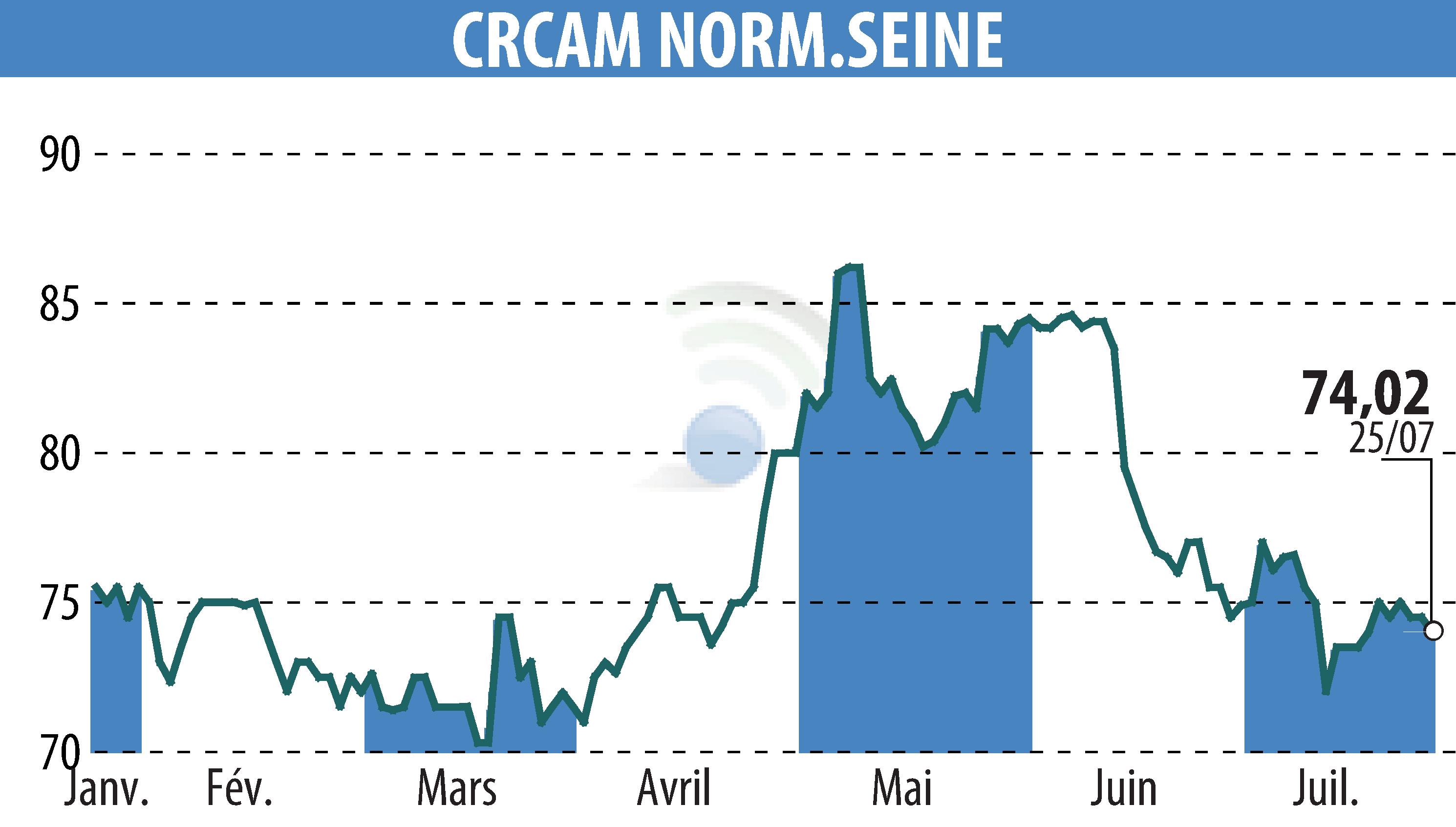

sur CREDIT AGRICOLE DE NORMANDIE SEINE (EPA:CCN)

Crédit Agricole Normandie-Seine: Financial results for the first half of 2024

As of June 30, 2024, Crédit Agricole Normandie-Seine displays resilient commercial activity despite an uncertain economic context. Outstanding loans remain stable at 17.06 billion euros, while savings increase by 4.1%, reaching 21.9 billion euros.

The number of customers increased by 0.6% with 14,500 new arrivals. The insurance portfolio also recorded growth, totaling 481,000 contracts. The company consolidates its status as a mutual bank by attracting 6,000 new members.

The financial results show an increase in net banking income of 1.6 million euros over one year. The social net income stood at 60 million euros, an increase of 2.9 million euros. The consolidated net profit increased by 10.7%, reaching 58.7 million euros.

With a Basel III solvency ratio of 24.34% and an LCR liquidity ratio of 121.55%, Crédit Agricole Normandie-Seine far exceeds regulatory requirements. The company, recently recognized as mission-driven, continues its commitment to sustainability and supporting its customers.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE DE NORMANDIE SEINE