sur ESKER (EPA:ALESK)

Strong shareholder commitment to Esker takeover bid

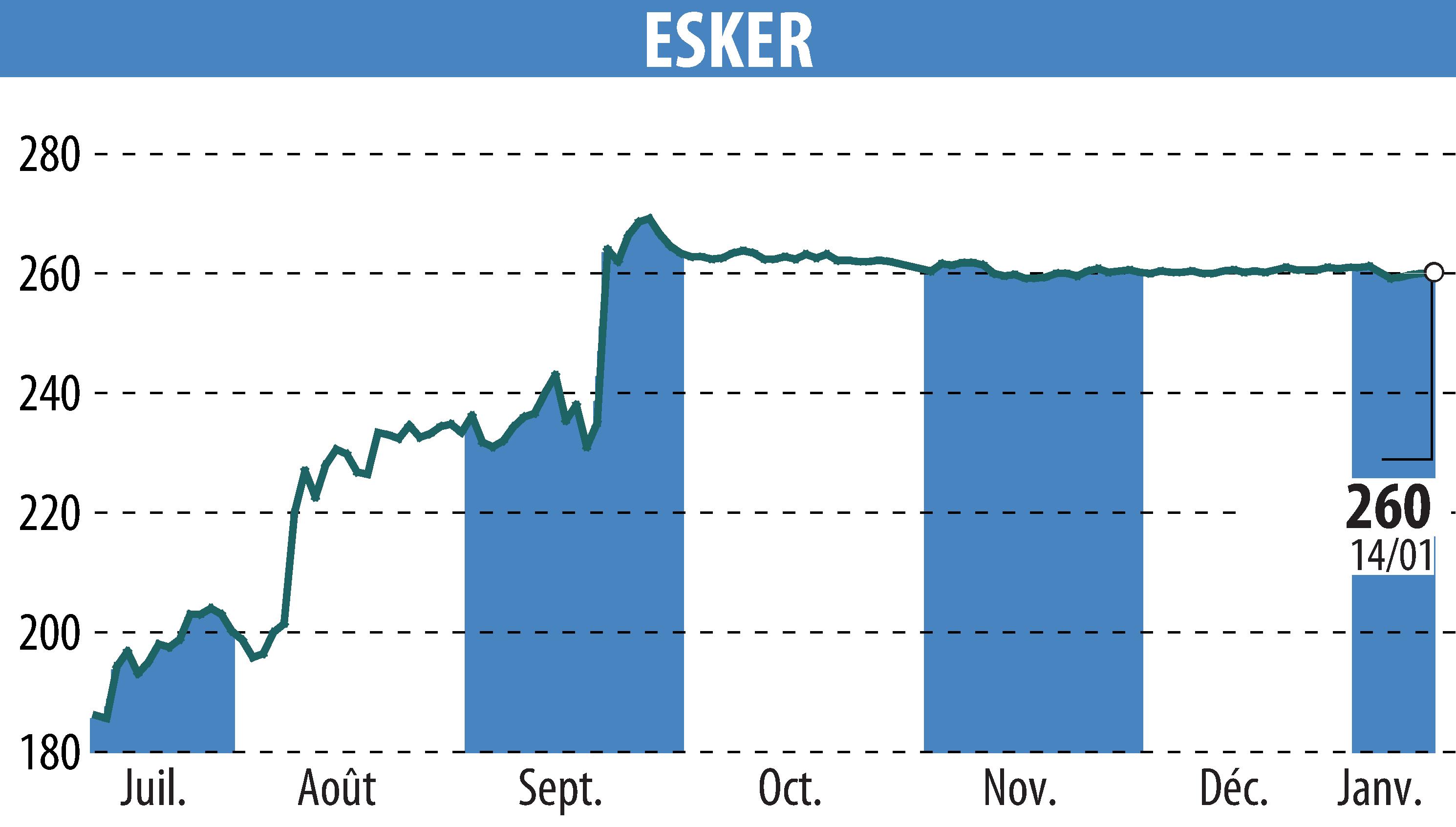

Esker received broad shareholder support in the friendly tender offer, led by Boréal Bidco alongside Bridgepoint and General Atlantic, with 68.79% of the shares tendered. At the end of the first period, Boréal Bidco controls 74.62% of the capital. A reopening of the offer is planned from January 17 to 30, 2025, allowing the remaining shareholders to sell their shares at €262 per share, a price that includes a premium compared to the previous price.

This takeover bid will be settled on 24 January 2025. Boréal Bidco could then request a mandatory withdrawal. Brokerage fees will be borne by the initiator within a certain limit. Shareholders are invited to contact their financial intermediaries to participate in the reopened offer.

R. P.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de ESKER