sur Nabaltec AG (isin : DE000A0KPPR7)

Nabaltec AG Maintains Strong Performance with Positive EBIT Margin Outlook

NuWays AG's recent research report on Nabaltec AG highlights a stable financial performance. Nabaltec's Q3 sales reached €49.8 million, largely unchanged year-on-year, with a 9-month total marking a 1.5% increase to €158.2 million. Despite declining prices, a volume increase of 8% balanced the sales figures. In particular, demand remained robust for alumina trihydrate (ATH) used in data centers and renewable energy solutions, countering the challenges faced by the boehmite segment.

Nabaltec's Q3 earnings before interest and taxes (EBIT) saw a remarkable rise of 30.4% year-on-year, amounting to €6.0 million, with an EBIT margin up by 2.6 percentage points to 11.8%. The 9-month EBIT stood at €16.8 million, demonstrating a 10.6% margin. These gains occurred despite weaknesses in both the boehmite business and the Specialty Alumina Segment. The company benefited from improved utilization rates and favorable mix effects within its Functional Fillers segment.

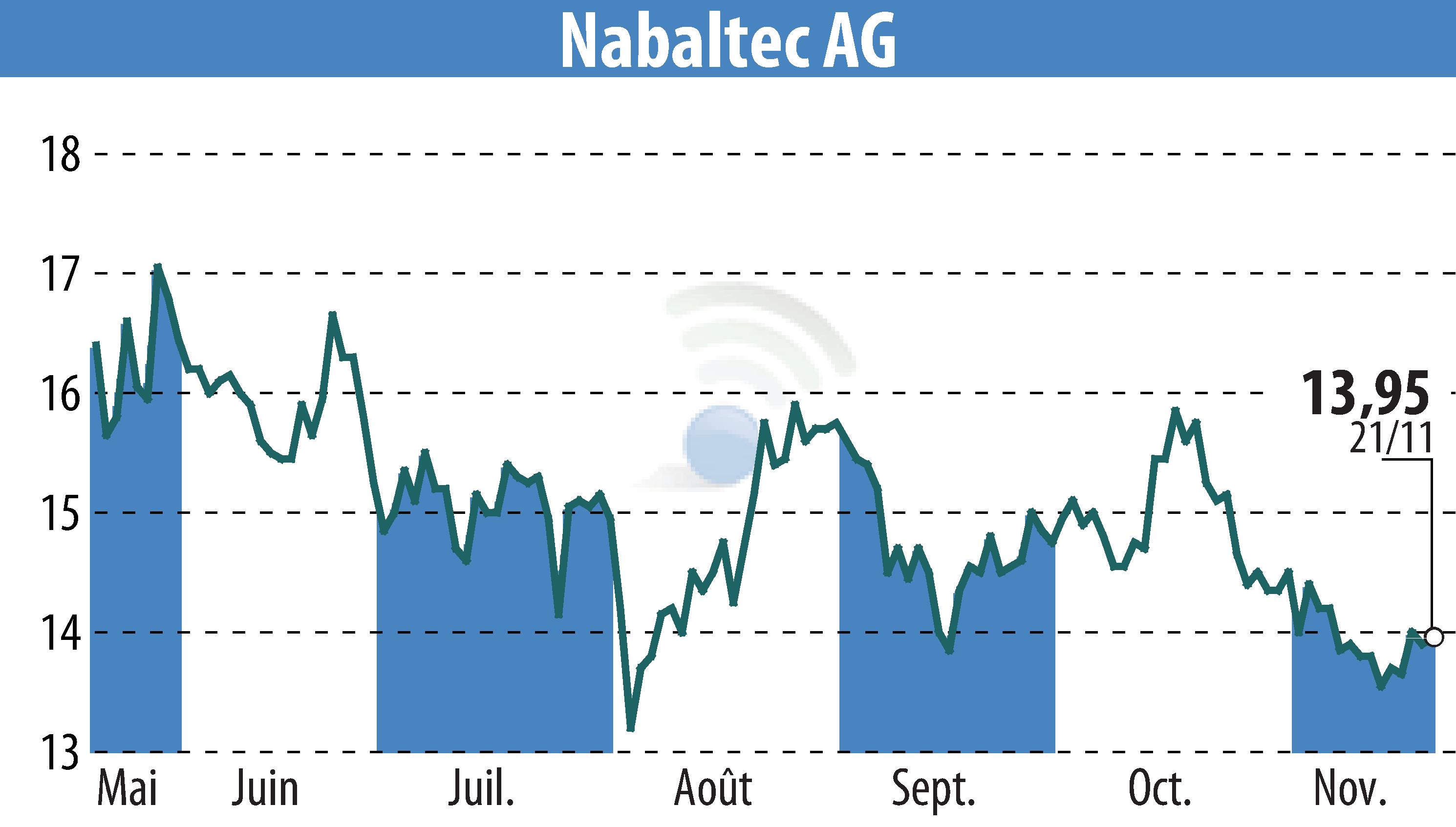

The company's financial position remains solid, with a cash reserve of €93.7 million and a net cash of €2.4 million. Consequently, management remains confident in achieving a full-year EBIT margin of 8-10%. The research maintains a "Buy" rating for Nabaltec with a target price of €25, emphasizing its long-term growth potential and undervaluation at its current stock price.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Nabaltec AG