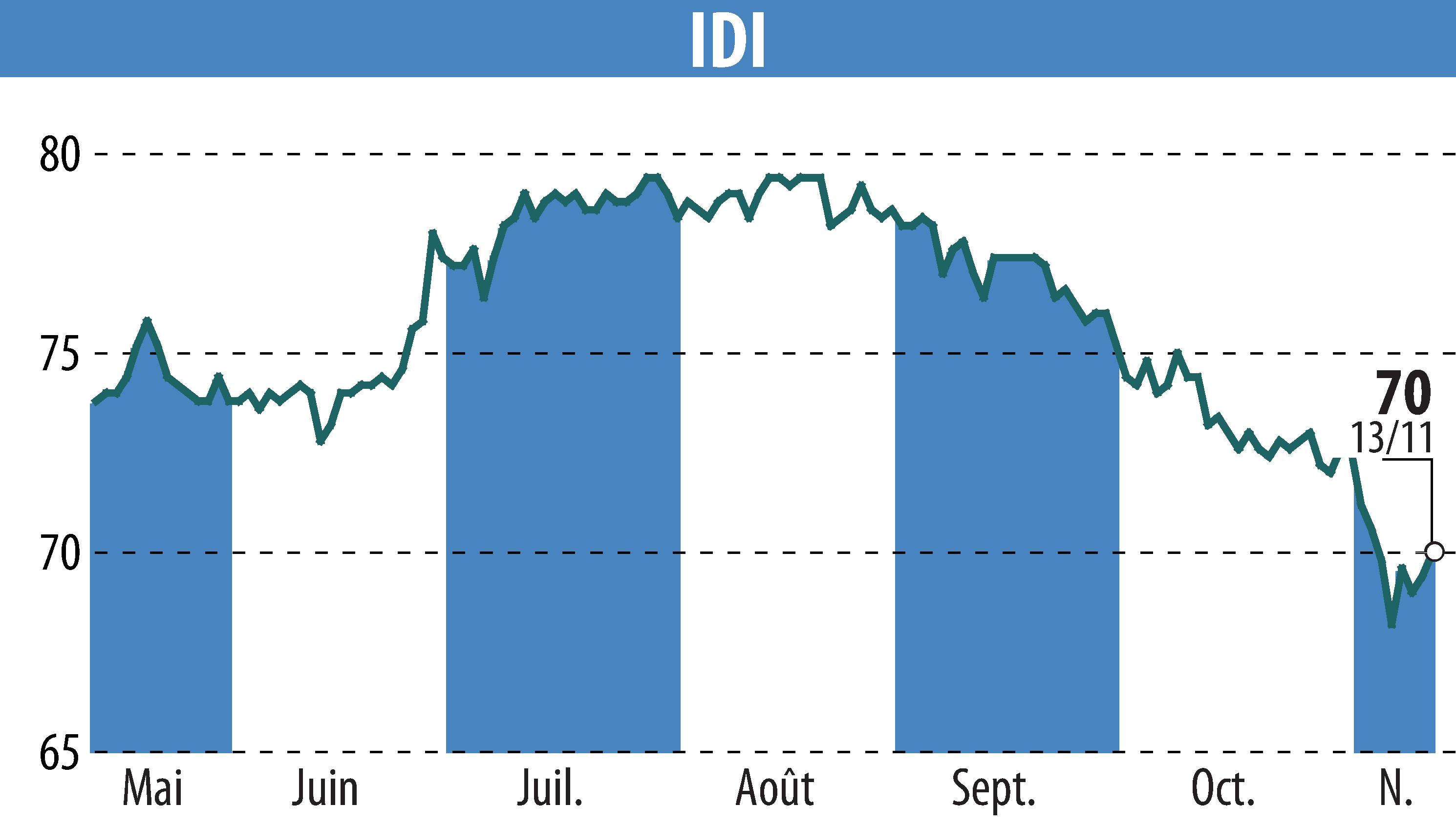

sur IDI (EPA:IDIP)

IDI's quarterly results: moderate growth and solid outlook

The IDI Group, specializing in private equity, announces a 2.14% increase in its net asset value (NAV) per share as of September 30, 2025, reaching €91.75. In nine months, IDI has completed six transactions, including a majority stake in Forsk and support for Ekosport in the expansion of its network.

Consolidated shareholders' equity stands at €698 million, reflecting a stable financial structure. IDI has €178 million in investment capacity. The group maintains its focus on resilient business models and seizes opportunities presented by an uncertain environment.

Finally, the group's ESG commitment is strengthening, with recent acquisitions having undergone in-depth ESG analysis. IDI continues to pursue international growth and the integration of technologies such as artificial intelligence within its portfolio companies.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de IDI