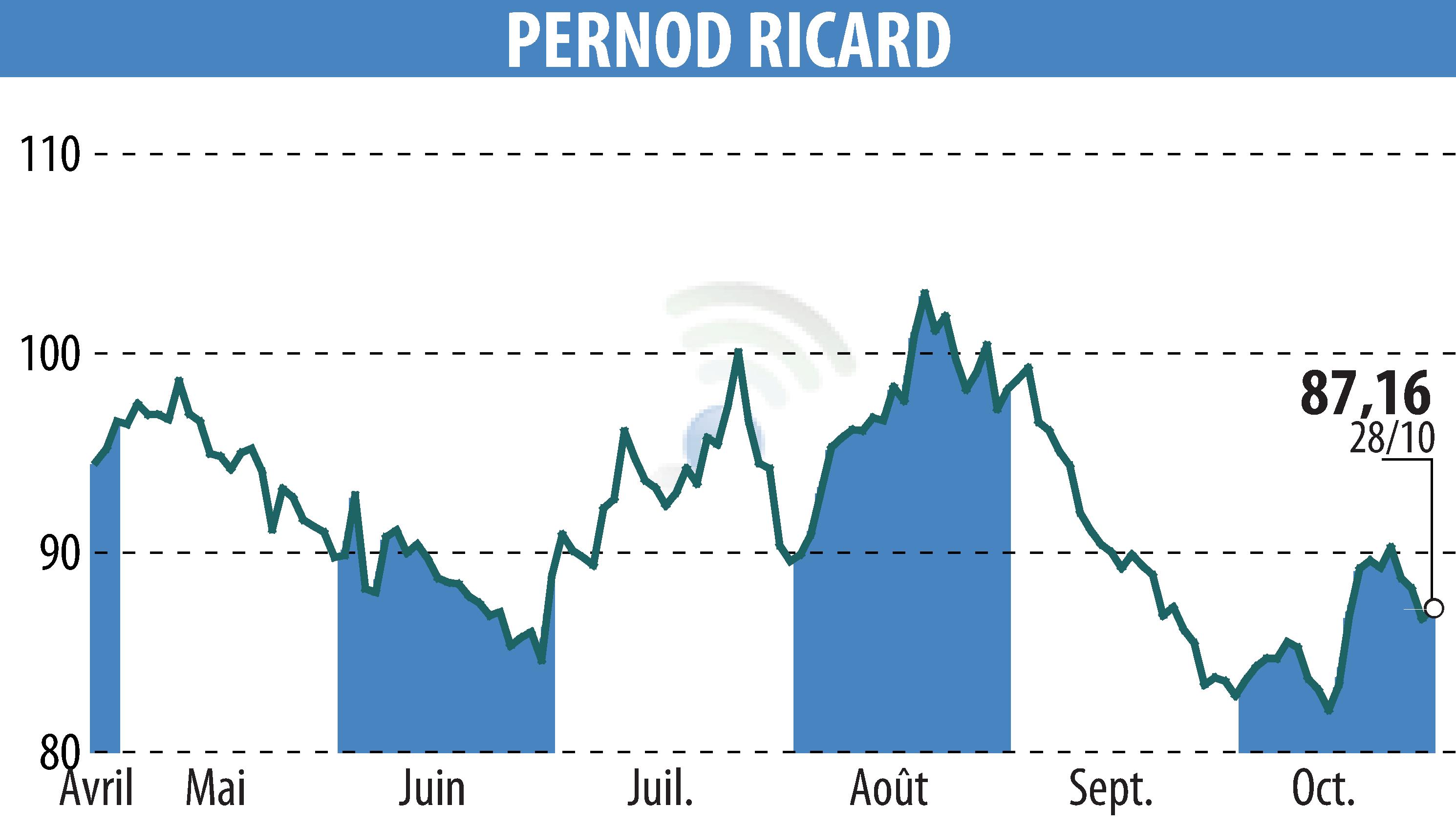

sur PERNOD RICARD (EPA:RI)

Pernod Ricard Completes €1.2 Billion Bond Issuance

Pernod Ricard announced the successful completion of its €1.2 billion bond issuance, setting favorable terms in a positive market environment. The bonds, denominated in euros, are divided into two tranches: a long 7-year tranche and a long 11-year tranche, each amounting to €500 million. The 7-year tranche holds a coupon rate of 3.25%, while the 11-year tranche is set at 3.75%.

Settlement for both tranches is scheduled for 4 November 2025, with maturities on 4 February 2033 and 4 February 2037, respectively. The issuance saw a strong reception from investors, enabling pricing at competitive spreads. Additionally, Pernod Ricard completed a two-year private placement of €200 million.

The net proceeds will be used for general corporate purposes, and the bonds are anticipated to be traded on Euronext Paris. Moody's and Standard & Poor's are expected to rate the issuance as Baa1 and BBB+, respectively.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de PERNOD RICARD