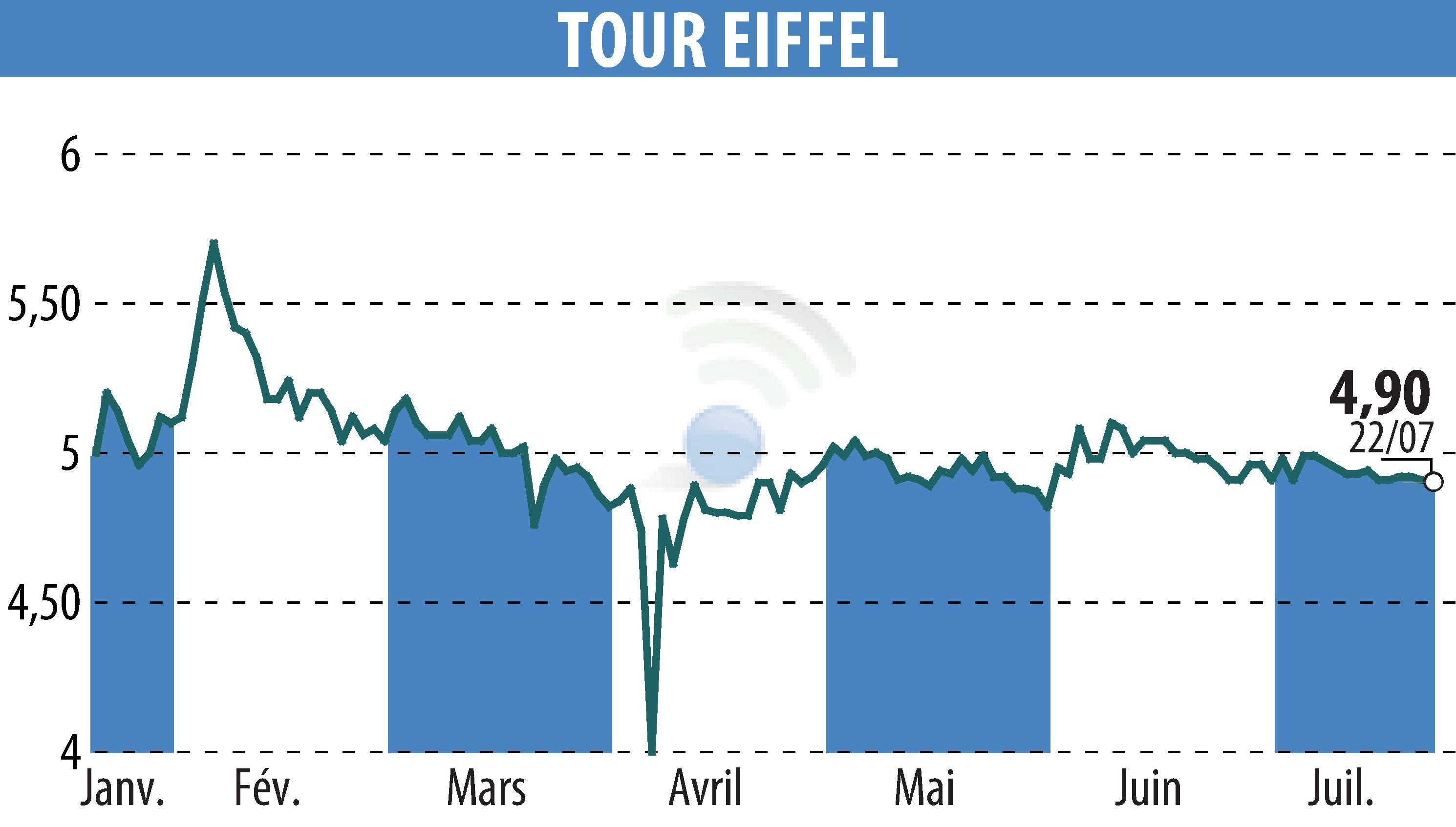

sur TOUR EIFFEL (EPA:EIFF)

2025 half-year results of the Eiffel Tower Company

The Board of Directors of Société de la Tour Eiffel has approved the results for the first half of 2025. The real estate company continues to adapt to the real estate market by adjusting its roadmap and focusing on diversified assets. Despite a 3.7% decline in the value of its portfolio, the company strengthened its financial structure thanks to a €598.8 million capital increase in January. This financing helped reduce its debt and stabilize its debt ratio at 20.9%.

Signature projects completed include EvasYon in Lyon, a co-living and office space, and the Parc du Golf in Aix-en-Provence, which is fully leased. The company is continuing its efforts to address climate change and is undertaking environmentally certified projects.

Rental income, however, fell by 5.9% on a like-for-like basis. Consolidated net income showed a loss of €46 million. The occupancy rate (EPRA) decreased to 71.1%. The property company remains committed to maintaining its asset transformation program in a constrained real estate market.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de TOUR EIFFEL