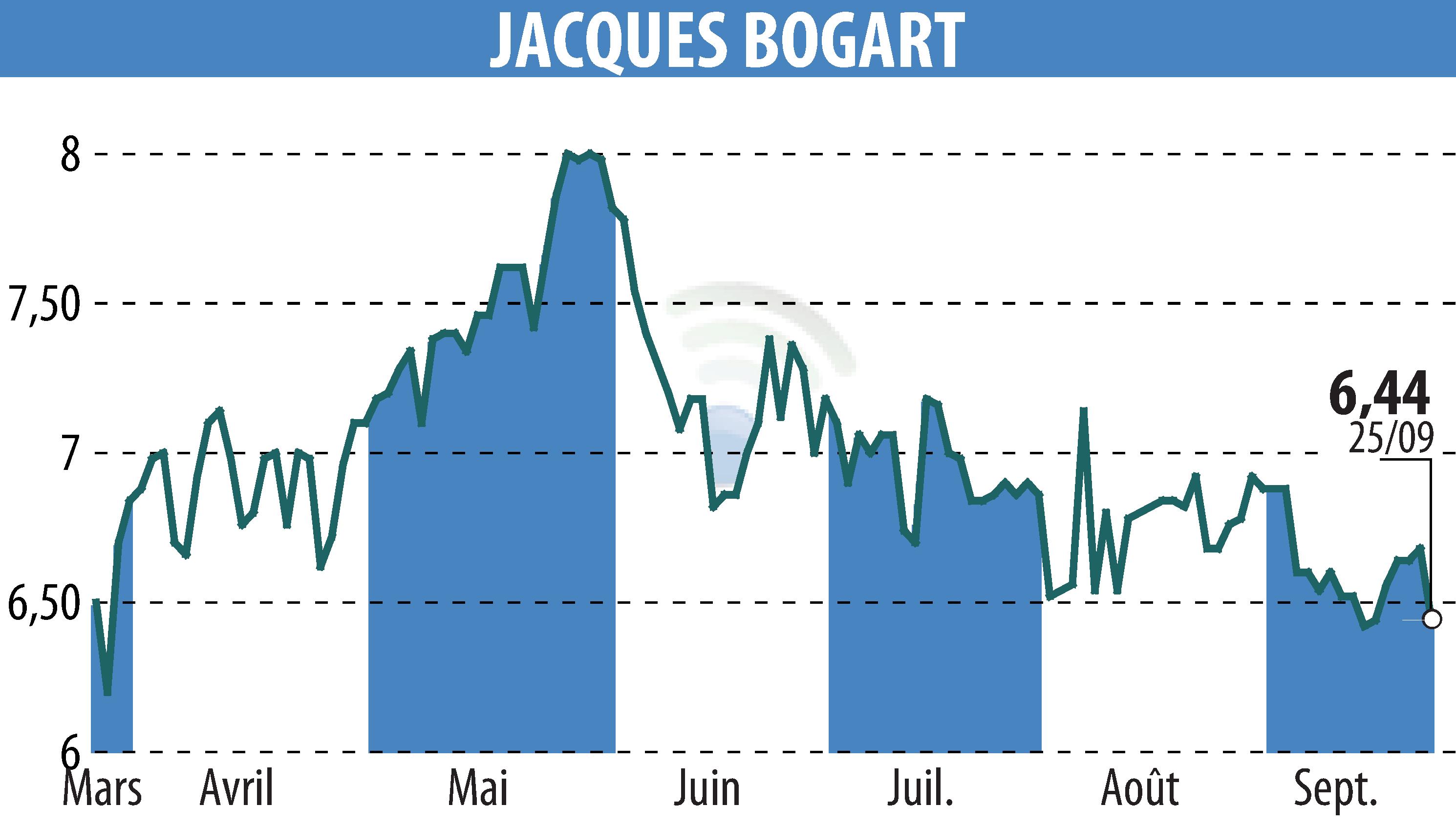

sur JACQUES BOGART (EPA:JBOG)

Jacques Bogart Announces H1 2024 Results: EBITDA Up by 13.9%

Jacques Bogart has reported its financial results for the first half of 2024. The group's turnover amounted to €134 million, reflecting a 2.6% decline from the same period in the previous year. This slight decrease is attributed to various factors, including changes in the operating model in Spain and the consolidation of new stores in Germany.

Despite the drop in turnover, EBITDA showed a robust double-digit growth of 13.9%, rising to €17.2 million. The company's gross margin remained strong at 52.3%, slightly up from 51.9% in H1 2023. Meanwhile, staff costs and other recurring expenses experienced a decrease, supporting the improved EBITDA performance.

Operating loss narrowed significantly to €(1.2) million, compared to €(3.1) million in the first half of the previous year. This improvement includes lower depreciation, amortisation, and non-recurring expenses related to reorganisation initiatives.

At the end of June 2024, the net loss for the Group was €(5.2) million, a notable improvement from the €(7.2) million loss recorded in H1 2023. The company's financial structure shows shareholders' equity of €75.7 million, with net debt increasing to €65.4 million from €27.6 million at the end of 2023.

Bogart plans to continue its profitable growth strategy, focusing on its core businesses of fragrances, cosmetics, and retail, with particular emphasis on margin improvement and value generation.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de JACQUES BOGART