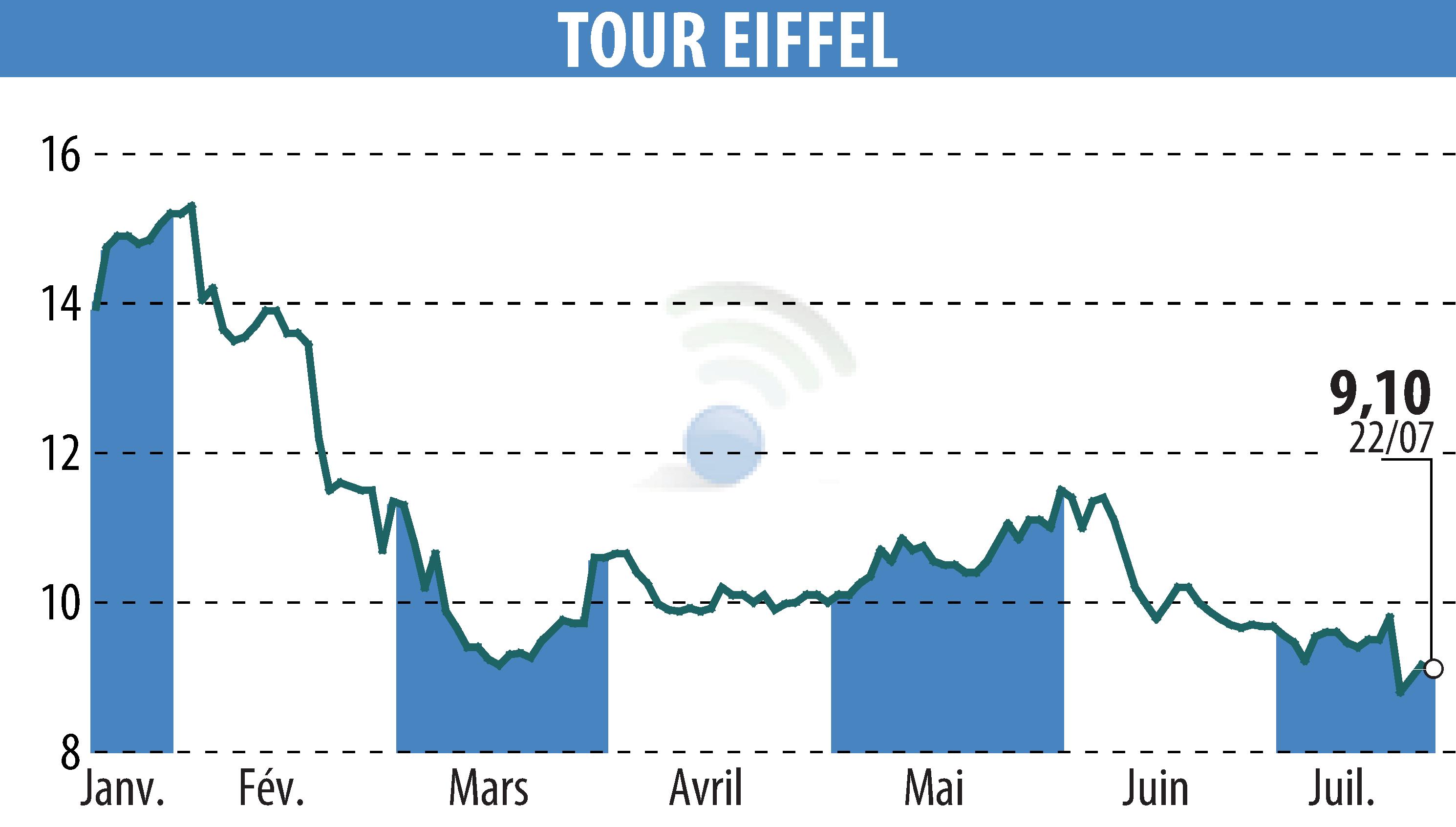

sur TOUR EIFFEL (EPA:EIFF)

Société de la Tour Eiffel - 2024 half-year results

The Board of Directors of the Société de la Tour Eiffel approved the half-year accounts as of June 30, 2024. The value of the company's assets is down 4.5% to €1.7 billion. Gross rental income amounted to €41.2 million, up 2.1% on a like-for-like basis. The consolidated net result is -€39.1 million compared to -€16.3 million in 2023.

The Company has completed €17 million in disposals, invested €38 million and has a drawing capacity of €440 million. The LTV debt ratio is 44.5% and the current cash flow per share is €0.58.

The Société de la Tour Eiffel continues to transform its assets with projects in Lyon, Aix-en-Provence, Puteaux, Nanterre and Bobigny. A total of €200 million in assets has been sold since the launch of its sustainable change plan.

Despite the challenges of the real estate market, the Company aims for sustainable growth by aligning with ESG issues. Managing debt and upcoming financial deadlines remains a priority.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de TOUR EIFFEL