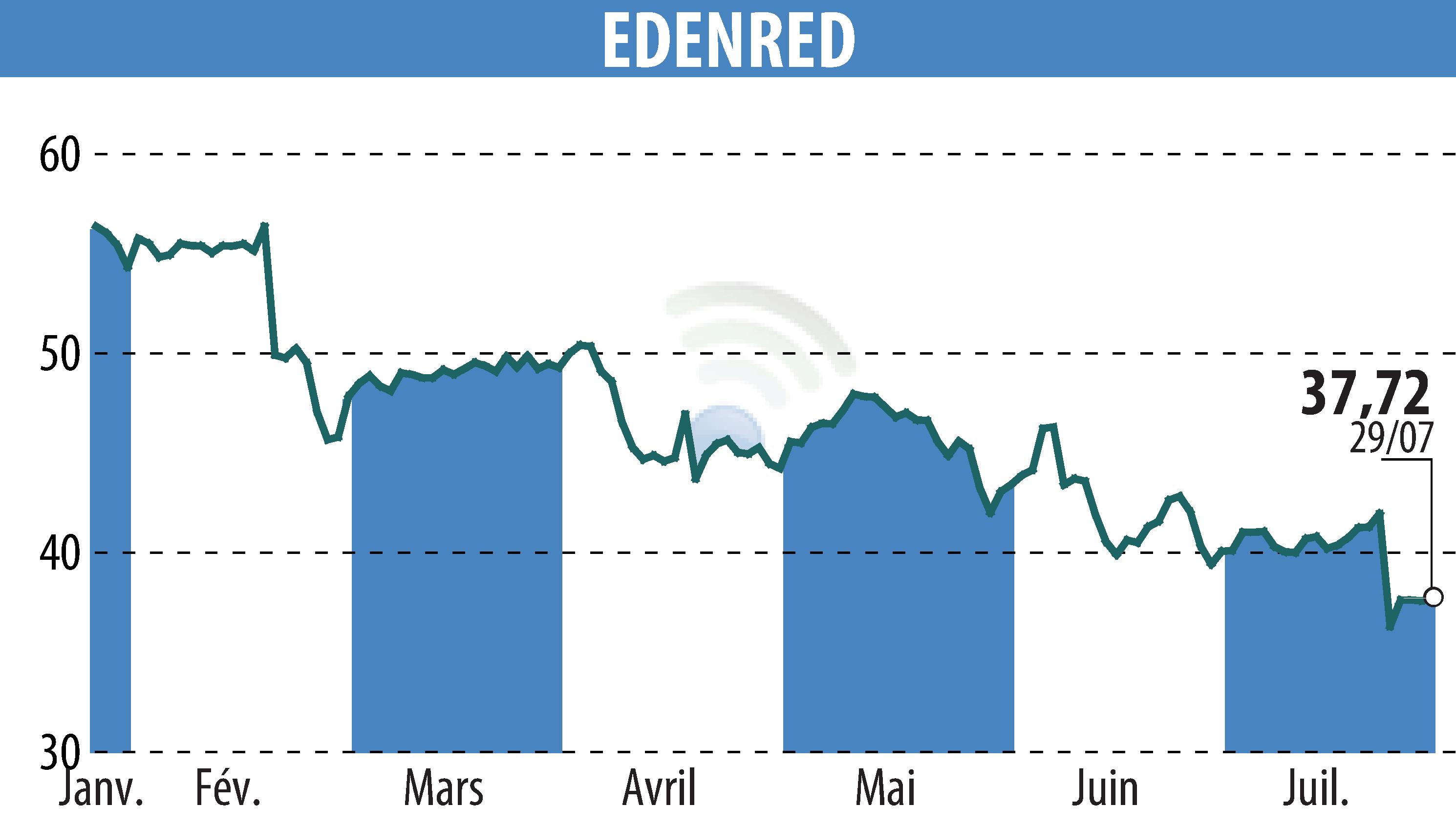

sur EDENRED (EPA:EDEN)

Edenred successfully issues a €500 million bond

Edenred has issued a €500 million bond with an 8-year maturity. The bond, carrying a coupon of 3.625%, will mature on August 5, 2032.

The issuance saw strong demand from international institutional investors, with an order book over four times subscribed, totaling more than €2.2 billion. This indicates significant market confidence in Edenred's credit quality, business model, and growth prospects.

This transaction enhances Edenred's financial structure and liquidity. It also extends the average maturity of the company's bond debt to 3.6 years from 3.2 years as of June 2024. The bond issue supports financing ongoing growth operations and investments in technology and products, aligning with Edenred's Beyond22-25 strategic plan.

Edenred is rated A- with a stable outlook by Standard & Poor's. Crédit Agricole CIB and Société Générale CIB coordinated the issuance, with Barclays, BNP Paribas, Citigroup, Commerzbank, CIC, and ING as joint active bookrunners.

R. P.

Copyright © 2024 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de EDENRED