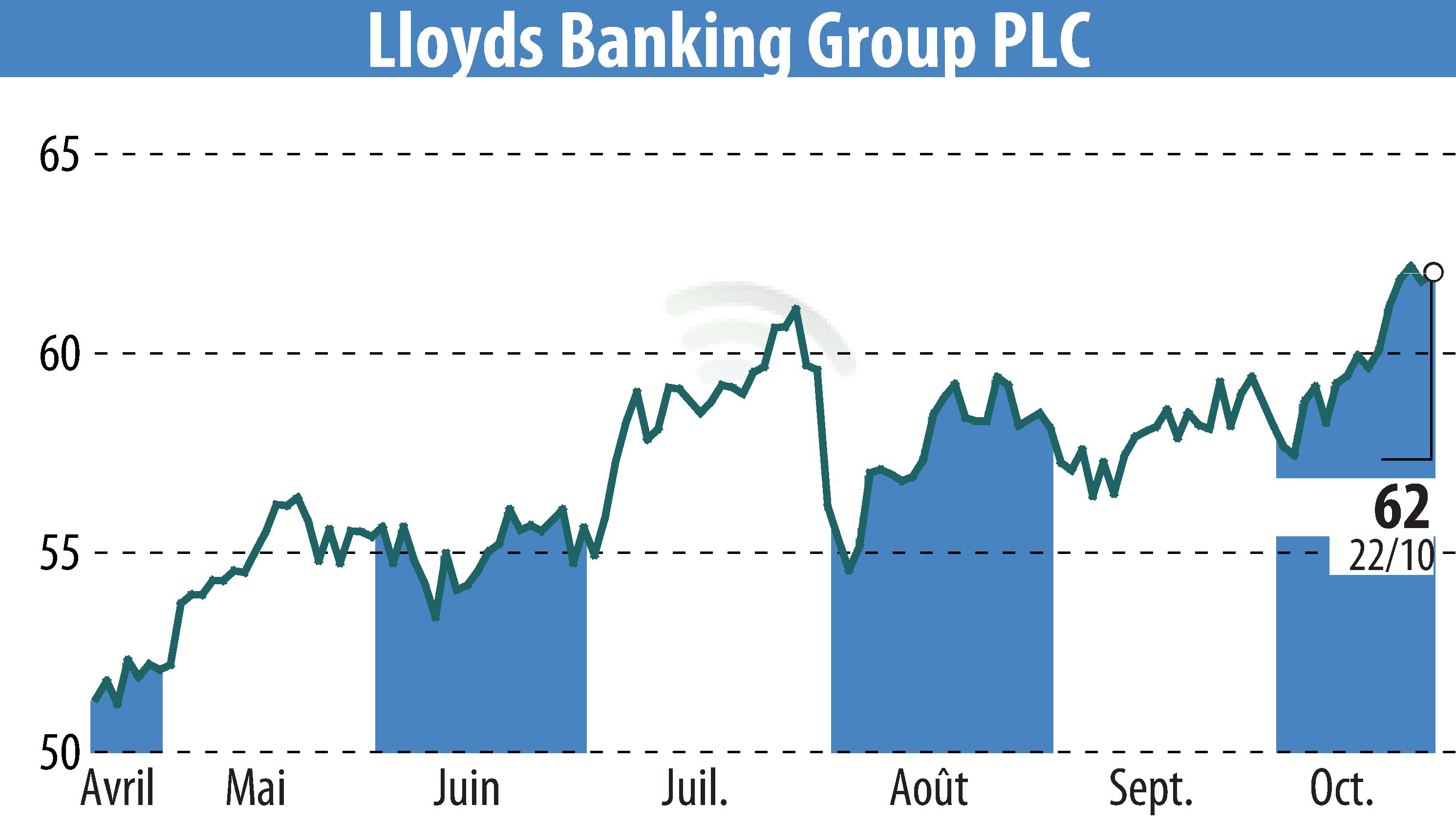

sur Lloyds Banking Group (isin : GB0008706128)

Lloyds Banking Group Reports Robust Q3 2024 Financial Performance

Lloyds Banking Group PLC announced a strong financial performance for the third quarter of 2024. Statutory profit after tax reached £3.8 billion, despite a 7% decline in net income due to increased operating costs, including the Bank of England Levy. Underlying net interest income was £9.6 billion, a decrease of 8% compared to the previous year. However, the third quarter saw a 2% rise in this metric, attributed to a banking net interest margin of 2.95%.

The Group also reported a 9% increase in underlying other income, driven by strengthened customer and market activities. Operating expenses climbed by 5% to £7.0 billion due to higher strategic investments and inflationary pressures. Underlying impairment charges were significantly reduced, reflecting resilient asset quality.

CEO Charlie Nunn expressed confidence in achieving 2024 targets, supported by capital generation of 132 basis points year-to-date and a CET1 ratio of 14.3%.

R. P.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Lloyds Banking Group