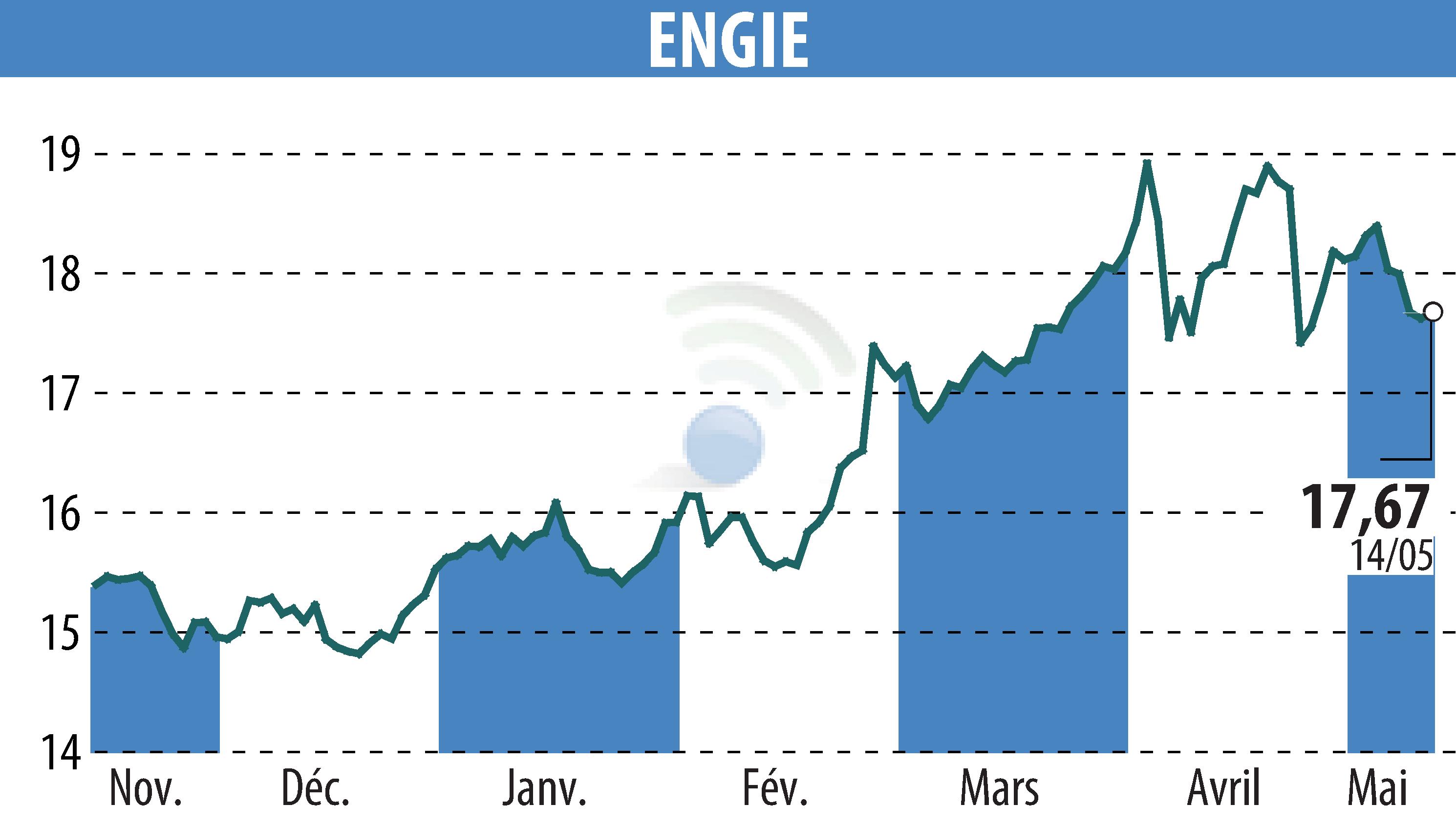

sur ENGIE (EPA:ENGI)

ENGIE Posts Solid Q1 2025 Financial Performance

ENGIE reported a sound start to 2025, posting €3.7 billion in EBIT excluding nuclear activities, marking an organic increase of 2.1%. This growth is attributed to strong infrastructure performance and favorable timing. The company also confirmed its full-year guidance with expectations of Net Recurring Income group share (NRIgs) between €4.4 and €5.0 billion.

Renewables showed robust activity with 8.5 GW under construction across over 100 projects. This includes acquisitions in the UK and Brazil and new projects in Chile. ENGIE aims to maintain its momentum with plans to add an average of 7 GW annually in renewables and storage capacity.

The company strengthened its infrastructure portfolio by winning a contract for a new electric substation in Chile and divesting from non-core assets in Kuwait, Bahrain, and Pakistan. Net financial debt increased to €34.6 billion due to investments but was offset by a robust cash flow from operations of €4.0 billion.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de ENGIE