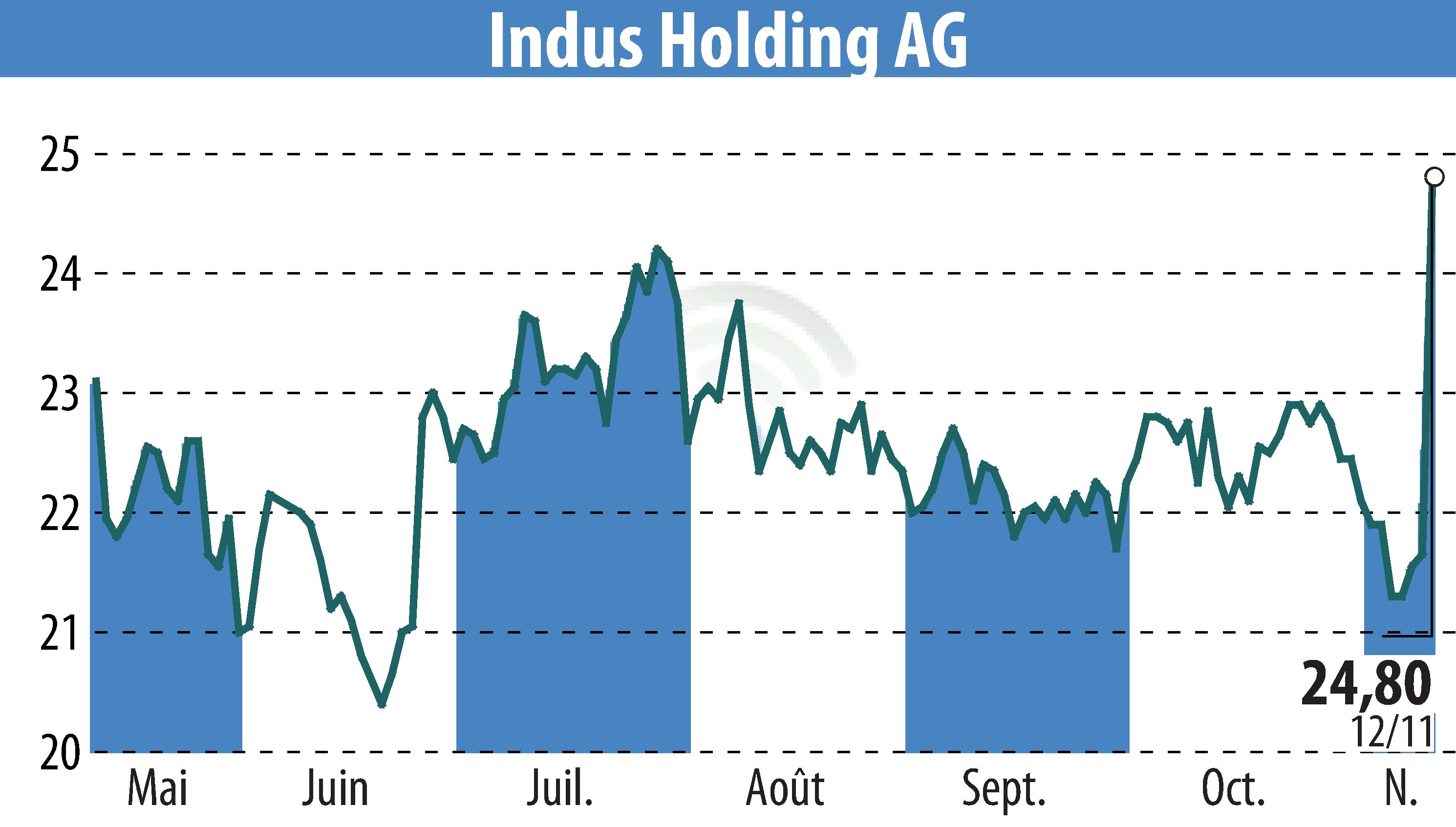

sur INDUS Holding AG (ETR:INH)

INDUS Holding AG's Q3 Results Beat Expectations

INDUS Holding AG announced surprisingly strong Q3 results, revealing an adjusted EBITA of €48.1 million, up 10% year-over-year, despite challenges like raw material costs, notably tungsten. This performance exceeded predictions (€36.4 million) and drove a substantial EBIT increase of 36% to €43.3 million, maintaining a 9.9% margin.

Sales slightly dropped by 1% to €437.4 million, primarily due to weaker performances in the Engineering and Material Solutions sectors, although Infrastructure growth buffered the decline. The company experienced currency-related costs of €2.2 million, influenced by a weaker dollar.

Notably, Engineering sales decreased by 9.2% year-over-year; however, new acquisitions positively impacted performance. Material Solutions saw a 3.3% decline, partially offset by cost strategies. Infrastructure sales increased by 8.8%, strongly supporting overall results.

The firm reported significant free cash flow of €66.6 million, bolstering acquisition prospects, with more deals potentially closing in Q4 2025. Standout order intake growth of 17.2% suggests a promising outlook.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de INDUS Holding AG