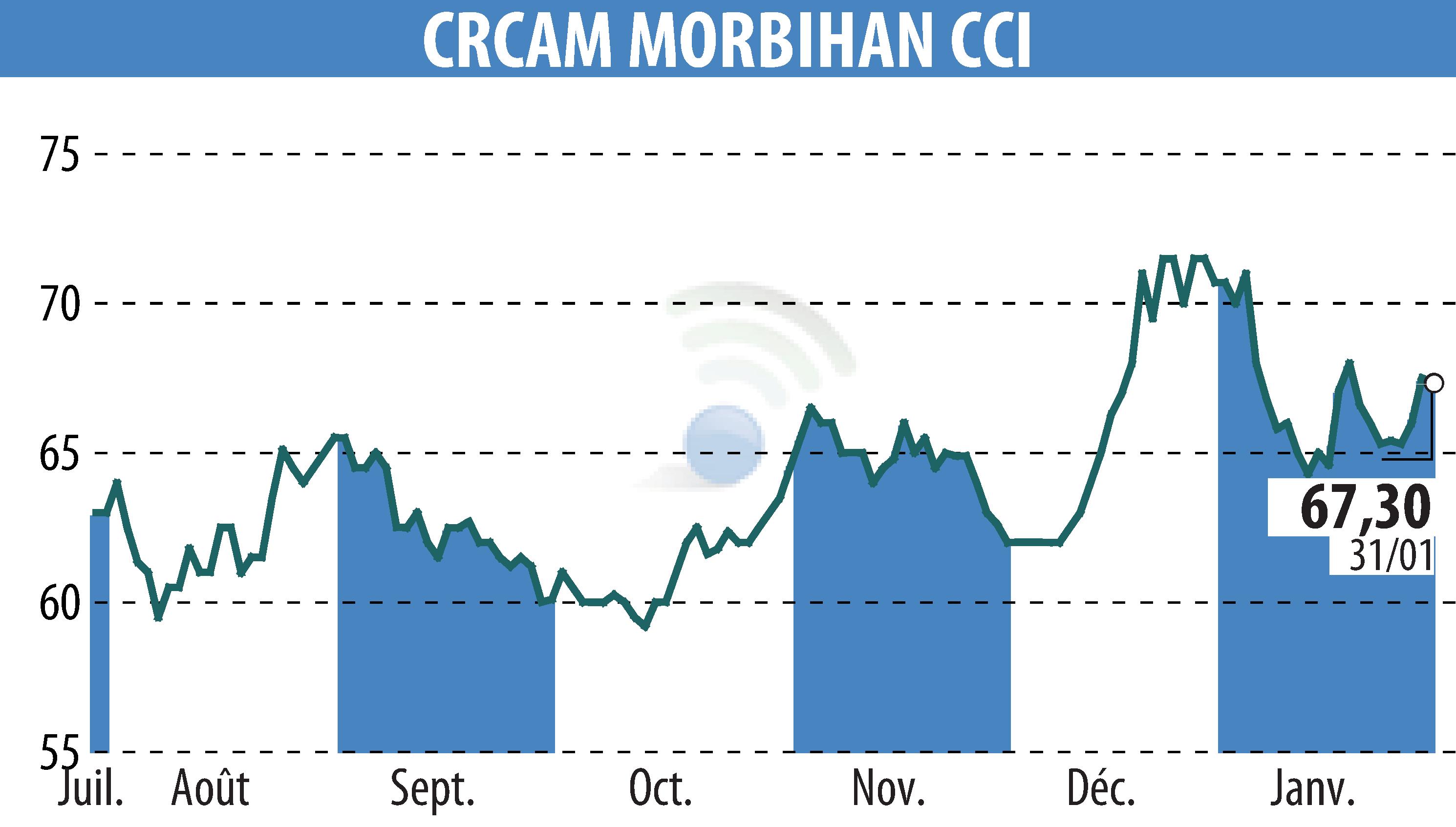

sur CREDIT AGRICOLE DU MORBIHAN (EPA:CMO)

Crédit Agricole du Morbihan 2024 Results: Resilient Growth

Crédit Agricole du Morbihan has announced solid results for 2024, despite a difficult economic environment. Total collection increased by 2.9%, reaching €15.7 billion while outstanding credit decreased slightly by 0.3% to €10.2 billion. Net Banking Income increased by 4.6% to €243.7 million.

Consolidated results according to IFRS standards also show an increase. Net income Group share increased by 33%, reaching 68.8 million euros, thanks in particular to rigorous management of expenses and positive dynamics of commissions. Consolidated equity amounts to 2.127 billion euros, up 7.8%.

Crédit Agricole du Morbihan maintains its role as the region's leading financier and plans to strengthen its support in 2025 in the face of economic and environmental challenges. The CET1 ratio remains solid at 25.52%, well above the required regulatory threshold.

R. E.

Copyright © 2025 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE DU MORBIHAN