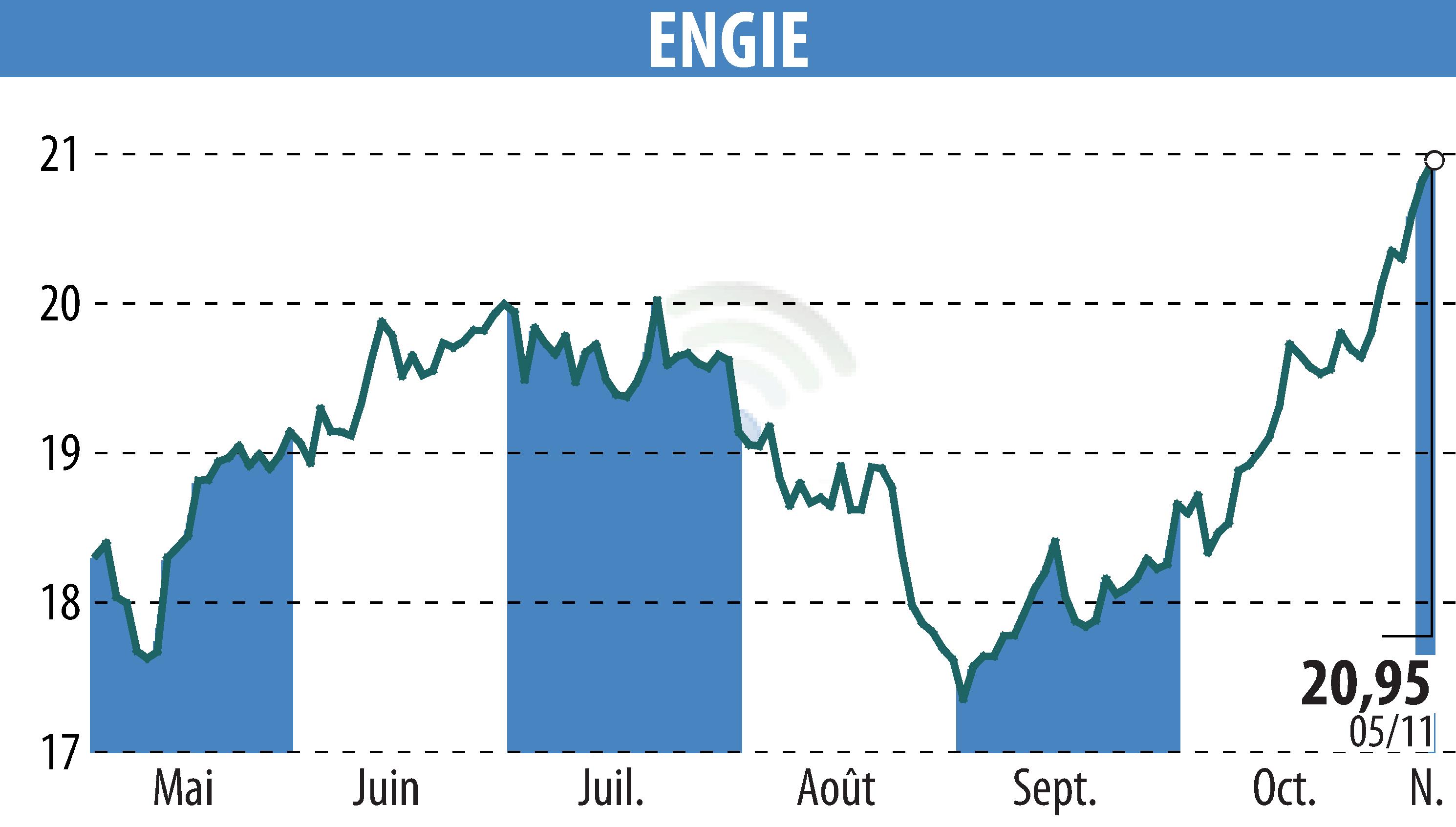

sur ENGIE (EPA:ENGI)

ENGIE 9M 2025 Financial Results: Strong Cash Generation amidst Market Challenges

ENGIE has released its financial results for the first nine months of 2025, showcasing a robust performance despite a challenging market environment with lower energy prices. The company reported a cash flow from operations of €11.4 billion, confirming the strength of its utility model. Revenue slightly increased to €52.8 billion, up 0.2% on a gross basis and 1.8% organically. However, EBIT excluding nuclear activities decreased by 7.3% organically due to a downturn in hydro volumes.

In terms of strategic development, ENGIE advanced significantly in the renewables sector, boasting 55 GW of installed capacity and an additional 6 GW under construction. The company signed 3.1 GW of Power Purchase Agreements (PPAs) during the period. The expansion in flexible assets continued across Italy, Romania, and Belgium.

ENGIE's balance sheet remains solid, with economic net debt reduced by €1.4 billion to €46.4 billion. The company's FY 2025 guidance remains at the upper end, with net recurring income expected between €4.4 and €5.0 billion.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de ENGIE