sur Genel Energy (isin : JE00B55Q3P39)

Genel Energy's Financial Performance and Strategic Outlook for H1 2025

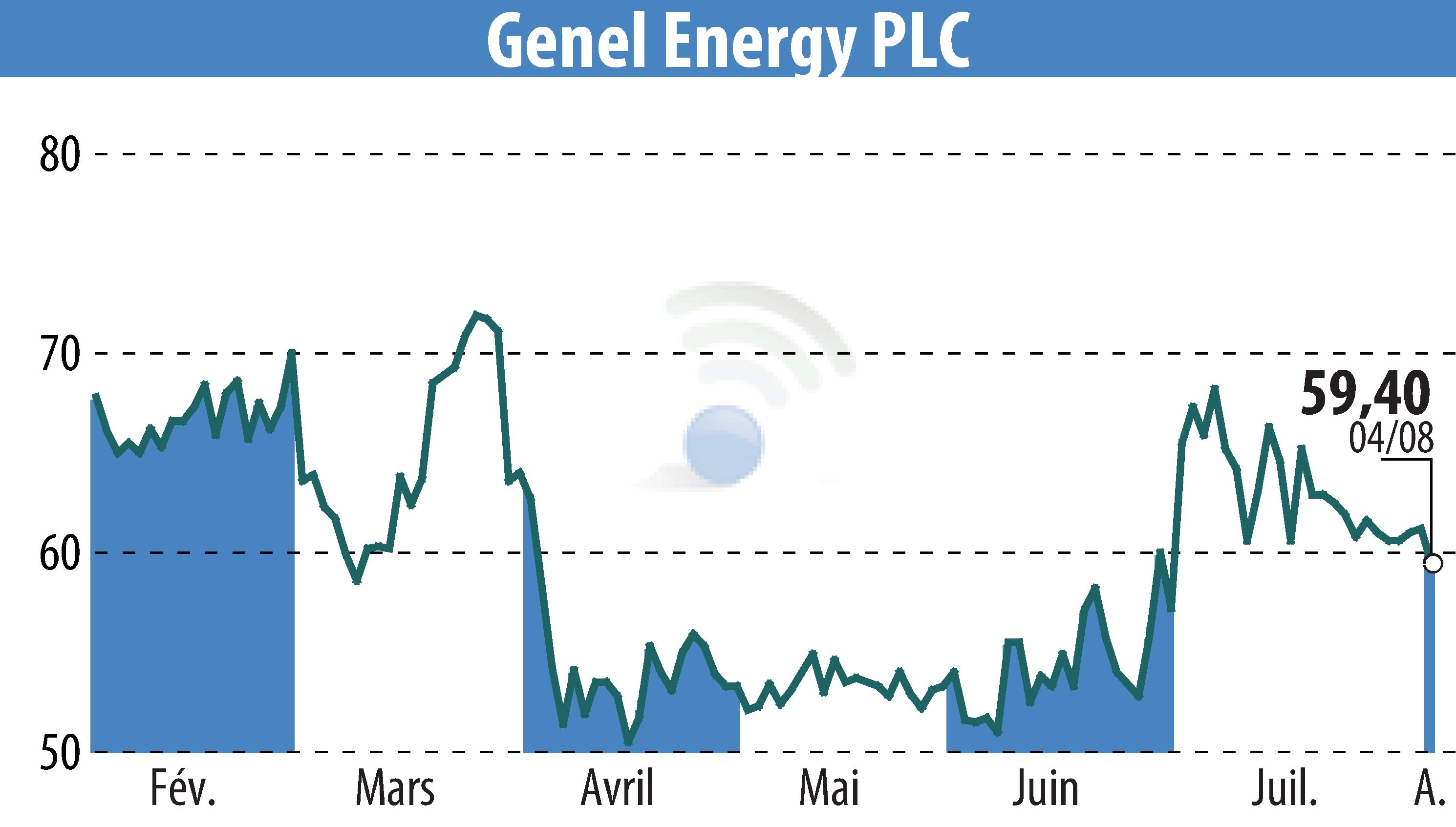

Genel Energy PLC reported its unaudited results for the period ending June 30, 2025, highlighting stable production and strategic initiatives. The Tawke PSC sustained steady production reaching 19,600 bopd, driven by consistent domestic demand. Despite a drop in the average Brent oil price to $72/bbl, domestic sales prices averaged $33/bbl. The company managed to increase its cash reserves to $225 million following successful bond refinancing in April.

In terms of strategic developments, Genel began operations on Block 54 in Oman, with results from testing expected in early 2026. However, challenges arose as drone attacks temporarily affected production in Kurdistan. Nevertheless, insurance coverage and cost controls are expected to cushion the financial impact. The company's focus remains on resuming oil exports from Kurdistan amid ongoing discussions between relevant stakeholders.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Genel Energy