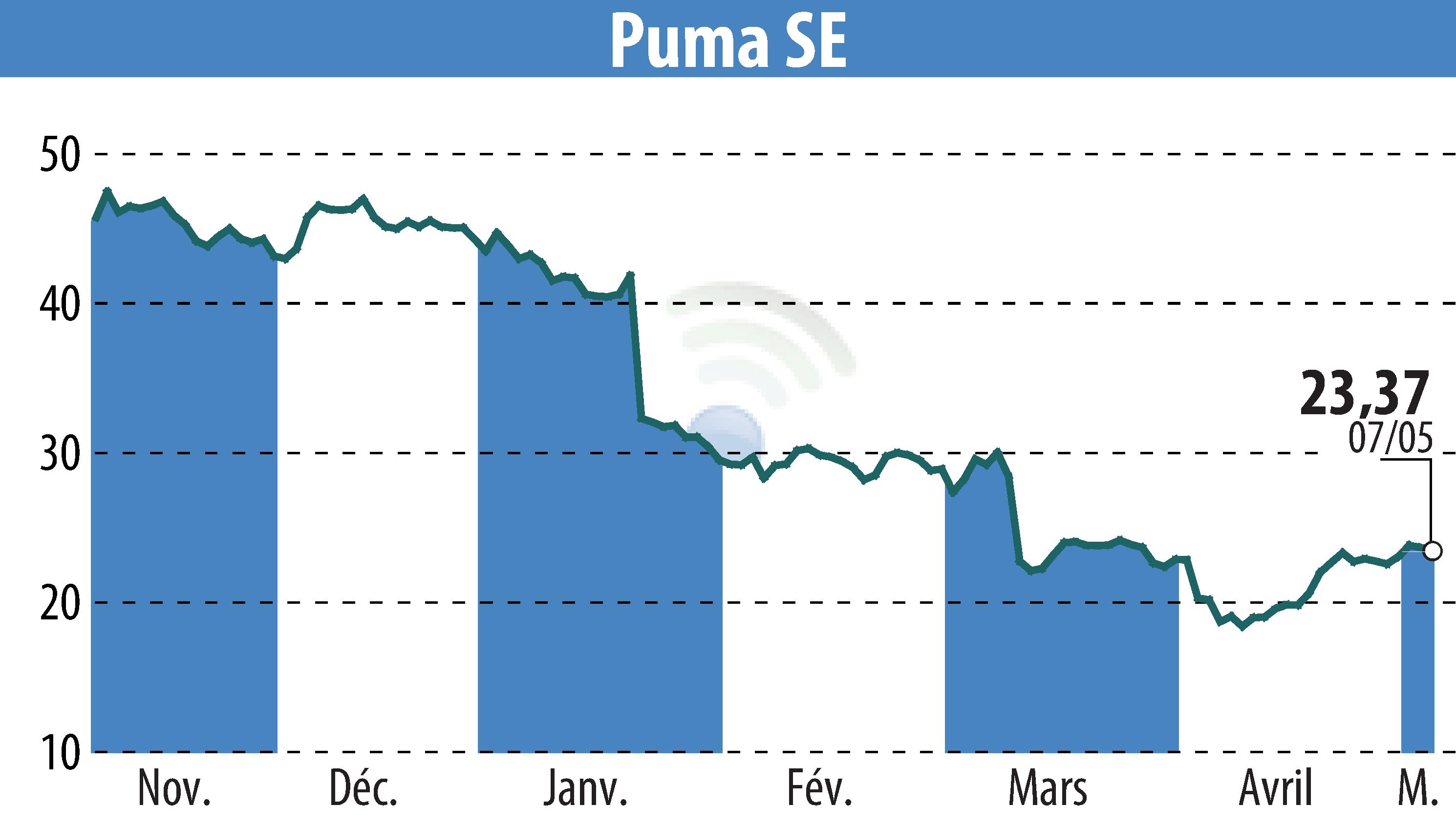

sur SAPARDIS S.A. (ETR:PUM)

PUMA's Q1 2025 Sees Stagnant Sales and Strategic Cost Cuts

In the first quarter of 2025, PUMA reported currency-adjusted sales growth of 0.1% to €2,076 million, despite challenges in the U.S. and China markets. Gross profit margins fell by 60 basis points to 47.0%, while operating expenses rose by 7.1%, reflecting ongoing investments in their Direct-to-Consumer (DTC) segments like e-commerce. Notably, their DTC business surged by 12%, driven primarily by a 17.3% increase in online sales.

PUMA's adjusted EBIT declined by 52.4% to €76 million, impacted by higher costs and a decreased gross margin. The firm continues its "nextlevel" cost efficiency programme, including a planned reduction of 500 staff by Q2, which incurred €18 million in one-time costs this quarter.

Looking ahead, PUMA remains focused on growth with an adjusted EBIT forecast between €520 million and €600 million for 2025, amid uncertainties such as recent U.S. tariffs. Strategic investments in retail networks and digital infrastructure are anticipated to continue, with CAPEX projected at €300 million.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SAPARDIS S.A.