sur SGL Carbon AG (isin : DE0007235301)

SGL Carbon: Improved Profitability Amid Decreasing Sales

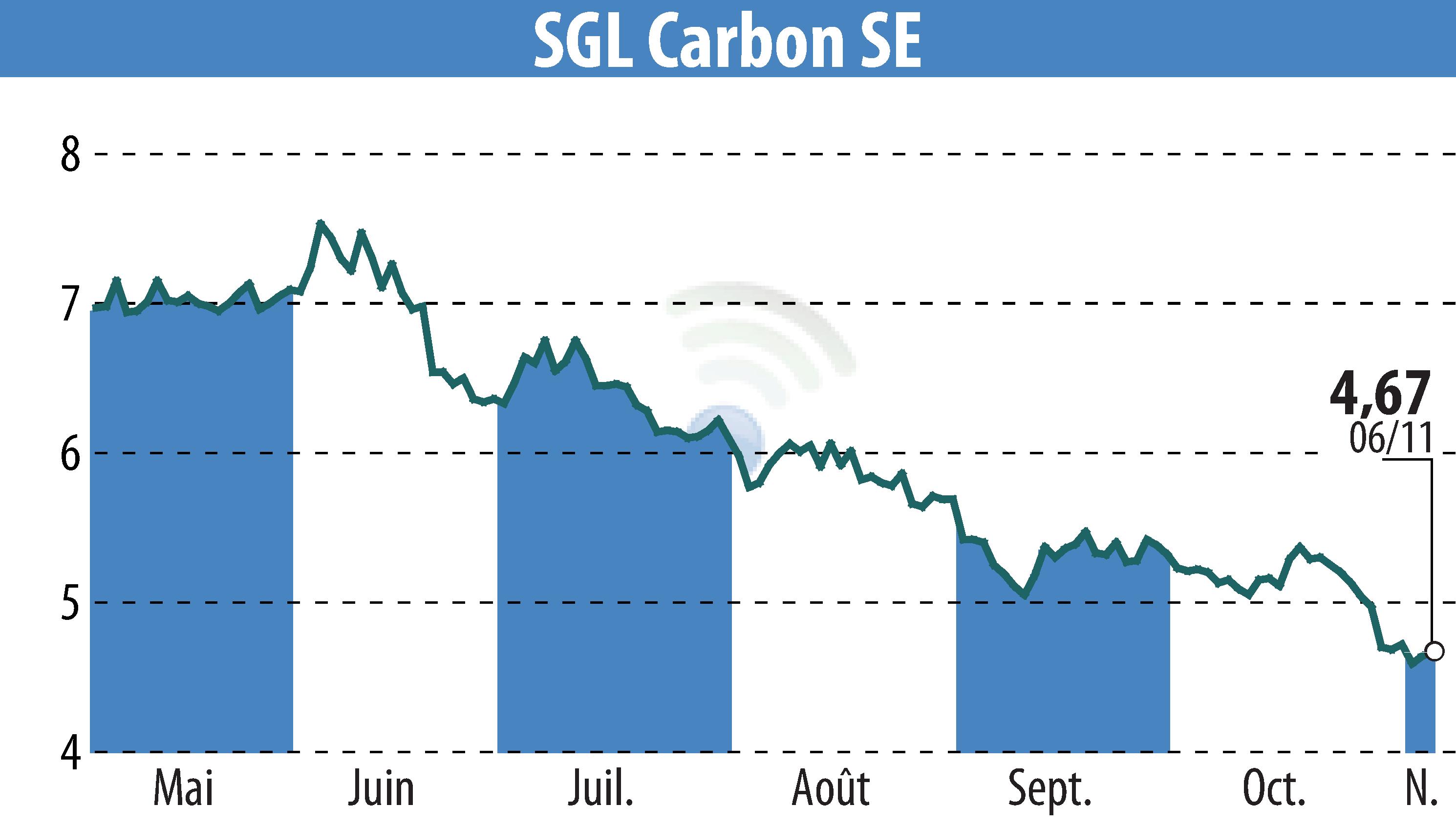

SGL Carbon reports an increase in EBITDA margin to 16.3% despite a 4.8% sales decline for the first nine months of 2024. Sales reached €781.9 million, slightly lower than the previous year. Adjusted EBITDA was stable at €127.6 million, supported by product mix effects in the Graphite Solutions and Process Technology units. However, weak demand and price pressure continue to impact the Carbon Fibers business.

The equity ratio improved to 43.3%, with a capital expenditure of €66.5 million and a positive free cash flow of €15.5 million. The company highlighted a decrease in demand for graphite products for semiconductors, affected by lower electric vehicle sales. A projected non-cash impairment of €60–80 million for Carbon Fibers is anticipated in Q4 2024 due to ongoing demand weakness. The 2024 outlook remains cautiously optimistic, expecting EBITDA at the lower end of the projected range, amid a challenging economic climate.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SGL Carbon AG