sur INDUS Holding AG (isin : DE0006200108)

INDUS Holding AG Poised for Long-Term Growth Amid New Acquisitions

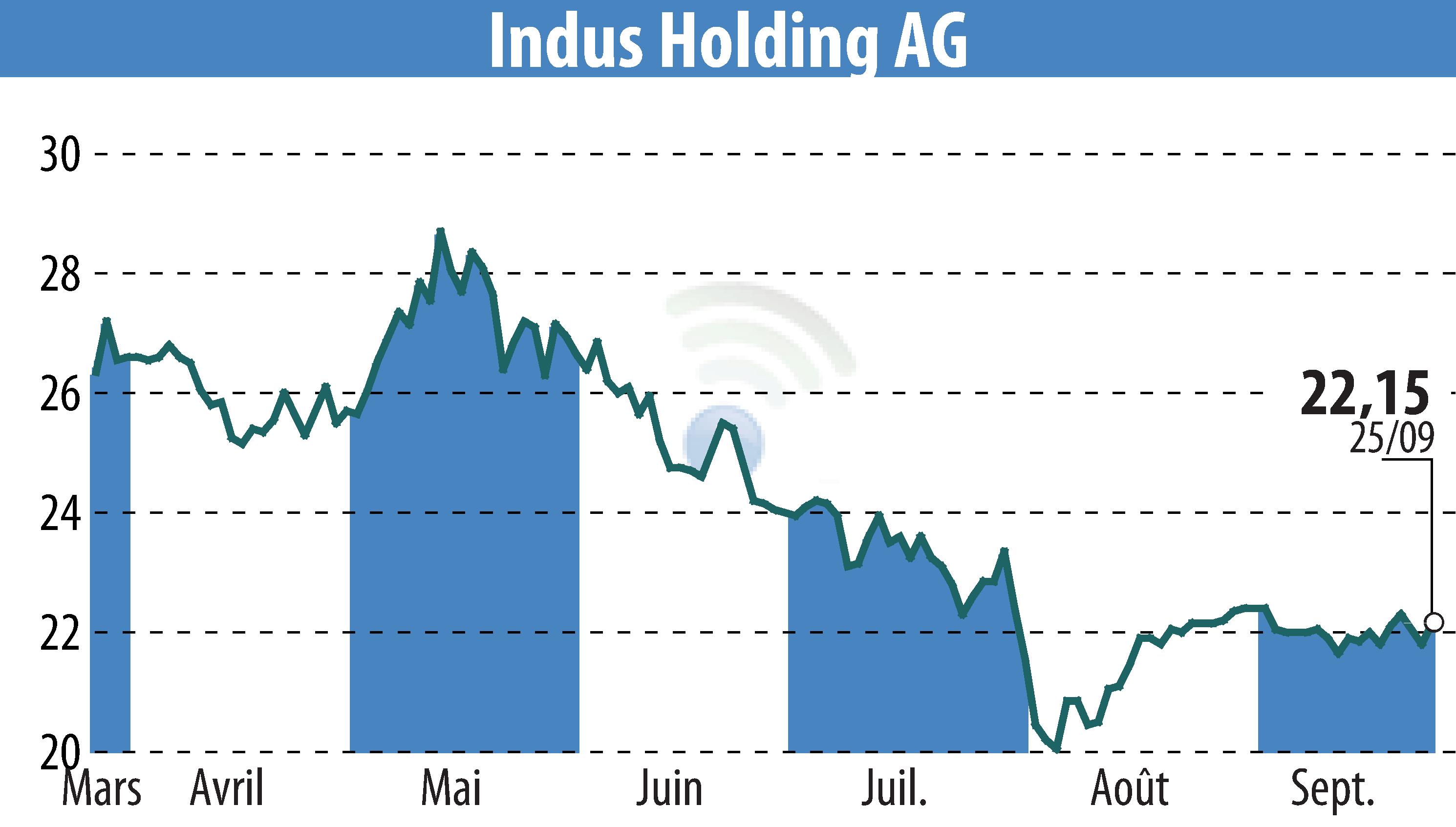

INDUS Holding AG, identified by ISIN DE0006200108, has been classified with a "BUY" recommendation by NuWays AG analysts as of September 26, 2024. The target price is set at EUR 34.00. Analyst Christian Sandherr highlights recent acquisitions and operational progress as key drivers for this recommendation.

INDUS has been active in mergers and acquisitions, finalizing five deals this year, including the notable acquisition of DECKMA, a supplier of marine equipment, which generates approximately €19m in revenue and showcases promising EBIT margins. INDUS has allocated €31.5m for M&A activities this year and plans to invest up to €70m, capitalizing on declining valuation multiples of German SMEs.

The aging demographic of SME owners in Germany presents additional acquisition opportunities. INDUS is seen as a preferred successor, offering more than just financial incentives but also focusing on job security and reputation.

Despite short-term macroeconomic challenges, the stock remains attractive with a forward P/E of 7x and an expected dividend yield of 5.4%. NuWays AG maintains a "BUY" rating for INDUS, recognizing its long-term growth potential.

R. H.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de INDUS Holding AG