par Alta Copper Corp. (NASDAQ:ATCUF)

Alta Copper Announces Robust Economics for Cañariaco with US$2.3 billion After-Tax NPV and 24% IRR

VANCOUVER, BC / ACCESSWIRE / May 15, 2024 / Alta Copper Corp. (TSX:ATCU)(OTCQX:ATCUF)(BVL:ATCU) ("Alta Copper" or "the Company") is pleased to announce attractive economics results from the 2024 Optimized Preliminary Economic Assessment ("2024 PEA") at its 100% owned Cañariaco Project ("Cañariaco" or the "Project"), a world class porphyry copper project, located 700 km northwest of Lima. The 2024 PEA has been prepared by Ausenco Engineering Canada ULC ("Ausenco"), AGP Mining Consultants Inc. ("AGP") and Whittle Consulting Pty. Ltd., ("Whittle"), respectively leading international engineering and mining consultancy firms.

All values contained in this press release are reported in US dollars.

Cañariaco 2024 PEA Highlights

- Robust Economics: Cañariaco 2024 PEA using 8% discount factor and three year trailing average metal prices of US$4.00/pound (lb) copper (Cu), US$1,850/ounce (oz) gold (Au) and US$23.00/ounce (oz) silver (Ag):

- Base-case Pre-tax Net Present Value ("NPV8%") of US$4.1 billion and IRR of 32.4%

- Base-case After-tax NPV8% of US$2.3 billion and Internal Rate of Return ("IRR") of 24.1%

- Significant Upside to Higher Metal Prices - At US$4.50/lb Cu After-tax NPV8% of US$3.2 billion and IRR of 28.9% (See Table 1)

- Highly Leveraged to Copper Price: For every US$0.25/lb Cu increase above US$$4.00 Cu approximately US$425 Million is added to the After-Tax NPV8%

- Life-of mine ("LOM") metal production of 8,026M lb (3,642M tonnes) Cu, 1.67 million oz Au, and 33.2 million oz Ag

- Average annual metal production (Year 1 to 10) of 347M lb (158k tonnes) Cu; 70K oz Au; 1.5 million oz Ag

- Average annual metal production LOM of 294M lb (134K tonnes) Cu; 61K oz Au; 1.2 million oz Ag

- After-tax Average Annual Free Cash Flow (Year 1-10) from Start of Operation: US$538 million

- After-tax Average Annual Free Cash Flow LOM from Start of Operation: US$383 million

- C-1 cost of $1.86/lb copper (net of by-products)

- Total average operating cost of $11.21 per tonne processed

- All In Costs ("AISC") of $1.96/lb copper

- Pre-production capital cost of $2.2 billion based on leased mining equipment and including a contingency allocation of 21% on initial project capital

- Rapid After-tax payback period of 3.1 years from initial production with a 27 year mine life

- One of the lowest capital intensities when compared to other current global copper development projects

The 2024 PEA is preliminary in nature. Current published resources for both of the Cañariaco Norte and Cañariaco Sur deposits (previously reported in News Release dated January 28, 2022) includes Inferred Mineral Resources along with a significant percentage of Measured and Indicated Resources. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the 2024 PEA will be realized. Mineral resources that are not mineral reserves have not demonstrated economic viability.

An independent technical report for the 2024 PEA,prepared in accordance with NI 43-101,will be available under the Company's SEDAR+ profile and website on or before June 7, 2024.

For readers to fully understand the information in this news release, they should read the technical report in its entirety when it is available, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read in its entirety and sections should not be read or relied upon out of context.

An updated Corporate Presentation will be available on the Company's website at www.altacopper.com

Giulio T. Bonifacio, Executive Chair, commented "We are extremely pleased with our 2024 PEA which is well advanced as we have clearly benefited from several previous engineering studies and a wealth of experience from our external international engineering firms. This PEA will prove of great value as we advance Alta Copper to the next stage. The PEA shows that Cañariaco is clearly a Tier 1 asset that provides a long-life, large-scale copper project producing annual average copper of 158,000 tonnes per year in the first 10 years. The Cañariaco project is economically robust with considerable leverage to increasing copper prices while also possessing considerable upside through resource expansion drilling with numerous high priority drill targets identified to date at Norte, Sur and the undrilled Quebrada Verde porphyry target".

Table 1 - Summary of Economic Results

AFTER-TAX (US$M, Unless Otherwise Stated) | |||||||||

Cu Price (US$/lb) | 3.50 | 3.85 | 4.00 | 4.50 | 5.00 | ||||

Undiscounted After-Tax Cash Flow (LOM) | 5,887 | 7,572 | 8,293 | 10,677 | 13,055 | ||||

Net Present Value (8%) | 1,450 | 2,054 | 2,312 | 3,163 | 4,011 | ||||

IRR (%) | 18.7 | 22.5 | 24.1 | 28.9 | 33.4 | ||||

Average Annual Revenue (US$M) | 1,118 | 1,217 | 1,259 | 1,401 | 1,542 | ||||

Average Annual EBITA | 463 | 561 | 604 | 744 | 885 | ||||

Average Annual Free Cash Flow (Note 3) | 295 | 356 | 383 | 470 | 557 | ||||

Average Annual Free Cash Flow (Year 1-10) (Note 3) | 437 | 508 | 538 | 638 | 739 | ||||

Payback Period (Note 3) | 3.7 | 3.2 | 3.1 | 2.6 | 2.3 | ||||

PRE-TAX (US$M, Unless Otherwise Stated) | |||||||||

Undiscounted Pre-Tax Cash Flow (LOM) | 9,746 | 12,433 | 13,585 | 17,424 | 21,264 | ||||

Net Present Value (8%) | 2,735 | 3,701 | 4,115 | 5,496 | 6,876 | ||||

IRR (%) | 25.3 | 30.3 | 32.4 | 39.0 | 45.1 | ||||

Mill Throughput | 120,000 tpd | ||||||||

Average Annual Cu Production (Year 1 to 10) | 347 million lbs Cu | 158K tonne Cu | ||||||||

Average Annual Cu Production (LOM) | 294 million lbs Cu | 134K tonne Cu | ||||||||

C-1 Cash Costs (net of by-products) $/lb | 1.86 | ||||||||

AISC (Note 5) $/lb | 1.96 | ||||||||

Strip Ratio (Waste to Ore) | 1.33 to 1 | ||||||||

Initial Mine Life (Years) | 27 | ||||||||

Initial Project Capital | 2,160 | ||||||||

Sustaining Capital | 526 | ||||||||

Closure Cost | 216 | ||||||||

Notes

(1) Copper contributes 88% of the net revenue with the balance of 12% from gold silver credits in copper concentrate.

(2) For this analysis Gold is US$1,850/oz and Sliver is US$23/oz and remain constant with only the Copper price changing.

(3) From Commencement of Operations.

(4) Cash Costs consist of mining, processing, site G&A, off-site treatment and refining, transport, and royalties net of by-product credits (Au & Ag).

(5) AISC consists of Cash Costs plus sustaining capital and closure costs.

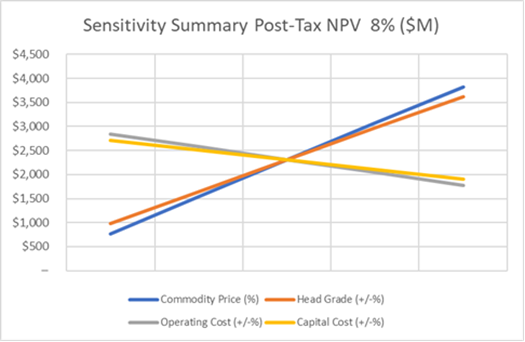

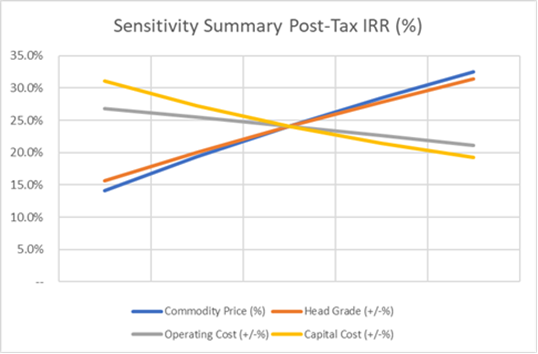

NPV Sensitivities

The sensitivity analysis provides a range of outcomes for the Project when the key parameters vary from their base-case values. The NPV estimate is most sensitive to changes of metal prices, resource grade, overall operating costs and capital costs as illustrated in Figure 1 and 2.

The After-tax NPV ranges from US$2,054 billion to US$4,011 billion as the applied Copper price varies from US$3.85/lb Cu to $5.00/lb Cu.

Figure 1 - Sensitivity Summary Post - Tax NPV 8% ($M)

Figure 2 - Sensitivity Summary Post - Tax IRR (%)

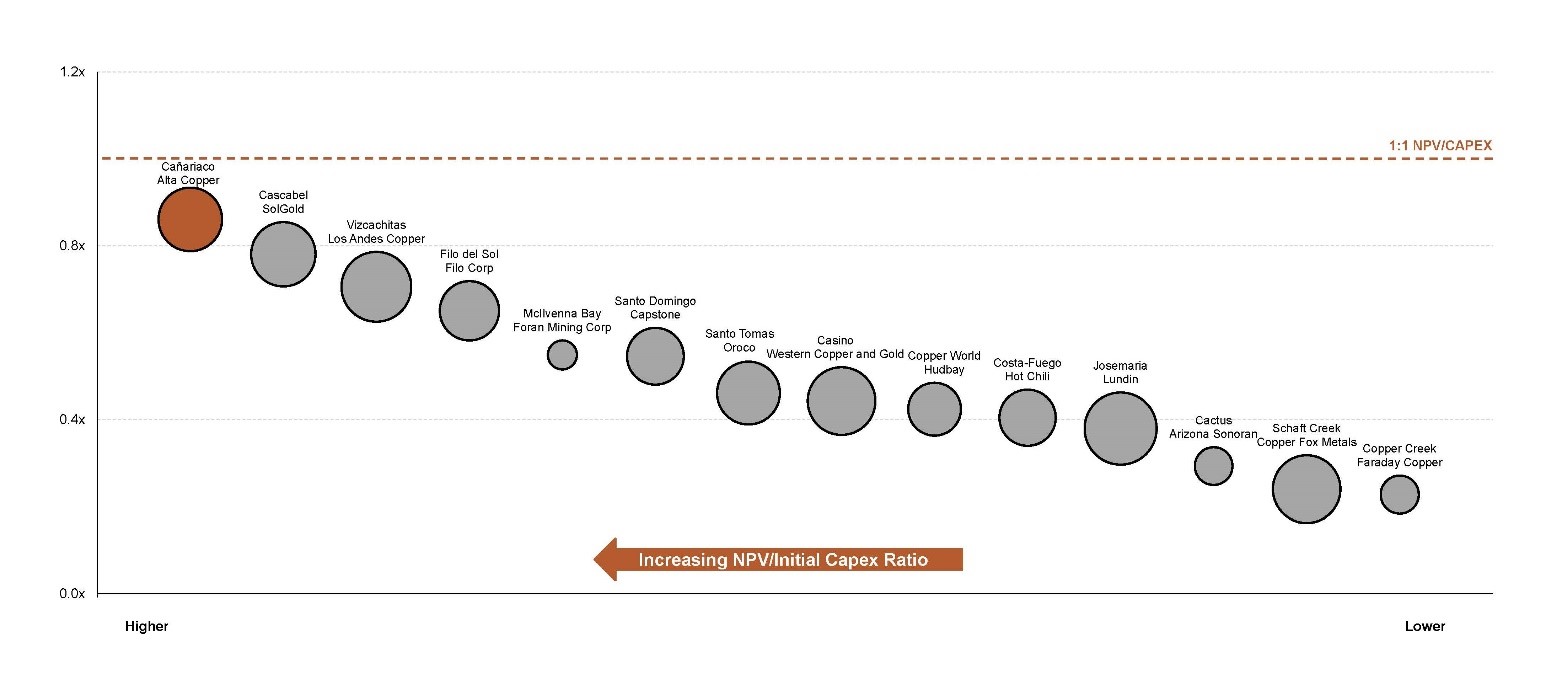

Figure 3 - Cañariaco displays strong economics, generating NPV for lower capital compared to its peers

(After-Tax NPV 8% / Total Capex (US$M) | Bubble size based on annual production)

Source/Notes: FactSet. Technical reports

(1) Copper equivalent production calculated using stated metal prices from each project's latest technical report

Table 2 - Detailed Results

METRIC | Unit of Measure | Year 1-10 | LOM | |

Plant Feed Grade | ||||

Cu | % | 0.41 | 0.35 | |

Au | g/t | 0.08 | 0.07 | |

Ag | g/t | 1.86 | 1.59 | |

Cu Equivalent | % | 0.48 | 0.41 | |

Metal Production | ||||

Cu | Mlb | 3,469 | 8,026 | |

Au | koz | 696 | 1,674 | |

Ag | Koz | 14,978 | 33,219 | |

Average Process Recovery | ||||

Cu | % | 89.2 | 88.2 | |

Au | % | 66.4 | 63.3 | |

Ag | % | 58.5 | 55.3 | |

Physicals | ||||

Total in-situ rock | Kt | 1,040,399 | 2,739,133 | |

Waste rock | Kt | 588,138 | 1,562,925 | |

Plant Feed (all grades) | Kt | 452,262 | 1,176,207 | |

Strip Ratio | w:o | 1.30 | 1.33 | |

Average Annual Production | ||||

Copper | Ktpa | 158 | 134 |

Project Description

The Cañariaco Project is situated within the Province of Ferreñafe, in the Department of Lambayeque, in northwestern Peru, approximately 700 km northwest of Lima, the capital of Peru, and approximately 102 km northeast of the city of Chiclayo. Current access from Chiclayo to the Cañariaco Project is 150 km along a paved road followed by secondary gravel roads.

The project area covers moderate elevations ranging from 2,200 to 3,600 metres ("m") above sea level. The copper deposits are situated on the eastern side of the continental divide and infrastructure will be on the top as well as both western and eastern sides of the divide. The topography varies from steep incised valleys at lower elevations to open grassy highlands at upper elevations. There is sufficient suitable land available within the concessions and close to the mining areas for the process plant, ancillary infrastructure and comingled waste rock and dry stack tailings facility.

The 2024 PEA contemplates that Cañariaco would be mined using conventional open pit mining equipment followed by crushing, SAG/ball mill grinding and flotation recovery of copper, gold and silver to a copper concentrate.

Cañariaco is estimated to have relatively low project capital and operating costs due to proximity to infrastructure and favourable natural setting with key features as follows:

- Large scale mining and processing operation to process 120,000 tpd/43.8 million tpa with a currently planned 27 year mine life;

- Conventional drill and blast mining, large scale electric shovels and haul trucks;

- Conventional crushing, SAG and ball mill grinding followed by flotation recovery of copper, gold and silver to a copper concentrate;

- Application of best practice process tailings management through comingled waste rock and filtered dry stack tailings storage;

- Water resources available in project area exceed project requirements;

- Low Strip Ratio life of mine of 1.33:1;

- Power supply from existing Northern Peru power grid with connection point only 57 kms from the project; and

- Project site located only 24 kms from existing paved highway connecting to the Pan American Highway on the west coast.

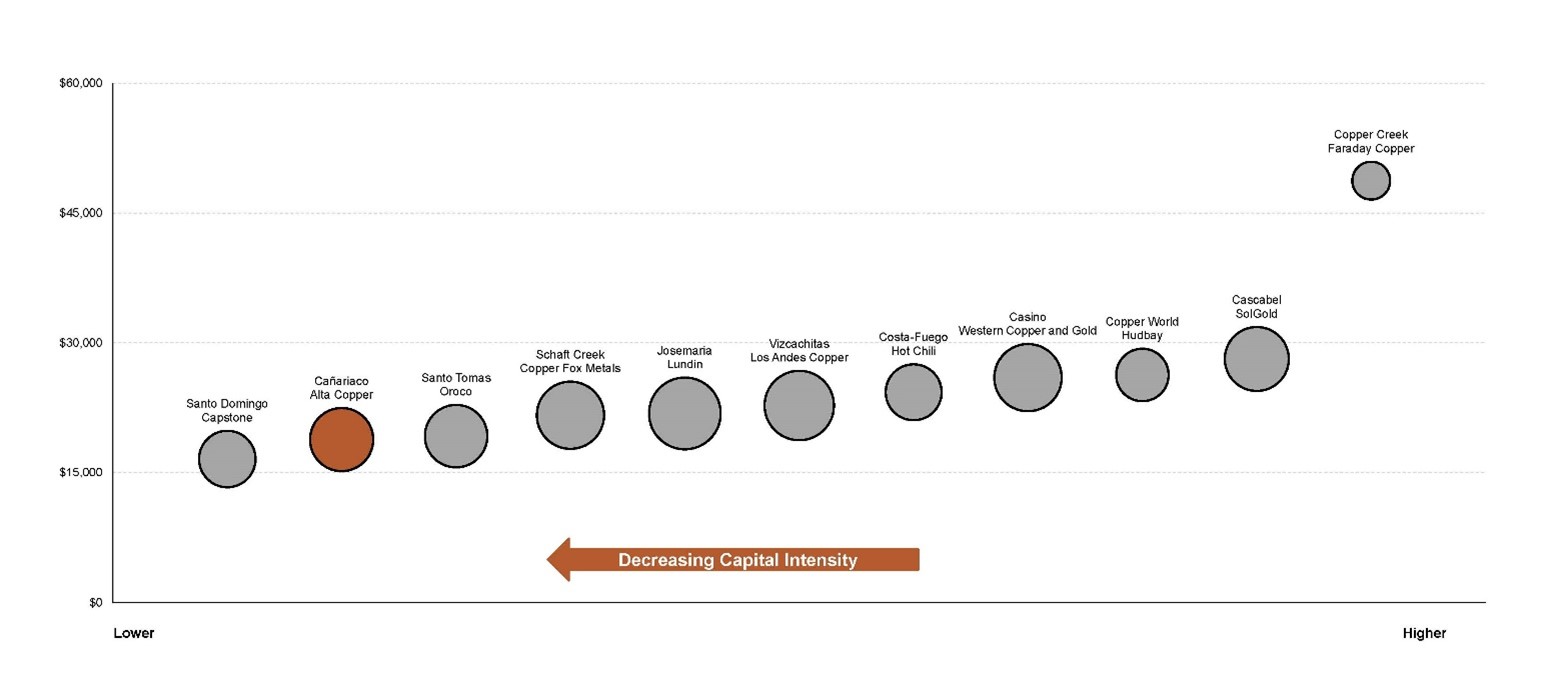

Low Capital Cost Intensity

Importantly, the Cañariaco project has low capital intensity when compared to several other global copper projects currently in the development stage. Key project attributes that reduce the capital cost include the following:

- The mineralized material from Cañariaco Norte and Sur deposits are moderately competent with Axb of 53, and moderately soft rock with an average BWI 12.2 kWh/tonne, which enables high throughput utilizing a single comminution line consisting of one primary crusher, one large SAG mill and two ball mills whereas many projects with comparable throughput require two SAG mills and four ball mills;

- The region receives significant annual rainfall and adequate fresh water is available at site eliminating the need for a desalination plant and pipeline from the coast;

- Relatively close proximity to the national power grid reduces the capital intensity of power supply infrastructure;

- Close proximity to an existing major transportation highway reduces access road construction cost and time;

- Utilization of trucks to transport concentrate along existing highways to the loadout port eliminates the requirement for a concentrate pipeline;

- The project site is in a sparsely populated area and there is no requirement for community relocation; and

- Concentrate loadout through an existing port on the west coast of Peru eliminates need to construct a new loadout facility.

Figure 4 - Cañariaco possesses a strong production profile with low capital intensity (based on average annual copper equivalent production (1)

(Capital Intensity (US$/t) | Bubble size based on annual production)

Source/Notes: Technical reports. Capital intensity equals total capex divided by average annual copper equivalent production. | (1) Copper equivalent production calculated using stated metal prices from each project's latest technical report.

Sustainable and Responsible Mining

The project development concept has utilized best practice technologies and will benefit from several existing external factors which will assist in making Cañariaco a very responsible, desirable and sustainable project.

The application of filtered dry stack tailings combined with comingled waste rock storage maximizes the recycling of process water and significantly reduces freshwater requirements. In addition, this technology eliminates the need for wet tailings storage and a major tailing retainment structure and reduces associated seismic risk.

Electrical power in Northern Peru is generated predominantly by hydro which is the preferred power source from ecological and carbon emissions perspectives.

Electric powered overland belt conveyors, rather than haul trucks, will transport most of the mill feed and waste rock from the mining areas to the plant as well as the comingled waste and dry stack tailings facility thereby reducing fuel consumption and CO2 emissions.

The project is located in a sparsely populated region and at elevations above major agricultural zones.

Capital, Sustaining and Operating Costs

The initial capital, expensed over the first four years of the Project, amounts to $2.2 billion. The sustaining capital over the remainder of LOM amounts to $526 million. Closure costs are estimated at $216 million. The project financial model incorporates a lease strategy for the purchase of the initial mining equipment whereby 20% of the mining fleet cost is capitalized and the remainder is carried as operating cost. Sustaining costs include construction of a crusher at the Sur deposit and related conveyor system to connect with the primary overland conveyor in year 16 prior to the start of mining operations at Sur.

A breakdown of capital cost is presented in the table 3 below:

Table 3 - Capital Cost Summary

Cost Area | Initial Capital | Sustaining | Total | |

Mine | 429 | 193 | 622 | |

Process Plant | 789 | 25 | 814 | |

Site Services and Utilities | 106 | - | 106 | |

Internal Infrastructure | 151 | 216 | 367 | |

External Infrastructure | 42 | - | 42 | |

Total Directs | 1,517 | 434 | ||