hyland deposit are presented in Table 2. The Hyland Project pit-constrained MRE is contained in a single near/on-surface deposit. The deposit is accessible by float plane and by ground via a winter road from Watson Lake with substantial drill and heavy equipment on site (Figure 1).

"The updated, pit-constrained Mineral Resource demonstrates the potential of the Hyland Project as a gold and silver project. Mineralization is still open along strike to the north and south as well as at depth. With additional work, there is potential to delineate additional mineral resources in the main zone, as well as define new resources in other portions of the property," stated Tara Christie, President and CEO. "Work will continue in the off-season to update the geologic model and refine targeting at the highly prospective Cuz and Montrose zones."

Table 1: Pit-Constrained Indicated and Inferred Mineral Resources - Hyland Project

Cut-off Grade (AuEq g/t) | Tonnes | Au | Ag | AuEq | |||

Grade (g/t) | Ozs | Grade (g/t) | Ozs | Grade (g/t) | Ozs | ||

Indicated | |||||||

0.5 | 11,272,000 | 0.93 | 337,000 | 7.27 | 2,634,000 | 1.02 | 368,000 |

Inferred | |||||||

0.5 | 3,865,000 | 0.95 | 118,000 | 6.94 | 863,000 | 1.03 | 128,000 |

Hyland Gold Project Main Zone Mineral Resource Estimate Notes:

The effective date of the Hyland Mineral Resource Estimate is September 1, 2025.

The mineral resource was estimated by Allan Armitage, Ph.D., P.Geo. of SGS Geological Services who is an independent Qualified Person as defined by NI 43-101.

The classification of the current Mineral Resource Estimate into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

All figures are rounded to reflect the relative accuracy of the estimateand numbers may not add due to rounding.

The mineral resources are presented undiluted and in situ, constrained by a continuous 3D wireframe model, and is considered to have reasonable prospects for eventual economic extraction.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve.

The Hyland mineral resource estimate is based on a validated database which includes data from surface trenching, and surface diamond and RC drilling completed between 1987 and 2018.

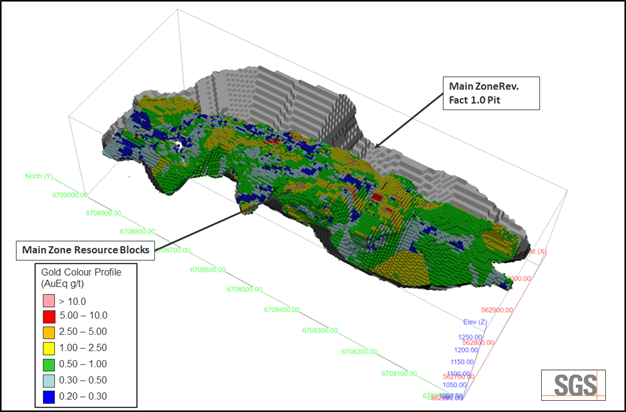

The MRE for Hyland is based on one three-dimensional ("3D") resource model representing the deposit.

Grades for Au and Ag were estimated for each mineralization domain using 1.5 metre drill core and 2.0 metre channel composites assigned to that domain. To generate grade within the blocks, the inverse distance cubed (ID2) interpolation method was used. An average SG value of 3.04 was used for tonnage calculation.

Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that Hyland may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.5 g/t AuEq. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domain (the constraining volume).

The pit optimization and base-case cut-off grade consider a gold price of $2,400/oz and a silver price of $28 /oz and considers a gold recovery of 92% and silver recovery of 70%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.40/t mined, pit slope of 55â° degrees, and processing, treatment, refining, G&A and transportation cost of USD$19.50/t of mineralized material.

The results from the pit optimization, using the pseudoflow optimization method in Whittle 2022, are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Project. The results are used simply as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 1.00 was selected as the ultimate pit shell for the purposes of the current MRE.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

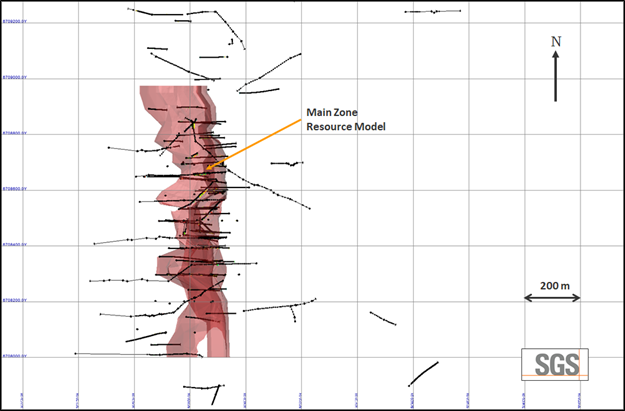

A NI 43-101 Technical Report supporting the updated Mineral Resource has been filed on SEDAR+ at www.sedarplus.ca on the same day as this release. The pit outlines used to constrain the MRE are shown in Figure 2.

Hyland Deposit

The drill data for Hyland is comprised of 86 drill holes (18,505.40 m) and 39 trenches (7,598.7 m). Completion of the current MRE also included an updated three-dimensional (3D) mineral resource model (resource domain; Figure 2).

Mineralization at Hyland occurs in a slightly recumbent anticline developed along a regional structural corridor known as the Quartz Lake Lineament which is cut by southeast-trending faults. Gold and silver occur in quartz veins and breccias in quartzite, silicified zones in phyllite, and iron sulphide and/or iron carbonate replacements zones in limestone.

Table 2. Pit-Constrained Indicated and Inferred Mineral Resources at Various AuEq g/t Cut-off Grades - Hyland Deposit

Cut-off Grade (AuEq g/t) | Tonnes | Au | Ag | AuEq | |||

Grade (g/t) | Ozs | Grade (g/t) | Ozs | Grade (g/t) | Ozs | ||

Indicated | |||||||

0.2 | 16,840,000 | 0.73 | 395,000 | 5.89 | 3,188,000 | 0.80 | 432,000 |

0.3 | 15,397,000 | 0.78 | 385,000 | 6.22 | 3,081,000 | 0.85 | 420,000 |

0.4 | 13,321,000 | 0.85 | 364,000 | 6.74 | 2,885,000 | 0.93 | 397,000 |

0.5 | 11,272,000 | 0.93 | 337,000 | 7.27 | 2,634,000 | 1.02 | 368,000 |

0.6 | 9,234,000 | 1.03 | 305,000 | 7.92 | 2,352,000 | 1.12 | 333,000 |

0.7 | 7,411,000 | 1.13 | 270,000 | 8.69 | 2,072,000 | 1.24 | 294,000 |

1.0 | 4,254,000 | 1.41 | 192,000 | 10.88 | 1,488,000 | 1.53 | 210,000 |

Inferred | |||||||

0.2 | 4,866,000 | 0.82 | 128,000 | 6.29 | 985,000 | 0.89 | 139,000 |

0.3 | 4,488,000 | 0.87 | 125,000 | 6.55 | 944,000 | 0.94 | 136,000 |

0.4 | 4,166,000 | 0.91 | 122,000 | 6.72 | 900,000 | 0.99 | 133,000 |

0.5 | 3,865,000 | 0.95 | 118,000 | 6.94 | 863,000 | 1.03 | 128,000 |

0.6 | 3,159,000 | 1.05 | 107,000 | 7.73 | 786,000 | 1.14 | 116,000 |

0.7 | 2,594,000 | 1.15 | 96,000 | 8.57 | 715,000 | 1.25 | 104,000 |

1.0 | 1,565,000 | 1.39 | 70,000 | 11.00 | 554,000 | 1.52 | 77,000 |

Notes to Table 2:

The effective date of the Hyland Mineral Resource Estimate is September 1, 2025.

The mineral resource was estimated by Allan Armitage, Ph.D., P.Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

The classification of the current Mineral Resource Estimate into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

The mineral resources are presented undiluted and in situ, constrained by a continuous 3D wireframe model, and is considered to have reasonable prospects for eventual economic extraction.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve.

The Hyland mineral resource estimate is based on a validated database which includes data from surface trenching, and surface diamond and RC drilling completed between 1987 and 2018.

The MRE for Hyland is based on one three-dimensional ("3D") resource model representing the deposit.

Grades for Au and Ag were estimated for each mineralization domain using 1.5 metre drill core and 2.0 metre channel composites assigned to that domain. To generate grade within the blocks, the inverse distance cubed (ID2) interpolation method was used. An average SG value of 3.04 was used for tonnage calculation.

Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that Hyland may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.5 g/t AuEq. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domain (the constraining volume).

The pit optimization and base-case cut-off grade consider a gold price of $2,400/oz and a silver price of $28 /oz and considers a gold recovery of 92% and silver recovery of 70%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.40/t mined, pit slope of 55â° degrees, and processing, treatment, refining, G&A and transportation cost of USD$19.50/t of mineralized material.

The results from the pit optimization, using the pseudoflow optimization method in Whittle 2022, are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Project. The results are used simply as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 1.00 was selected as the ultimate pit shell for the purposes of the current MRE.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Average width of the drill core sample intervals is 1.51m; the average width of the channel assay samples is 3.10m. A composite length of 1.50m and 2.00 metres was chosen for the drill core assay data and channel sample data, respectively.

No capping of high-grade composites was used in this MRE. Analysis of the composite data indicates very few outliers within the database. Analysis of the spatial location of these samples and the sample values proximal to them led the independent QP to believe that the high values were legitimate parts of the population and that the impact of including these high composite values uncapped would be negligible to the overall resource estimate.

The estimation of gold grades into a block model was carried out with the inverse distance squared (ID2) interpolation method on uncapped composites with the resultant block model comprised of a block size of 5m (easting) x 5m (northing) x 5m (elevation). Specific gravity was estimated was based on 76 mineralized samples and 67 waste rock samples.

Upcoming Events

New Orleans Investment Conference - November 2 to 5, 2025

Corporate Update and Breakfast - November 5, 7:15 AM CST

Deutsche Goldmesse Fall, Frankfurt - November 14 to 15, 2025

Yukon Geoscience Forum, Whitehorse - November 16 to 19, 2025

Quality Assurance, Quality Control Measures and Data Verification

The reported work was completed using industry standard procedures, including a quality assurance/quality control ("QA/QC") program consisting of the insertion of certified reference materials, field duplicates and coarse blanks into the sample stream and utilizing certified independent analytical laboratories for all assays. Additionally, historic QA/QC data and methodology on the Hyland Project were reviewed and are summarized in the NI 43-101 Technical Report. Based on a review of all possible information, the author of the Technical Report is of the opinion that the database is of sufficient quality to be used for the current Indicated and Inferred MRE.

A robust system of standards, core duplicates and coarse blanks, was implemented in all Banyan drilling programs and was monitored as chemical assay data became available. All control samples were within accuracy and precision thresholds required to meet data quality standards. These control samples amounted to approximately 10% of all samples submitted to analytical laboratories.

All geological data in the MRE was reviewed and verified by SGS Canada Inc. - Geological Services ("SGS") as being accurate to the extent possible and to the extent possible all geological information was reviewed and confirmed. SGS made site visits to the Hyland Project on October 12, 2011, September 19-20 2017 and August 25-26, 2025 and observed Banyan's drilling and sampling techniques, as well as viewed Hyland drill core. SGS confirms that the assay sampling QA/QC protocols undertaken by Banyan provide adequate and good verification of the data and believes the work to have been done within the CIM guidelines.

NI 43-101 Technical Report

Additional discussion and disclosure on the updated MRE, Hyland Mineral Resource Model Data Verification, as well as on Project earn-in status, underlying royalties and metallurgical test work completed by Banyan is included in the NI 43-101 Technical Report which was filed on SEDAR+ with this release.

Qualified Persons

The updated Mineral Resource Estimate for the Hyland Project was prepared by Allan Armitage, Ph.D., P.Geo., Technical Manager and Senior Resource Geologist, SGS Canada Inc. - Geological Services, an independent "Qualified Person" as required by NI 43-101, who has reviewed and approved the contents of this release and has verified the data disclosed as it relates to the MRE.

Duncan Mackay, M.Sc., P.Geo., is a "Qualified Person" as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"), and has reviewed and approved the content of this news release in respect of all disclosure other than the MRE. Mr. Mackay is Vice President Exploration for Banyan and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Analytical Method

All drill core and trench samples collected from the Hyland Gold program were analyzed at Bureau Veritas Minerals of Burnaby, B.C., utilizing the four-acid digestion ICP-MS 35-element MA300 analytical package with FA450 50-gram Fire Assay with AAS finish for gold on all samples. All core samples were split on-site at Banyan's core processing facilities at the Hyland Gold Project. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. All these samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas's Analytical laboratory in Burnaby, B.C., for pulverization and final chemical analysis. A robust system of standards was implemented in the 2017 exploration drilling program and was monitored as chemical assay data become available. A more robust description of historic analytical procedures will be included in the forthcoming Hyland NI 43-101 report to be filed on SEDAR+.

About Banyan

Banyan's primary asset, the AurMac Project is located in the Traditional Territory of First Nation of Na-Cho Nyäk Dun, in Canada's Yukon Territory. The current Mineral Resource Estimate ("MRE") for the AurMac Project has an effective date of June 28, 2025 and comprises an Indicated Mineral Resource of 2.274 million ounces of gold ("Au") (112.5 M tonnes at 0.63 g/t) and an Inferred Mineral Resource of 5.453 M oz of Au (280.6 M tonnes at 0.60 g/t ) (Table 3: as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43â101). The 303 square kilometres ("sq km") AurMac Project lies 40 km from Mayo, Yukon. The AurMac Project is transected by the main Yukon highway and benefits from a 3-phase powerline, existing power station and cell phone coverage.

Table 3: Pit-Constrained Indicated and Inferred Mineral Resources - AurMac Project

Deposit | Gold Cut-Off (g/t) | Tonnage | Average Gold Grade (g/t) | Contained Gold (Moz) |

Indicated MRE | ||||

Airstrip | 0.30 | 27.7 | 0.69 | 0.611 |

Powerline | 0.30 | 84.8 | 0.61 | 1.663 |

Total Combined Indicated MRE | 0.30 | 112.5 | 0.63 | 2.274 |

Inferred MRE | ||||

Airstrip | 0.30 | 10.1 | 0.75 | 0.245 |

Powerline | 0.30 | 270.4 | ||