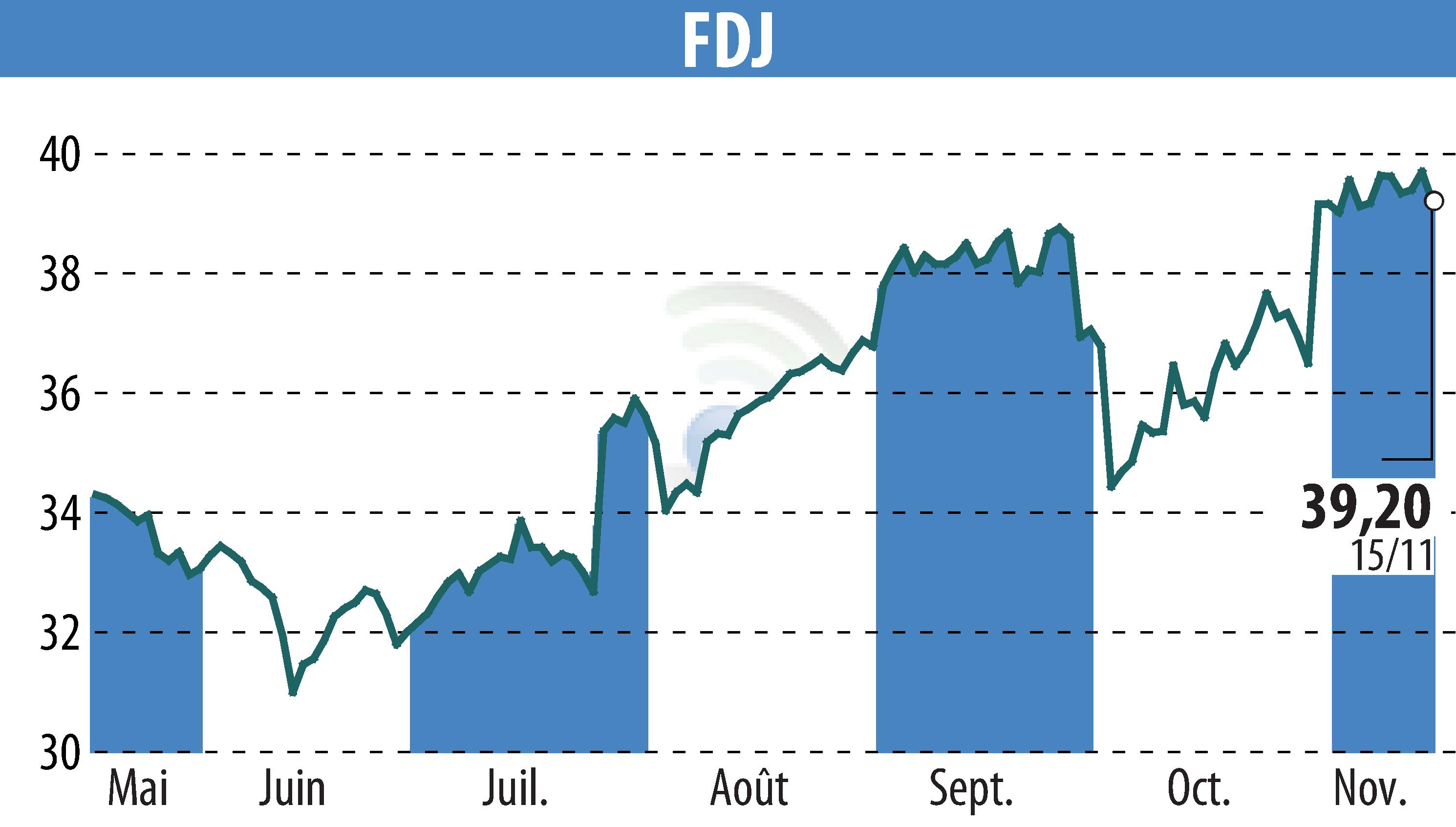

sur FDJ (EPA:FDJ)

FDJ Completes €1.5 Billion Bond Issue to Refinance Kindred Acquisition

FDJ, a leading European betting and gaming operator, has successfully executed its inaugural bond issue, totaling €1.5 billion. This issue, aimed at refinancing the Kindred acquisition, comprises three tranches with maturities in 2030, 2033, and 2036, and annual coupons of 3.000%, 3.375%, and 3.625%, respectively.

The bonds are rated Baa1 by Moody's, reflecting the group's stable credit profile. The issuance attracted substantial interest, with final demand surpassing €7 billion, indicating strong investor confidence. The transaction was oversubscribed almost five times, with over two hundred top-tier investors participating.

Global coordinators for the transaction included BNP Paribas, Crédit Agricole CIB, and Société Générale, among others.

FDJ also secured a €400 million syndicated loan, repayable over five years, to further settle the bridging loan with the group’s cash.

R. P.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de FDJ