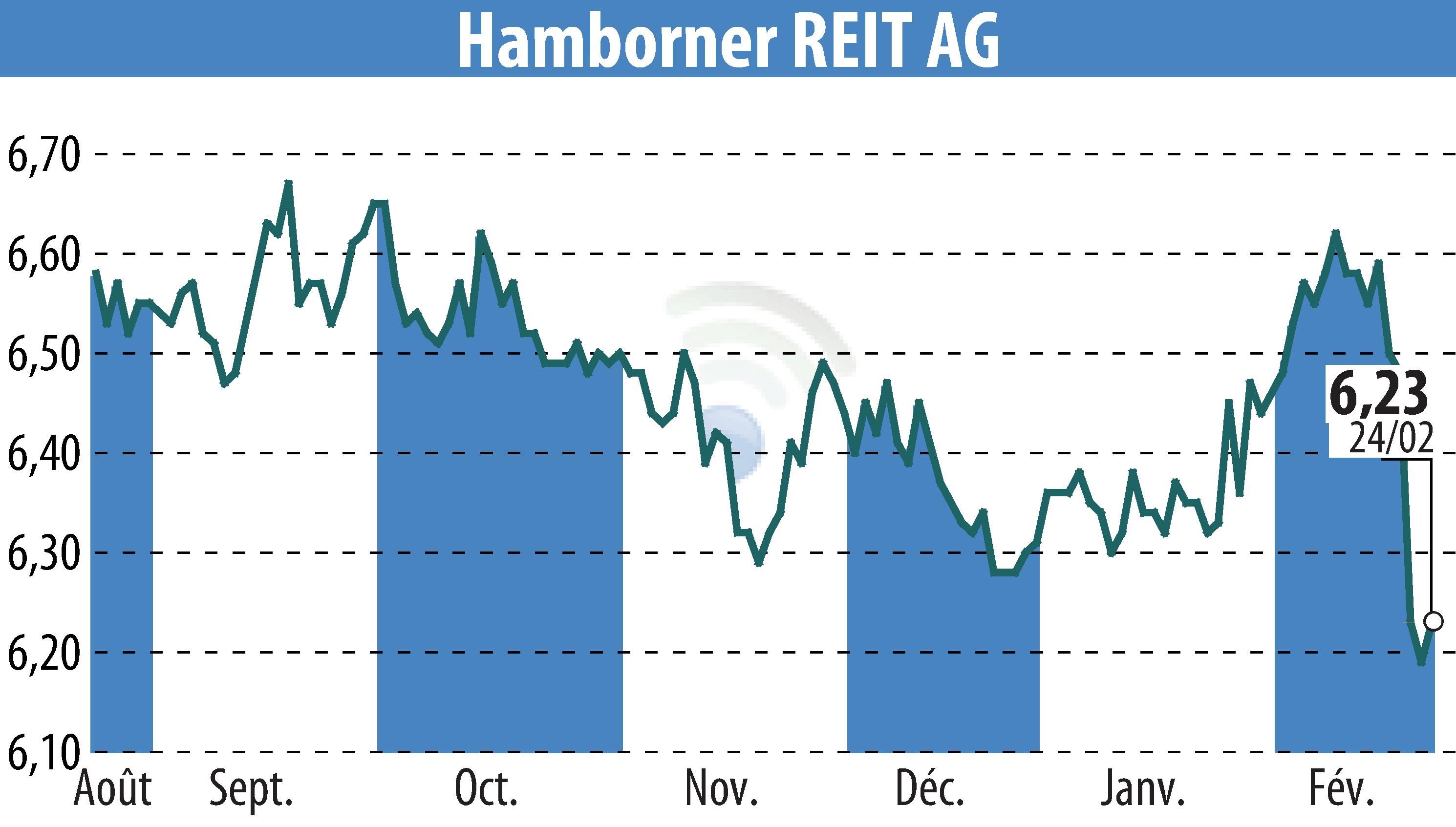

sur HAMBORNER REIT AG (isin : DE000A3H2333)

HAMBORNER REIT AG Reports Stable Growth and Dividend for 2024

HAMBORNER REIT AG has released its preliminary figures for 2024, showing a stable business performance despite challenging conditions. Rental income increased by 2% to €93.0 million, driven by new property acquisitions and contractual rent adjustments. However, funds from operations (FFO) fell by 5.5% to €51.6 million, impacted by higher maintenance and administrative expenses.

The company's financial stability remained solid, with a loan-to-value ratio of 43.7% and a REIT equity ratio of 55.2%. HAMBORNER proposed a dividend of €0.48 per share, maintaining the previous year's level, resulting in a 7.7% yield.

The past year included strategic asset sales, such as the Haerder Center in Lübeck and an office property in Osnabrück. These transactions contributed to a minor decline in the net asset value to €9.79 per share.

Looking forward, HAMBORNER forecasts a decrease in rental income and FFO for 2025 due to property sales and increased expenses. Dividend policy will be reviewed due to anticipated higher costs and reduced revenue.

R. H.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de HAMBORNER REIT AG