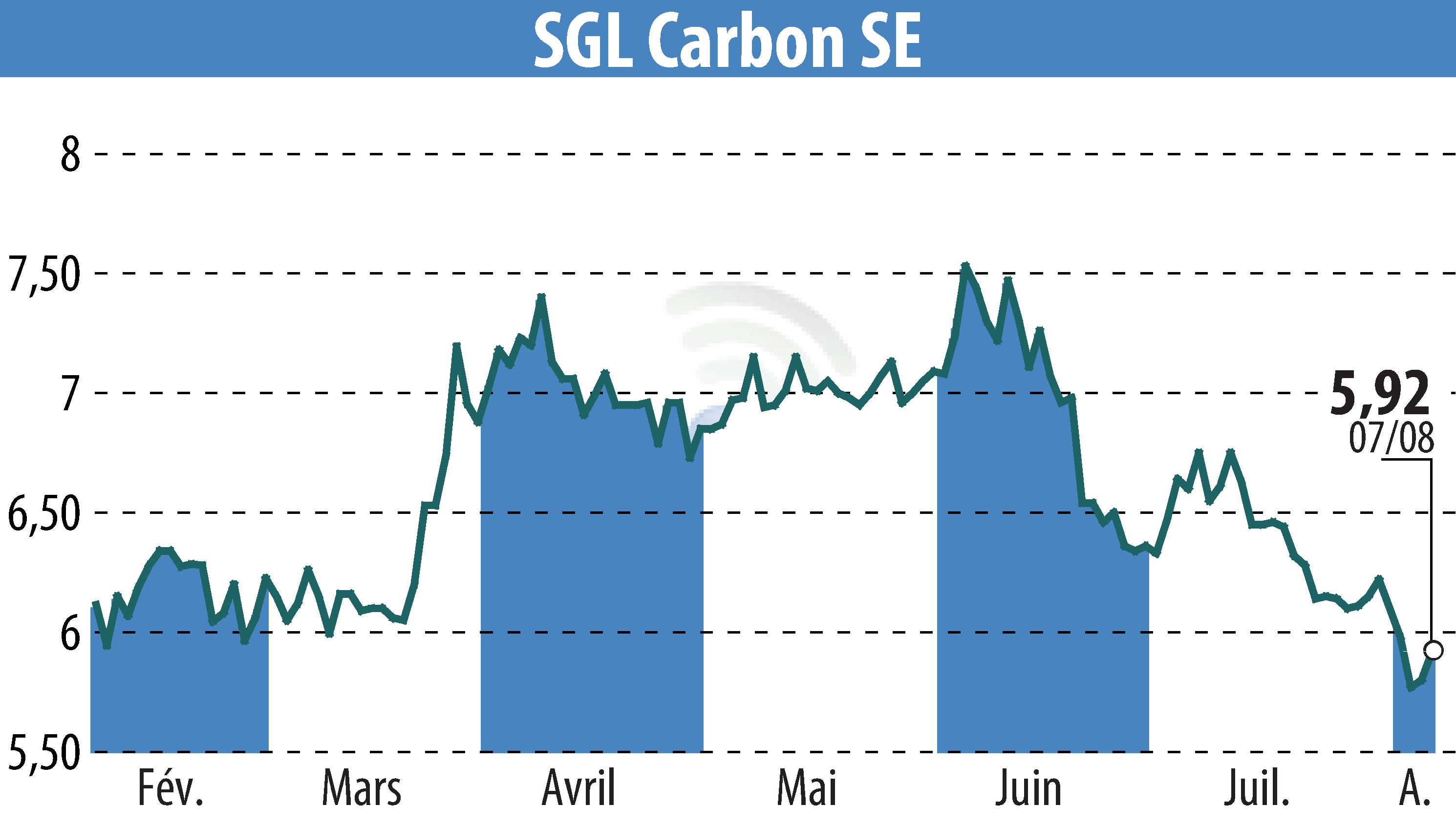

sur SGL Carbon AG (isin : DE0007235301)

SGL Carbon Demonstrates Stability Amid Market Volatility

SGL Carbon has reported stable business development despite a volatile market environment. The company recorded consolidated sales of €538.0 million in H1 2024, a 4.0% decline from H1 2023, but saw an improvement in the adjusted EBITDA margin, which rose from 15.7% to 16.1%. This was mainly due to strong performance in the semiconductor market.

While the Graphite Solutions and Process Technology units performed well, Carbon Fibers continued to face weak demand, impacting overall sales and profitability. CEO Dr. Torsten Derr noted that, despite challenges in the automotive sector, the company expects to meet its fiscal year 2024 forecast at the lower end of the range.

The outlook remains cautious, with the semiconductor industry's high inventory levels affecting demand. CFO Thomas Dippold highlighted ongoing strength in the demand for silicon carbide-based semiconductors used in electric vehicles, despite a slowdown expected in the latter half of 2024.

R. P.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SGL Carbon AG