sur Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Companies, Inc. Sees Significant Growth Opportunity Amid Market Changes

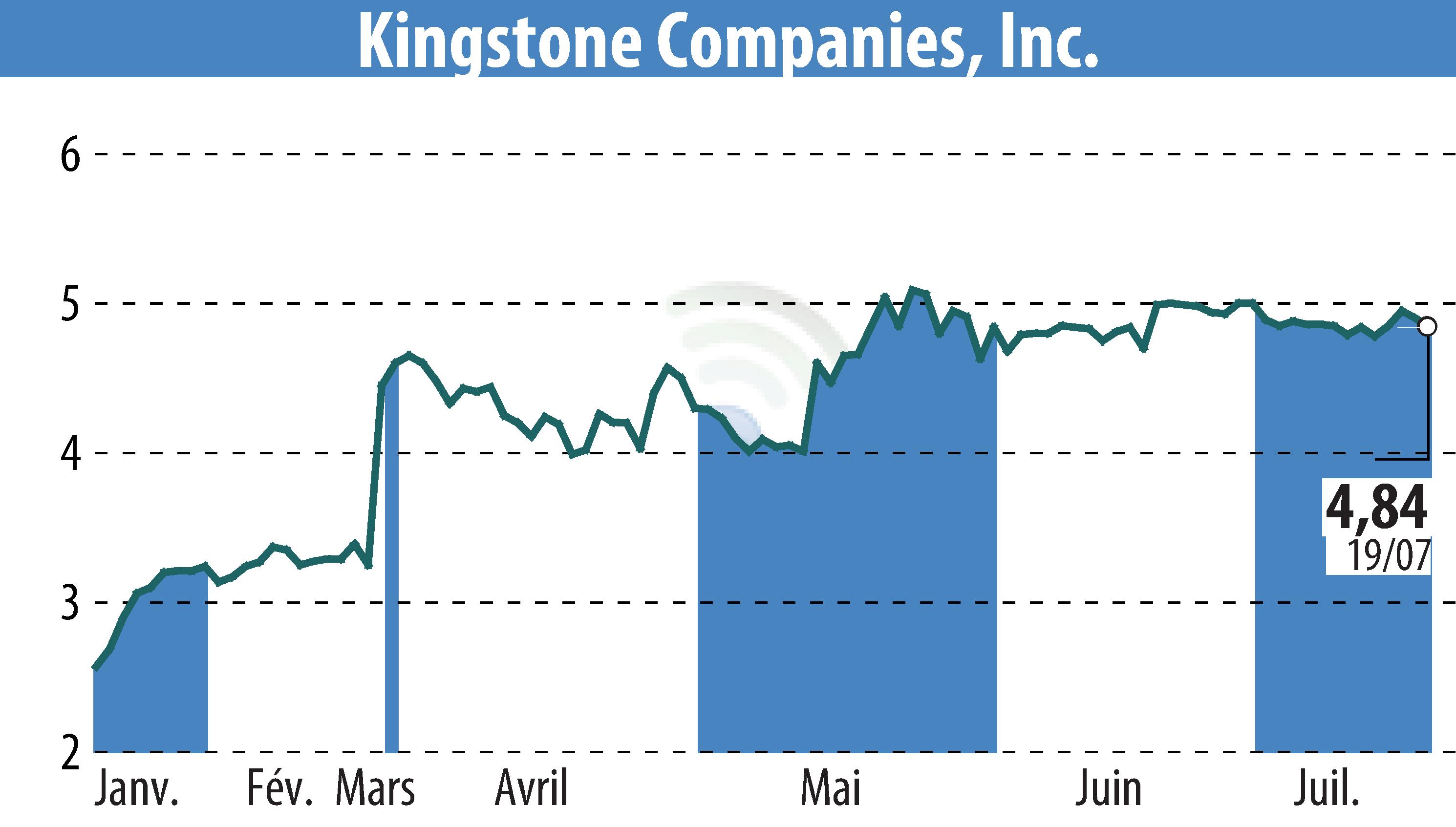

Kingstone Companies, Inc. (Nasdaq: KINS), a Northeast regional property and casualty insurance holding company, issued a mid-year update to its shareholders. The open letter, penned by CEO Meryl Golden, highlights changes in the New York property market that present significant growth opportunities for the company.

CEO Meryl Golden emphasized the importance of Kingstone's strategy to focus on its core state of New York. The strategy includes precise pricing, risk-matching, insuring properties at current replacement costs, and maintaining an efficient expense structure. These measures have led to three consecutive quarters of profitability.

Notably, Kingstone projects substantial growth in its core New York business, with its estimated direct written premium growth for Q2 2024 reaching 21.5%. The company has raised its 2024 guidance for core business direct written premium growth to a range of 21% to 30%, up from the prior 16% to 20% estimate.

The market shift is attributed to several competing carriers exiting the New York State market, freeing up an estimated $200 million in annual premiums. This situation is akin to the post-hurricane surge Kingstone experienced nearly twenty years ago.

Kingstone's management is confident that this represents the greatest growth opportunity in the company's history. The CEO pledged to keep stakeholders updated as the company capitalizes on this opportunity.

R. E.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Kingstone Companies, Inc