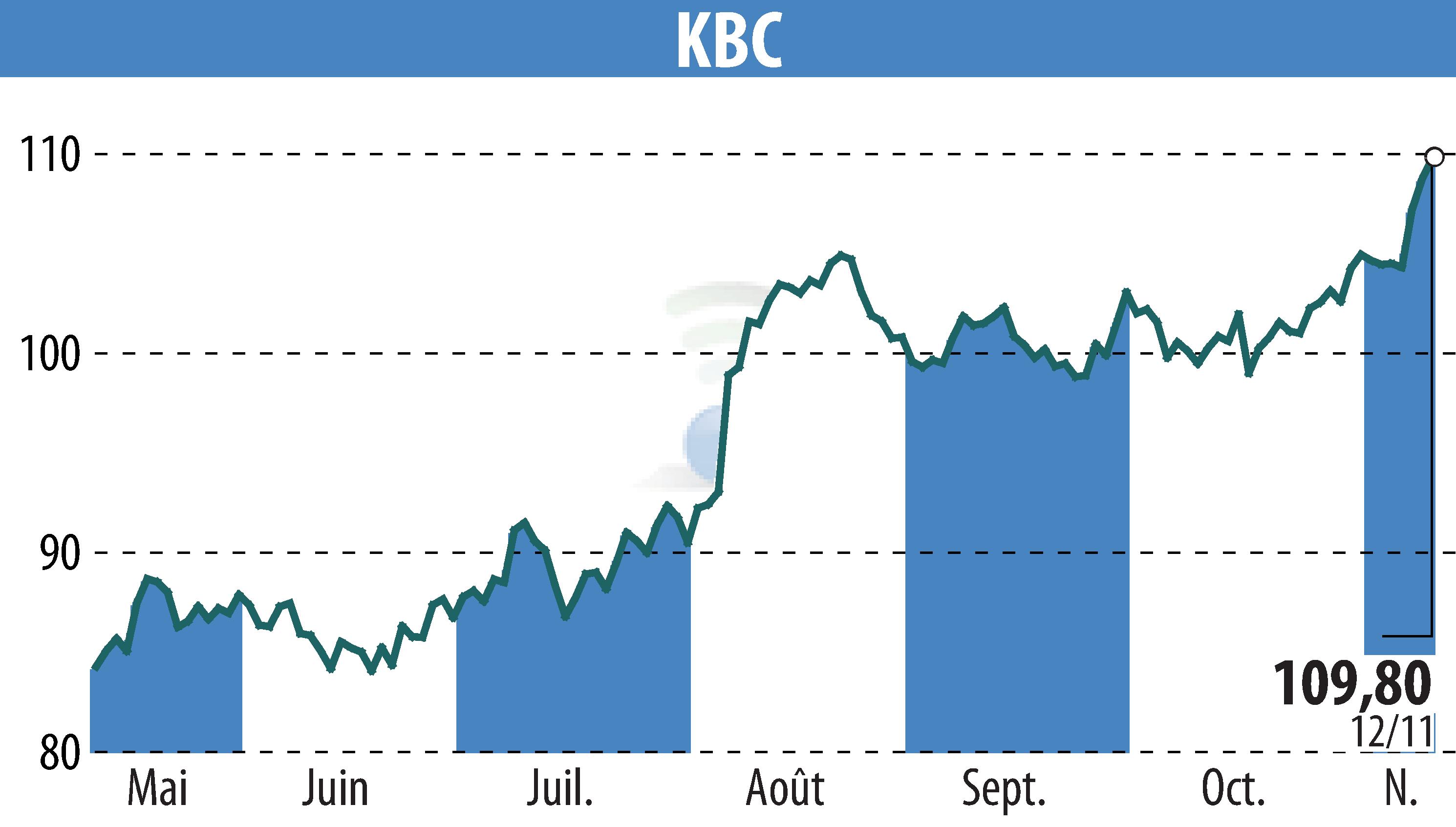

sur KBC (EBR:KBC)

KBC Completes Significant Risk Transfer on €4.2 Billion Loan Portfolio

KBC Group has announced the completion of a significant risk transfer transaction on a €4.2 billion corporate loan portfolio. This marks KBC's first venture into significant risk transfer, aligning with their strategy to optimize risk-weighted assets (RWA) and strengthen their capital ratio. The bank achieved this through the issuance of credit linked notes to institutional investors, addressing the mezzanine exposure within the portfolio originated by its corporate banking department.

The transaction is expected to result in a saving of approximately €2 billion in RWA, thereby bolstering KBC Group's Common Equity Tier 1 (CET1) ratio by around 23 basis points in the fourth quarter of 2025. This development reflects KBC's commitment to efficient capital deployment and supporting future growth.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de KBC