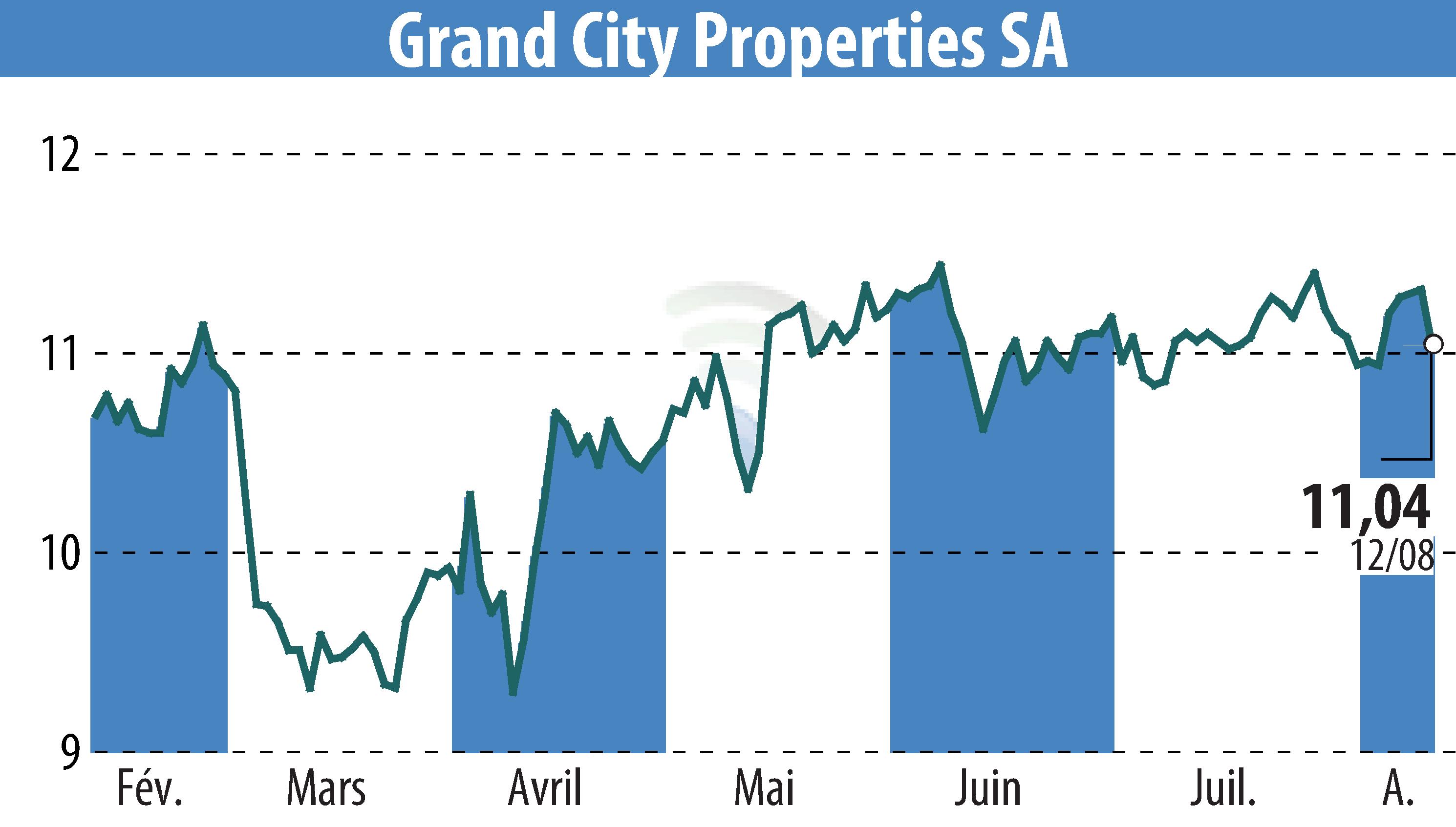

sur Grand City Properties S.A., (ETR:GYC)

Grand City Properties Reports Strong H1 2025 Results

Grand City Properties S.A. announced H1 2025 financial results reflecting solid operational performance. Net rental income reached €213 million, a 1% increase year-over-year, despite net property disposals. The adjusted EBITDA improved to €169 million, a 2% rise from the previous year, driven by operational efficiencies.

The company's financial health remains robust with a liquidity position of €1.5 billion, covering 34% of total debt, and a low loan-to-value ratio of 32%. Notably, GCP completed property disposals totaling €131 million, and reinvested in acquisitions worth €60 million, aiming for future growth.

Net profit surged to €210 million, compared to a €74 million loss in H1 2024. This reflects strong portfolio revaluation and rental growth. The full-year 2025 guidance has been confirmed, showcasing confidence in continued operational efficiency and market position.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Grand City Properties S.A.,