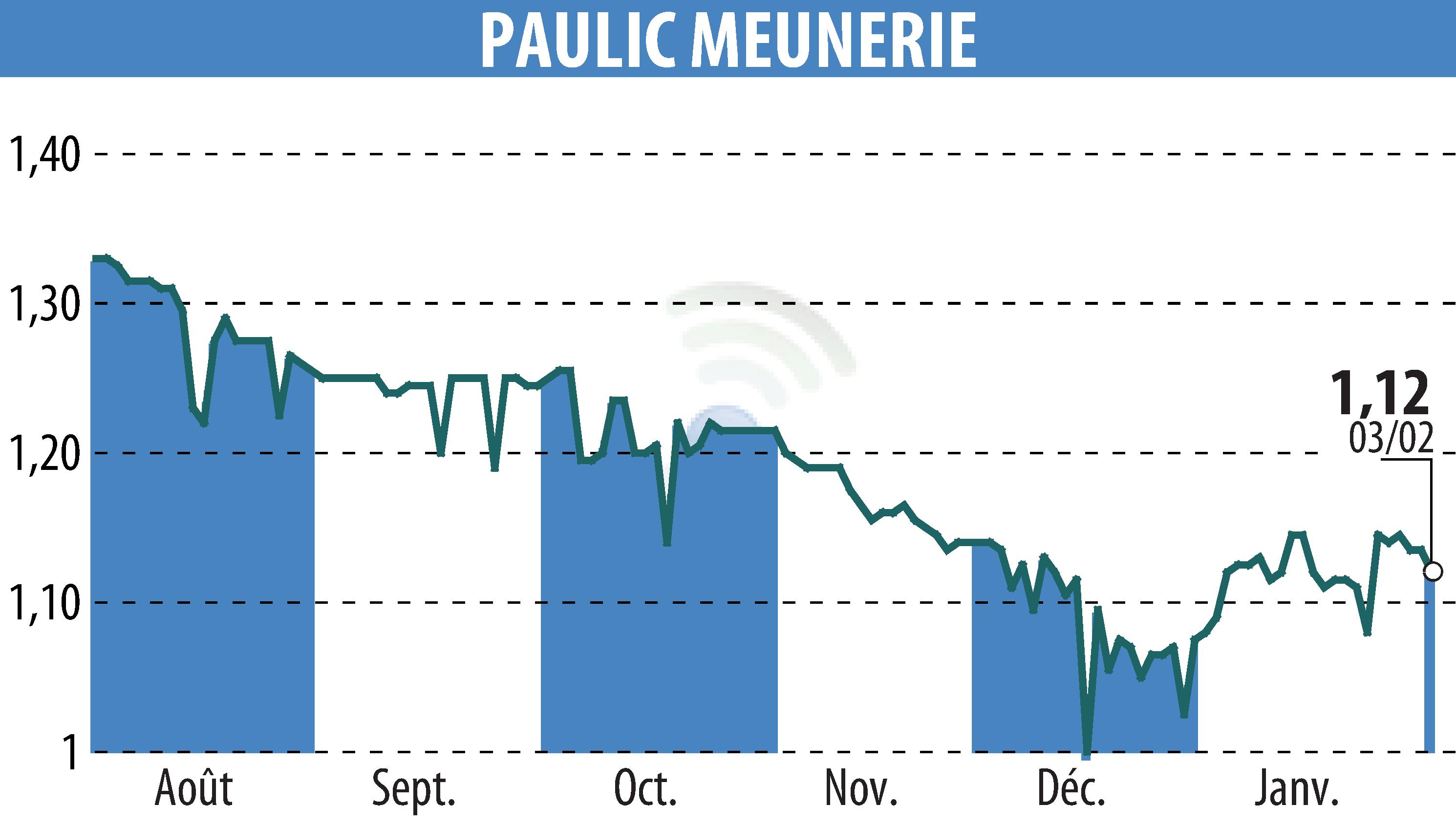

sur PAULIC MEUNERIE SA (EPA:ALPAU)

Paulic Meunerie: 2025 Review and 2026 Outlook

In 2025, Paulic Meunerie experienced stable volumes with an annual production of 39.3 kT, representing a slight increase of 0.2% compared to 2024. Despite a decrease in turnover of 4.9%, settling at €18.25 million, the company is forecasting a significant improvement in gross margin, rising to 35% of turnover compared to 30% the previous year.

This performance is linked to a context of falling wheat prices and a strengthened commercial strategy. The integration of new contracts, particularly with large retailers, is seen as a growth driver. The grocery and foodservice segments are showing positive momentum, with respective volume increases of 15% and 9%.

Optimistic forecasts for 2026 are put forward thanks to a robust commercial pipeline and industrial investments, promising increased volumes and improved profitability.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de PAULIC MEUNERIE SA