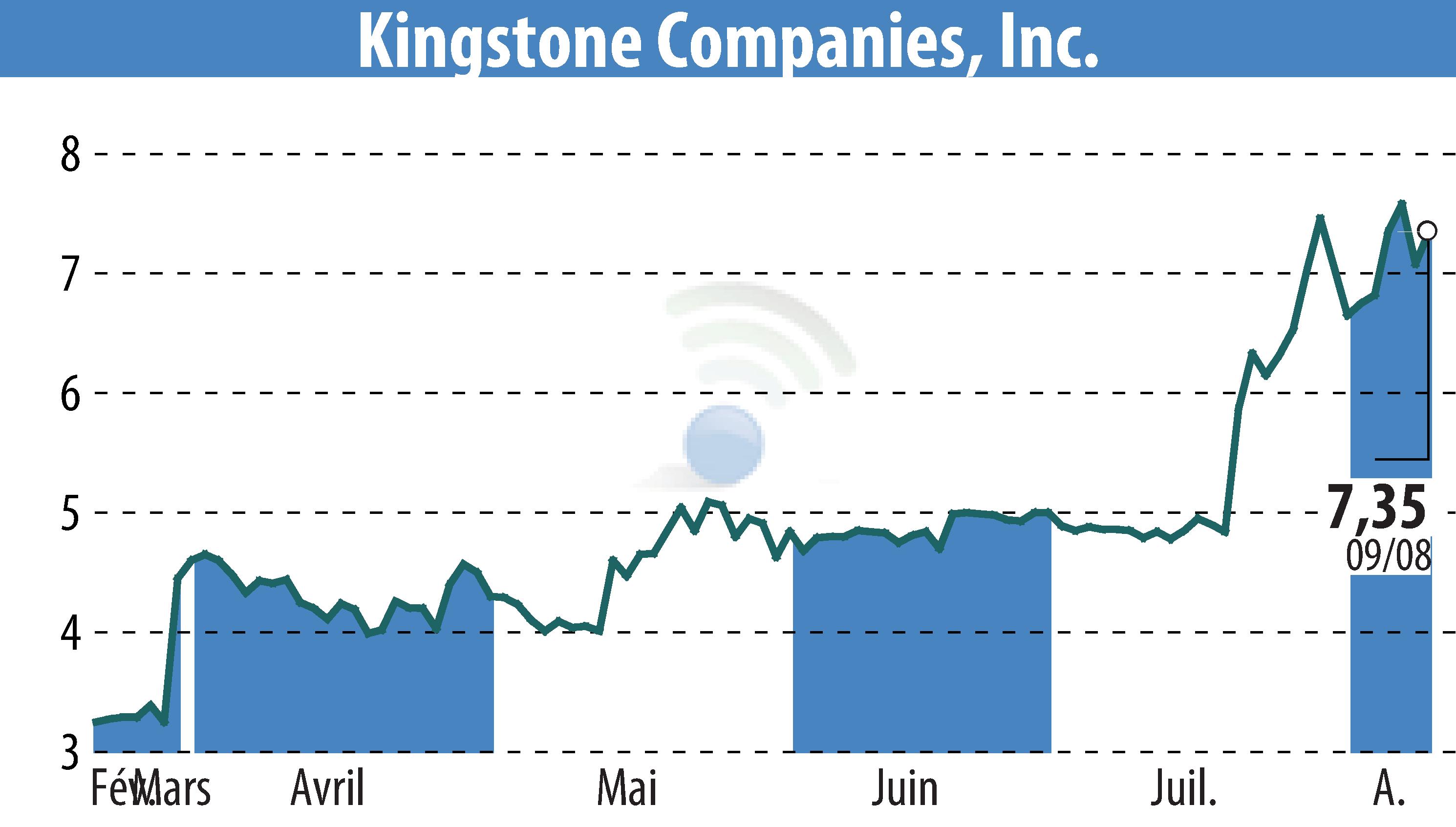

sur Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Reports Double-Digit Premium Growth and Third Consecutive Quarter of Net Income

Kingstone Companies, Inc. (Nasdaq: KINS), a property and casualty insurance holding company, announced double-digit premium growth in its core business for Q2 2024. Direct premiums written increased by 21.5% compared to Q2 2023, reaching $51.3 million. For the first half of 2024, the increase was 17%, totaling $97.9 million. The net combined ratio improved to 78.2%, from 98.9% a year earlier.

Net income for Q2 2024 reached $4.5 million, a significant turnaround from a loss of $522,000 in Q2 2023. Basic earnings per share were $0.41, compared to a loss of $0.05 per share in the previous year. The return on equity soared to 47.2%, from a negative 6.4%.

Kingstone's CEO, Meryl Golden, attributed the performance to favorable weather, a reduction in non-core business, and improved expense management. The company raised its full-year 2024 guidance, expecting core business direct premiums written to grow between 25% and 35%, with a combined ratio between 84% and 88%. For 2025, growth is expected in the range of 15% to 25%.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Kingstone Companies, Inc