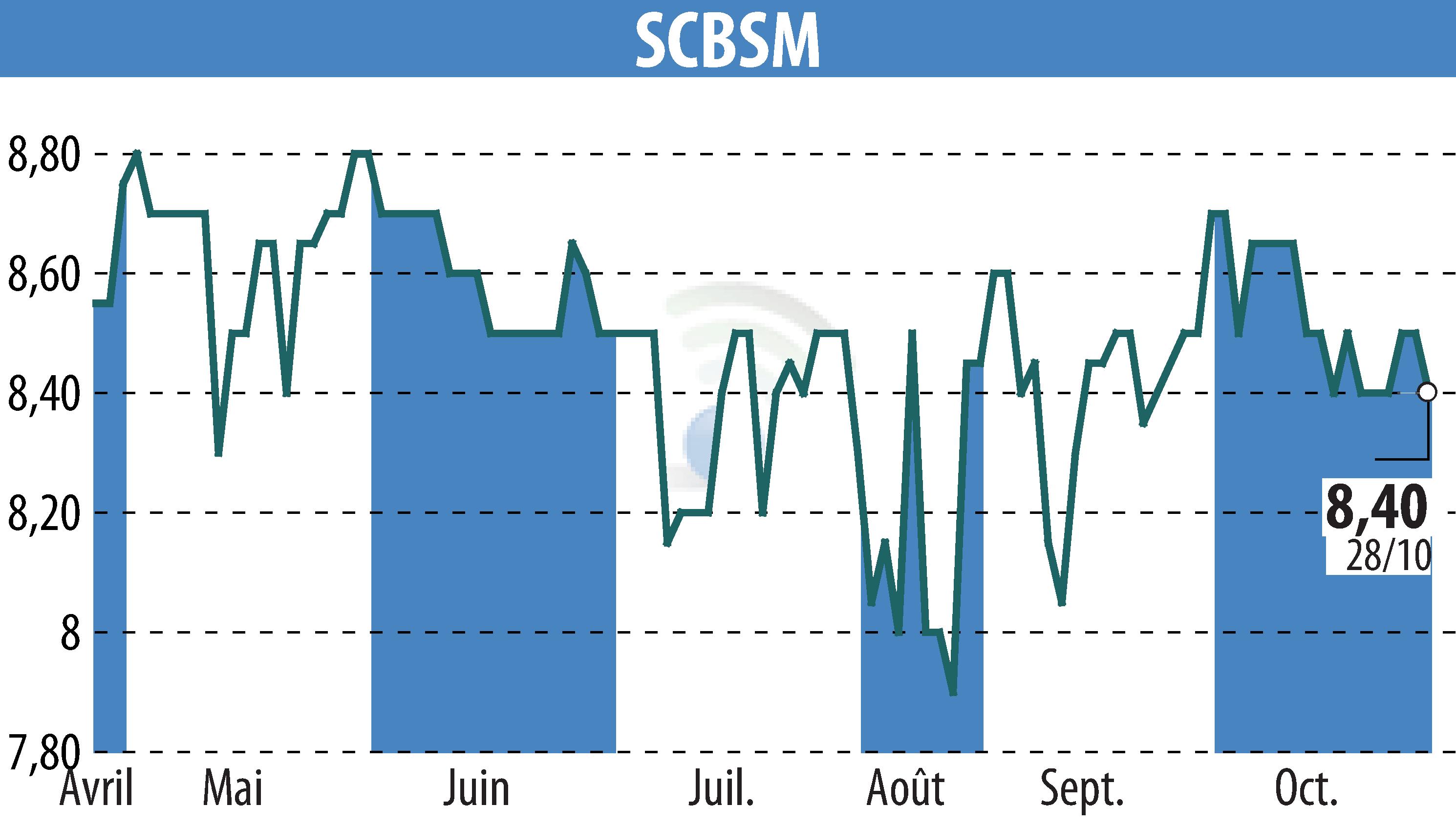

sur SCBSM (EPA:CBSM)

SCBSM posts 20% increase in recurring profit in 2023-2024

SCBSM, the real estate company listed on Euronext Paris, closed the 2023-2024 financial year with a notable 20% increase in its recurring profit, reaching €10.8 million. This performance is part of a context of continued improvement in the profitability of its real estate assets and the stabilization of interest rates.

Composed of 90% Parisian assets, SCBSM's assets have benefited from significant restructuring projects, such as that of the Ponthieu building in Paris. Thanks to optimized management, SCBSM was able to lower its debt ratio to 37.3%.

The group plans to offer a coupon of €0.17 per share at its next General Meeting. In terms of sustainable commitment, its ESG rating reached 52/100, signaling efforts to formalize responsible practices.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SCBSM