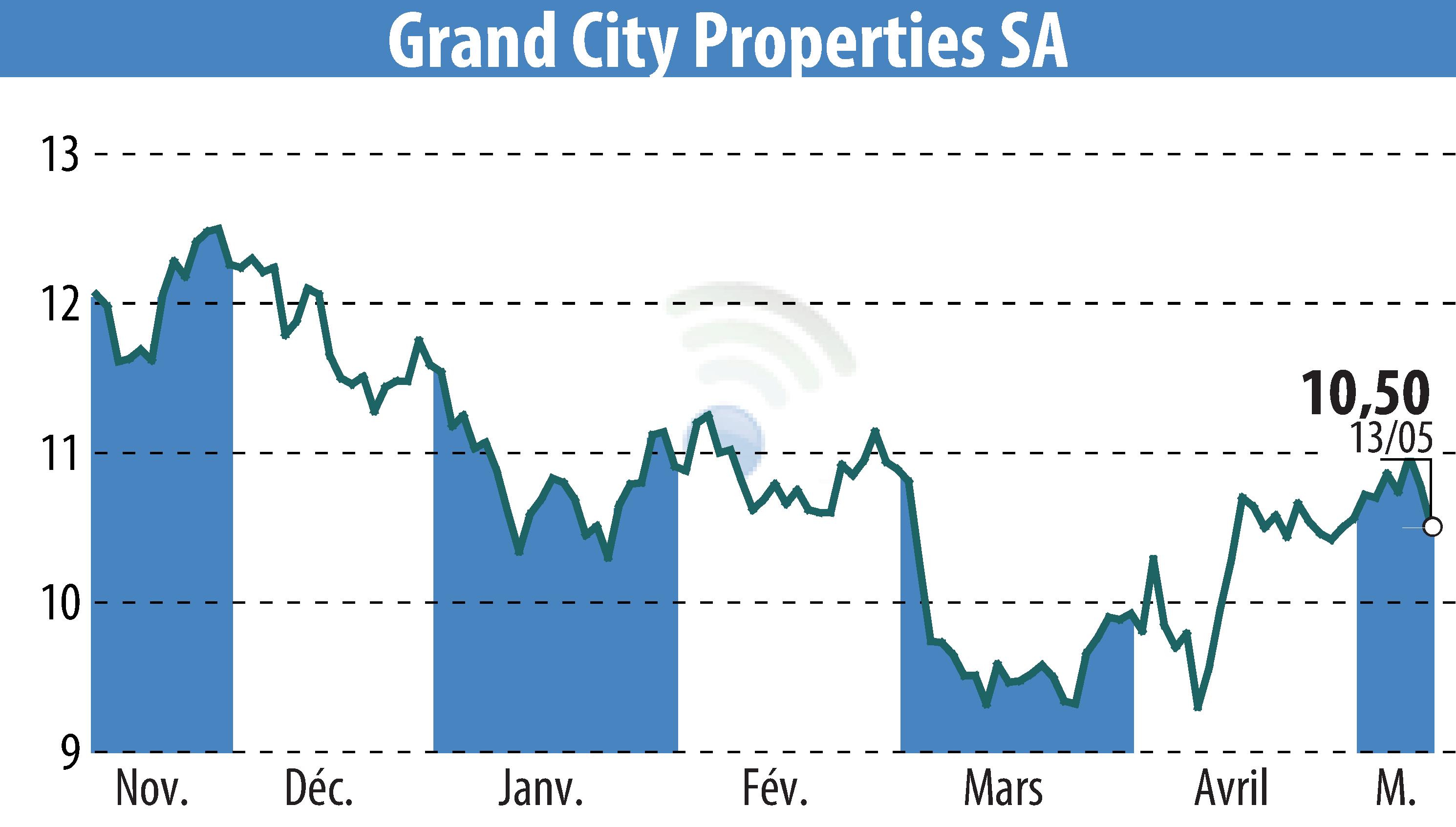

sur Grand City Properties S.A., (ETR:GYC)

Grand City Properties Reports Q1 2025 Financial Growth

Grand City Properties S.A. has released its financial results for Q1 2025, highlighting growth driven by operational efficiency. The company reported a net rental income of €106 million, a 1% increase from Q1 2024, despite asset disposals. Like-for-like rental growth reached 3.8%, with adjusted EBITDA up by 3% to €85 million.

Additionally, FFO I rose by 6% to €48 million, boosting per share value to €0.27. A 0.6% property revaluation was noted, with €120 million in disposals completed at book value. The financial position remains robust, with nearly €1.7 billion in liquidity and an LTV ratio of 32%.

The company's EPRA NTA increased to €4.3 billion. Despite a rating downgrade by S&P to BBB, GCP maintains significant financial headroom. The company has opted not to declare a dividend for 2024 to prioritize financial stability.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Grand City Properties S.A.,