sur INDUS Holding AG (isin : DE0006200108)

INDUS Holding AG Announces Strategic Acquisition

INDUS Holding AG has revealed the acquisition of DECKMA, a supplier of technical marine equipment, marking a strategic addition to its Engineering segment. The acquisition includes 75% of DECKMA's shares with an option to obtain the remaining 25% by 2026. The existing DECKMA management will remain in place post-acquisition.

DECKMA specializes in lighting, fire alarm systems, corrosion protection technology, and automation solutions for the maritime industry, serving customers such as cruise ship, merchant ship, and mega yacht manufacturers. The company generates approximately €19 million in revenue with a profitable margin, estimated to deliver a low double-digit EBIT margin.

The purchase price for DECKMA is around €13 million, contributing to INDUS's €31.5 million spent on M&A this year, leaving room for further acquisitions within the €70 million annual budget. The company is optimistic about utilizing the full budget this year due to several promising opportunities, expecting another acquisition soon.

Historically, EBIT multiples in the German Small Cap M&A market have decreased, making this acquisition strategic. Additionally, the increasing number of container ships and offshore wind farms, such as EnBW’s “He Dreiht”, indicate further growth potential.

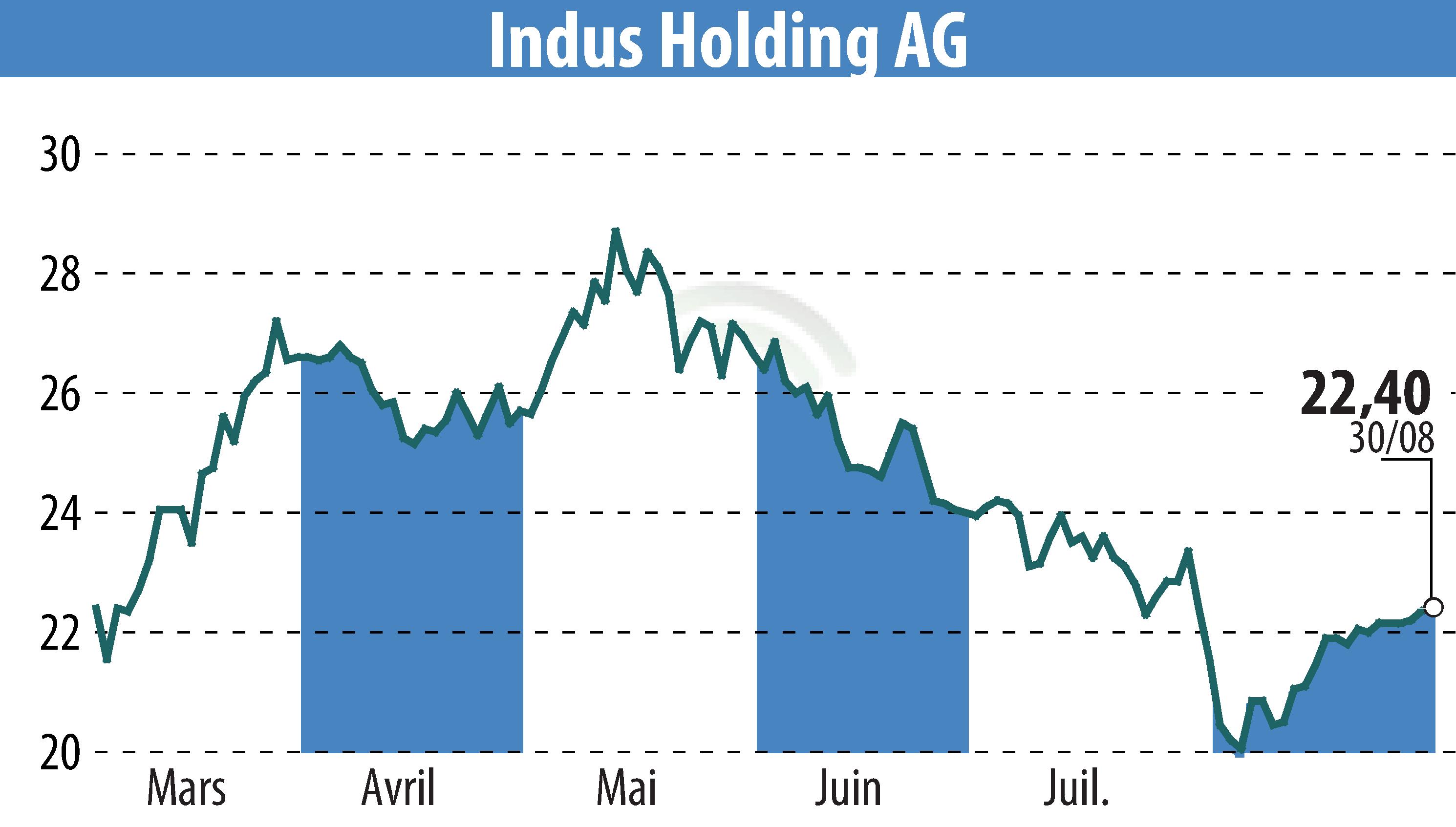

With a forward P/E of 7x, an expected dividend yield of 5.3%, and a strong forecasted cash flow yield for 2024, INDUS remains a "BUY" with an unchanged price target of €34.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de INDUS Holding AG