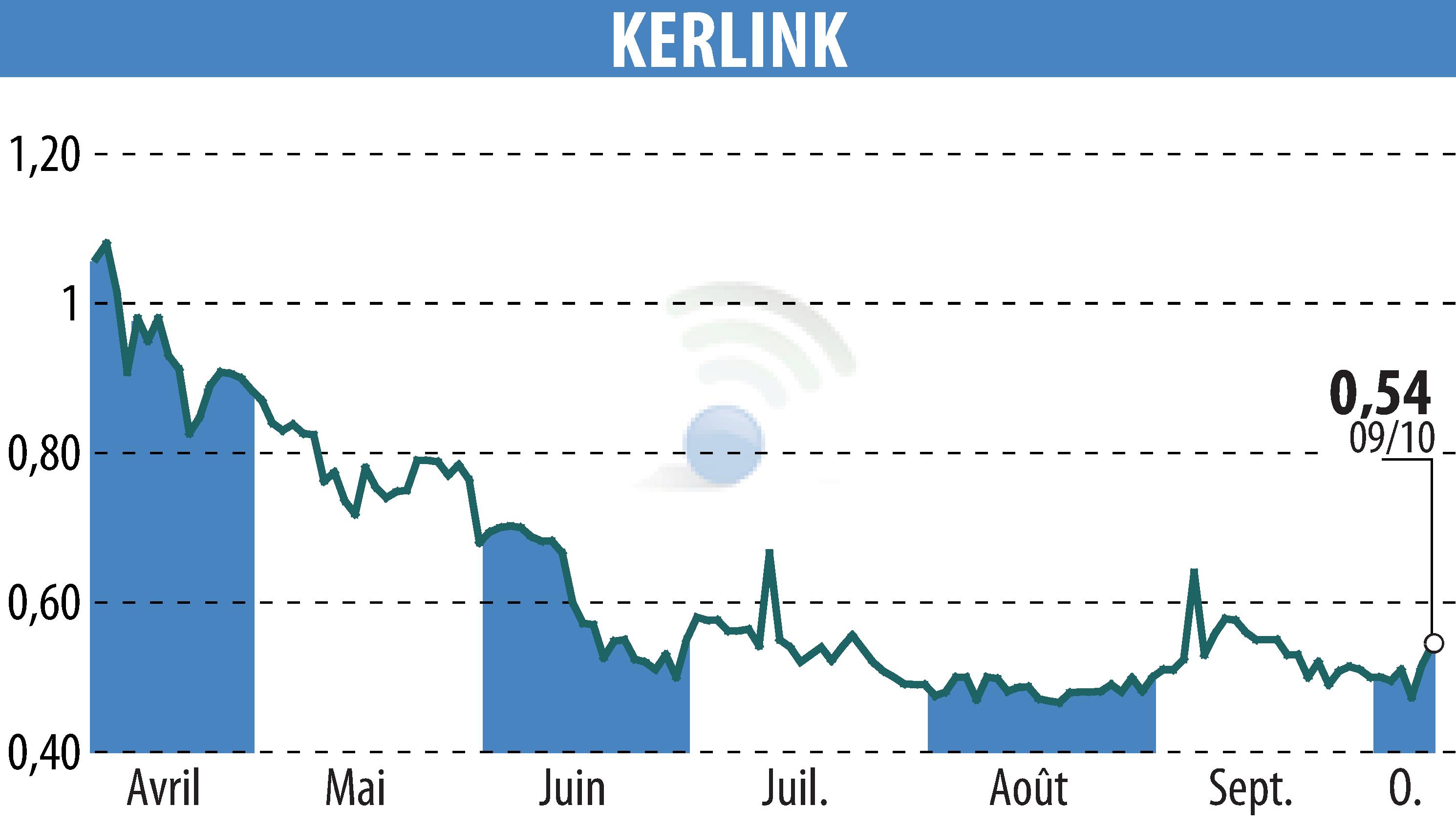

sur KERLINK (EPA:ALKLK)

Kerlink Reports H1 2024 Results Amid Economic Challenges

Kerlink, a global Internet of Things solutions provider, disclosed a 6% decline in H1 2024 activity, generating €6.2 million compared to the previous year. Despite economic and geopolitical hurdles, cost control measures reduced the EBITDA loss to under €1.3 million from €1.6 million in H1 2023.

The decline in revenues was significantly influenced by the termination of two Network as a Service contracts. Equipment sales contributed to 77% of total revenue, reflecting a like-for-like increase of 5%. Cash improved to €5.3 million, aided by debt rescheduling agreements.

Management anticipates better performance, with positive order intake momentum expected to translate into revenue growth in 2025. While targets for 2024 might not be achieved, Kerlink remains optimistic about future profitable growth.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de KERLINK