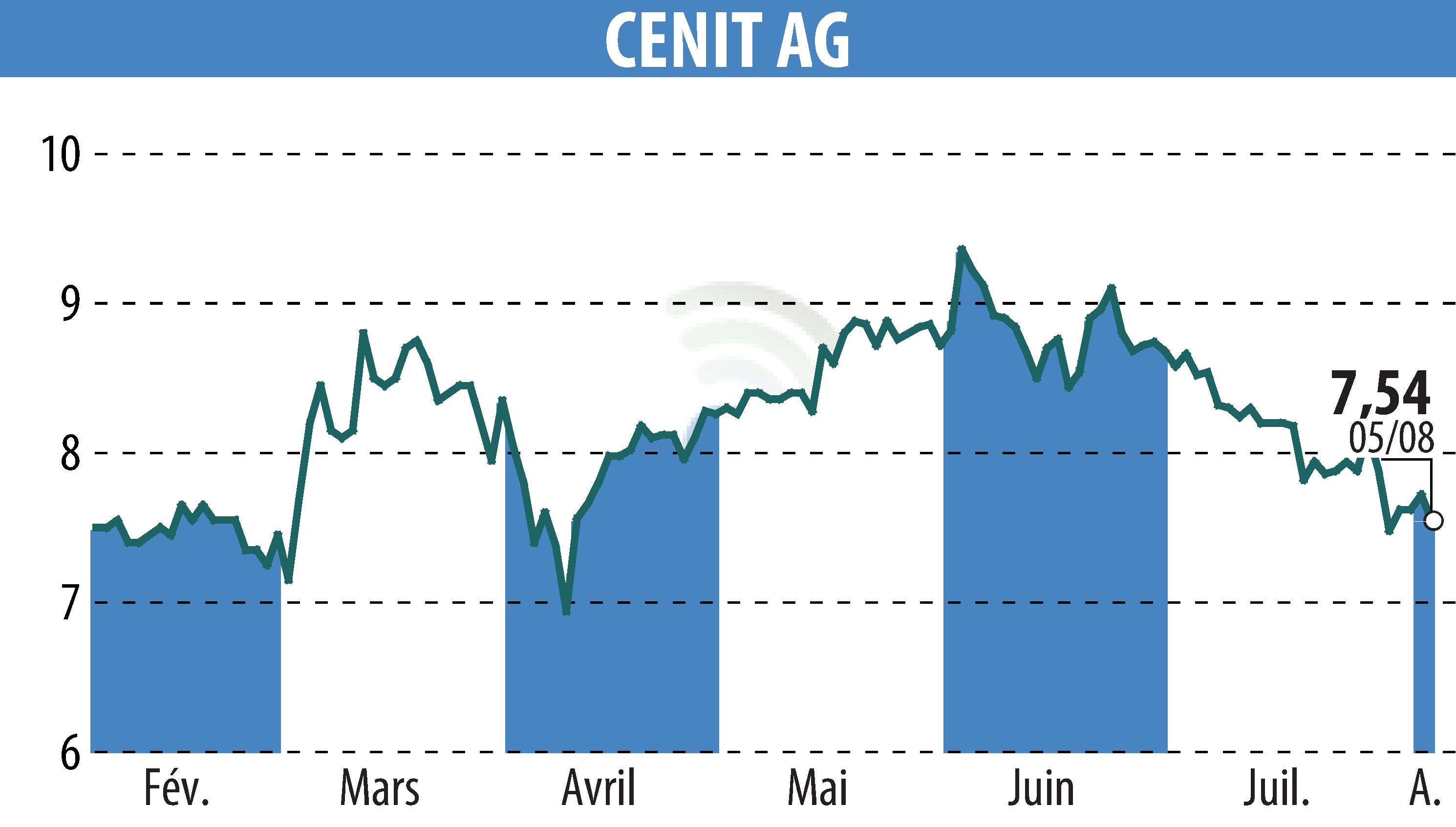

sur CENIT AG (ETR:CSH)

CENIT AG Forecasts Lowered but 'BUY' Rating Maintained

CENIT AG saw a revenue increase of 4.4% to €103.71 million in the first half of 2025. However, the earnings were below expectations, largely due to the new acquisition, Analysis Prime. The revenue growth was solely due to this US company, acquired in July 2024. It contributed over €6 million, but expectations for a €25 million annual contribution appear optimistic.

The company's EBIT fell to €-3.69 million, partly due to €3.8 million in restructuring costs under the 'Project Performance' program. This aims to reduce the workforce by about 50, aiming for cost improvements in the next financial year.

Despite operational losses, cash flow remained positive at €9.99 million. Still, due to persistent market challenges, CENIT revised its forecast, expecting €205 million in revenue and a €-1.5 million EBIT.

The target price was adjusted to €16.00, down from €19.00, following lowered revenue projections. Despite this, analysts maintain a 'BUY' rating for the stock.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CENIT AG