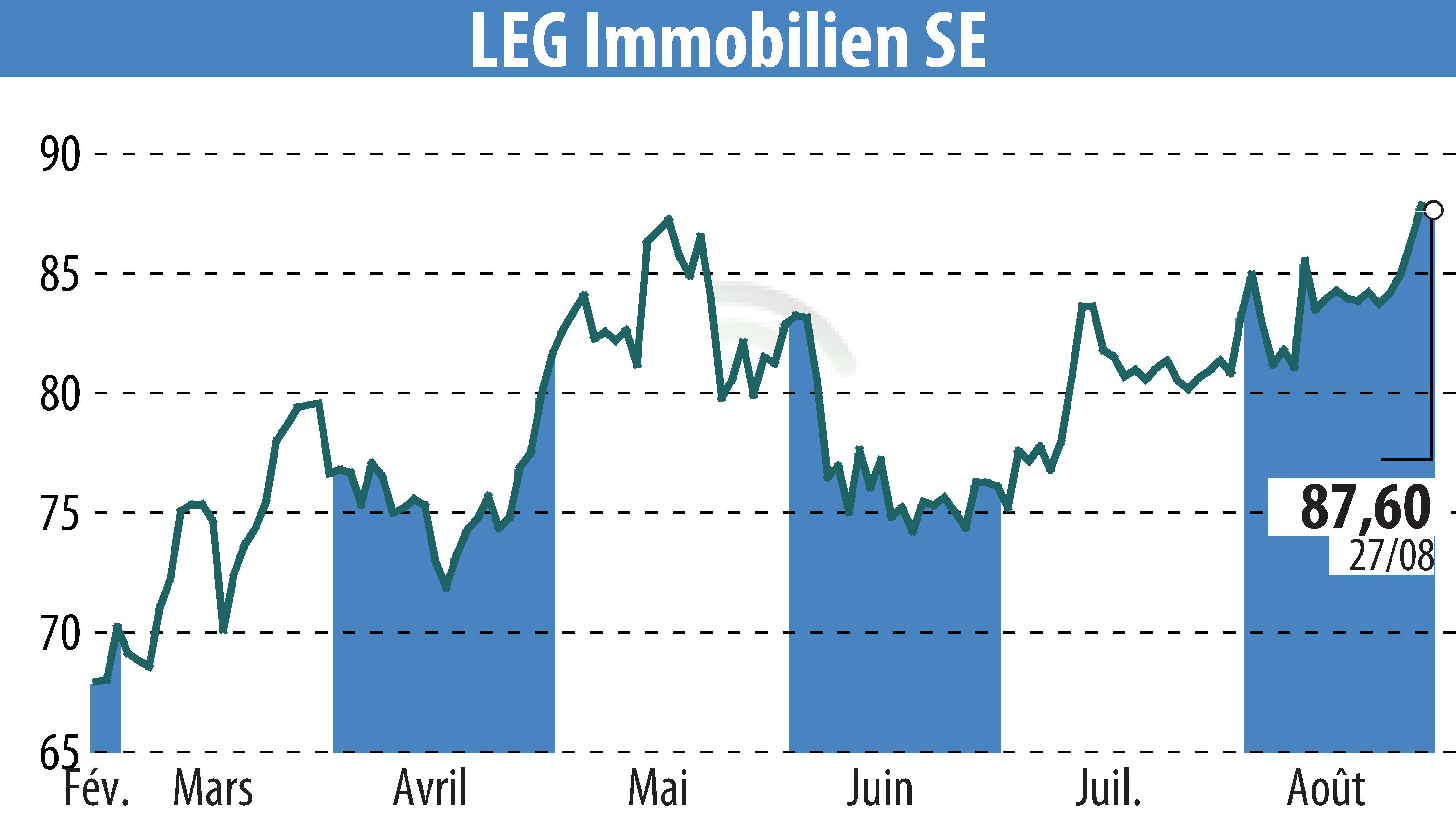

sur LEG Immobilien AG (isin : DE000LEG1110)

LEG Immobilien SE Announces EUR 500 Million Convertible Bond Offering

On August 28, 2024, LEG Immobilien SE's Management Board, with the Supervisory Board's consent, approved a EUR 500 million offering of senior, unsecured convertible bonds. The bonds, guaranteed by LEG and issued by its Dutch subsidiary LEG Properties B.V., are due in 2030. They are convertible into new and/or existing ordinary shares of the Company, excluding pre-emptive rights of shareholders.

The proceeds aim at refinancing existing debts and general corporate purposes. Each bond, with a denomination of EUR 100,000, will have a fixed annual coupon of 1.00%, payable semi-annually in arrears. The pricing will be based on an accelerated bookbuilding process.

Settlement is expected around September 4, 2024, with subsequent trading on the Frankfurt Stock Exchange's Open Market segment. Redemption at accreted amounts up to 107.98% of the principal is planned for September 4, 2030.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de LEG Immobilien AG