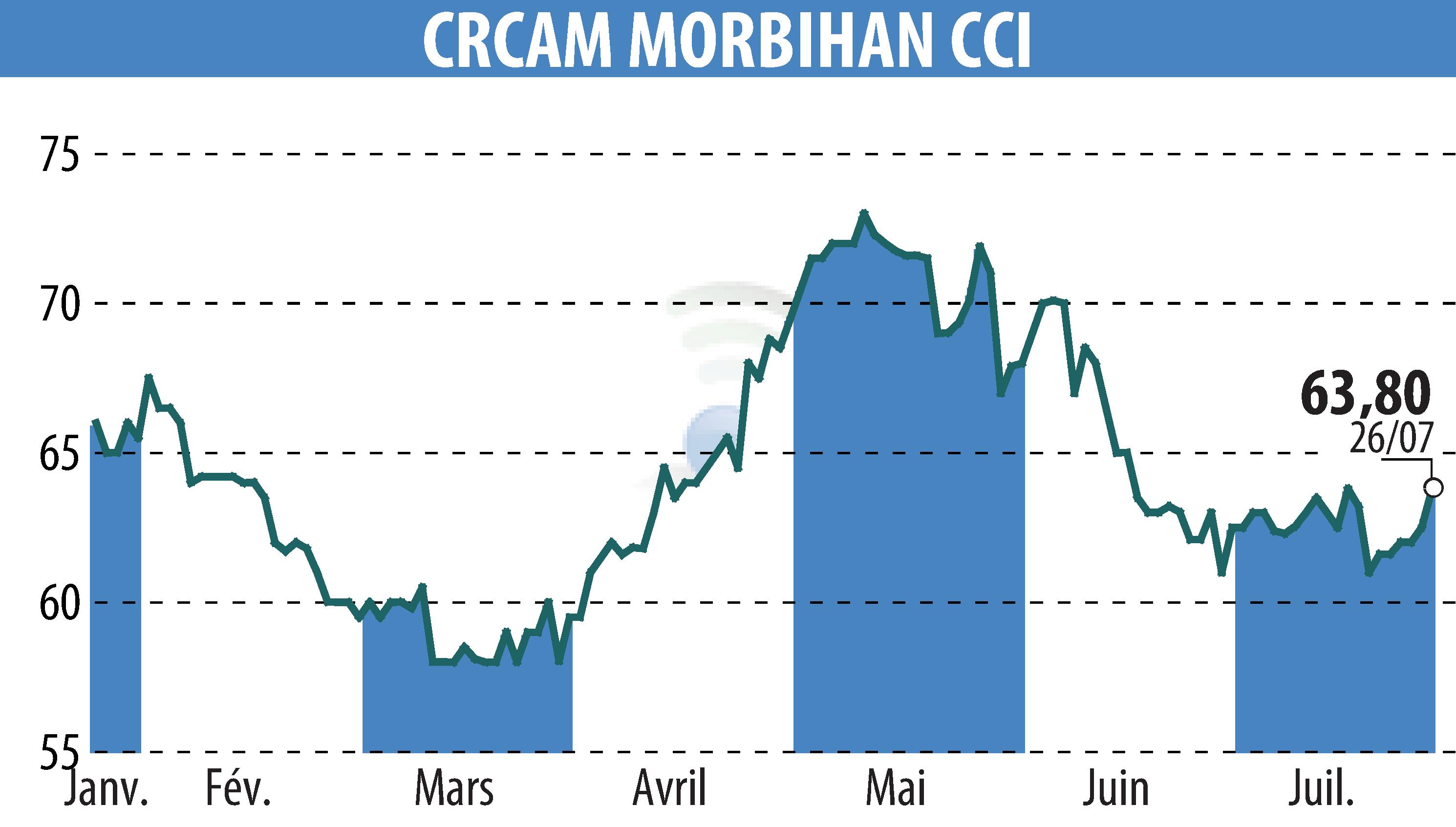

sur CREDIT AGRICOLE DU MORBIHAN (EPA:CMO)

CREDIT AGRICOLE DU MORBIHAN: Balance sheet and outlook as of June 30, 2024

Crédit Agricole du Morbihan, employing more than 1,200 employees in 78 branches, is actively committed to responding to environmental and societal challenges. The company has reduced its carbon emissions by 51% since 2018 and promotes local purchasing. Furthermore, it maintains an inclusive policy with 9.15% of employees with disabilities.

Despite the economic slowdown, 8,000 new customers joined the bank and overall collections increased by 3.2%. Outstanding loans amounted to 10.2 billion euros, although down slightly.

Net Social Banking Product reached 143.6 million euros, up 8.5%. Operating expenses increased by 3.4% due to inflationary contexts. Social Gross Operating Income stood at 65.8 million euros, an increase of 15.3%.

Note, a deterioration in the economic environment is reflected in the increase in bad debts to 2.02%. The cost of risk is 13.7 million euros, mainly concentrated on a few customers in difficulty.

The Social Net Profit amounted to 45.5 million euros, an increase of 14%. Consolidated equity reaches 2 billion euros with a CET 1 ratio of 25.81% as of March 31, 2024.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE DU MORBIHAN